DappRadar allows users to track and explore decentralized apps around the world. It provides many useful functions including portfolio management, payment options, staking, and more. The company claims it has over 8,000 dapps supported and around four million users.

DappRadar will launch a native token called RADAR. The RADAR token, which is based on Ethereum blockchain, will be used to pay for the service. RADAR token holders will have access to DappRadar's PRO section. This section offers exclusive analysis, new collections, and early access. As a bonus, RADAR holders can also participate in the staking mechanism and claim rewards.

The token will serve two purposes: it will reward users and it will act as an incentive to users to use DappRadar. This includes voting, staking and proposing recommendations. Moreover, the RADAR holders can help in deciding product decisions.

As a staker, RADAR can help to increase the number of dapps available on the Ethereum network. In the same way, DappRadar members can vote on projects and take part in DappRadar's community. The token will be used as a governance token in the DappRadar DAO. RADAR is a token that will enable the platform's portfolio tools to be improved and its coverage expanded.

DappRadar (open source) is a project. It has partnered to the LayerZero protocol to enable smart contract communication across chains. DappRadar will be able to eliminate gas fees from the Ethereum blockchain through this protocol.

According to the recent DappRadar industry report, the total number of dapps on the platform has increased 396% from the first quarter of 2021. Furthermore, 2.4 million unique wallets are interacting with Dapps daily. According to the company, multichain blockchain is the future. Hence, it aims to develop an ecosystem that benefits both users and developers.

Currently, the total supply of the RADAR token is 10 billion. DappRadar intends to expand the token's usage and is working on the second phase of its platform. RADAR, apart from being able to be staked, can also be traded on Web3's network.

DappRadar also offers four utility tokens to its platform. These tokens include Portfolio, Contribute2Earn (Boosts), Portfolio, and Polygon. You can either purchase these services on the Marketplace or through an Airdrop.

DappRadar is proud to announce a new cross-chain tokenstaking mechanism. This eliminates the need for bridge assets and drastically reduces staking fees. Additionally, the protocol ensures smooth user experience on all chains.

DappRadar is a pioneer in the multichain blockchain sector. In addition, the company aims to be a leading platform for users to discover and analyze decentralized applications. This is why the company is determined to provide the largest app store in the entire world.

DappRadar works on the development and launch of a full-scale DappStore. With a larger community, dapps are able to gain more power as well as unlock many new possibilities.

FAQ

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

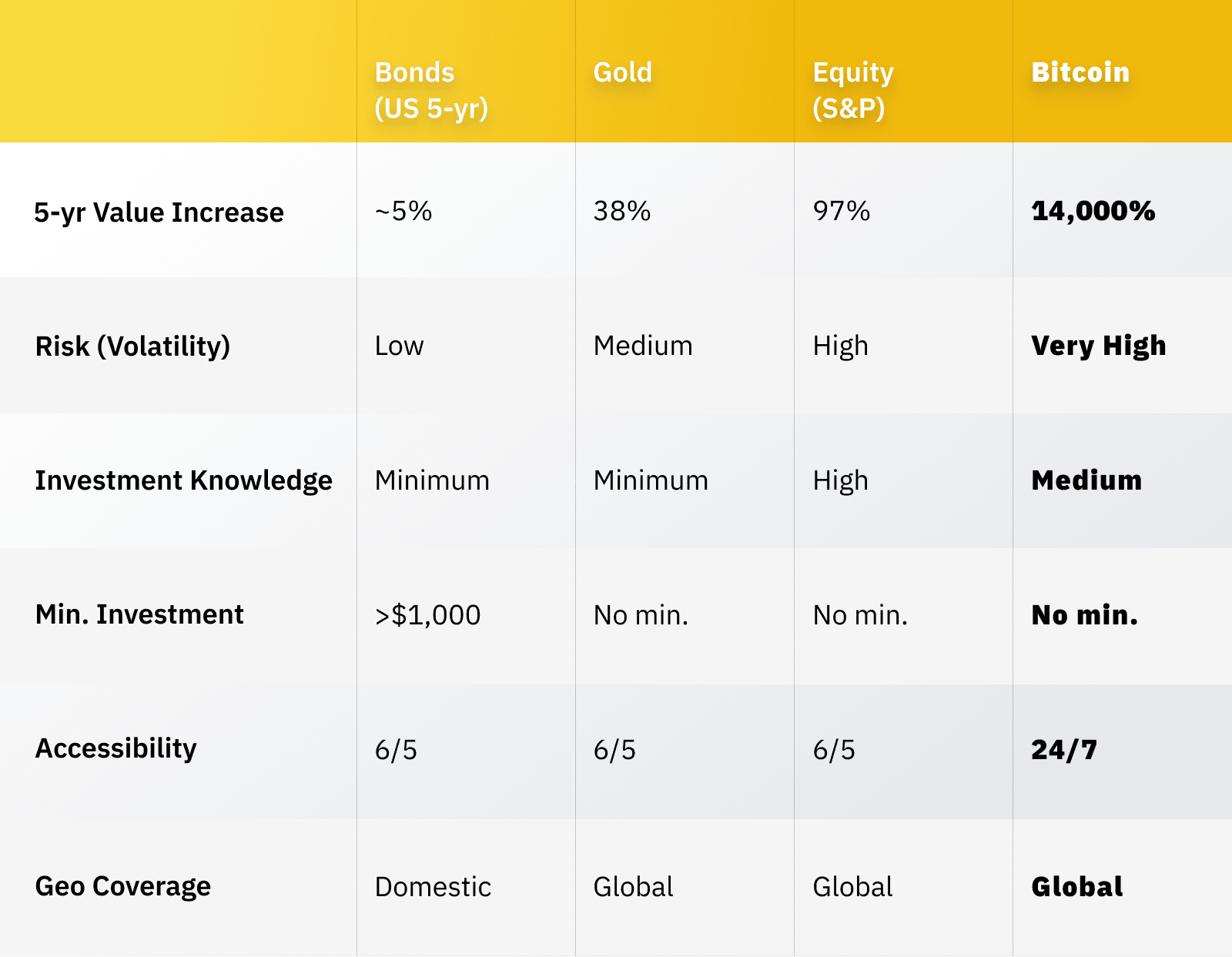

You can also invest in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which trading site is best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it's important to understand both the risks and the benefits.

What are the advantages and drawbacks to online investing?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which is more secure, forex or crypto?

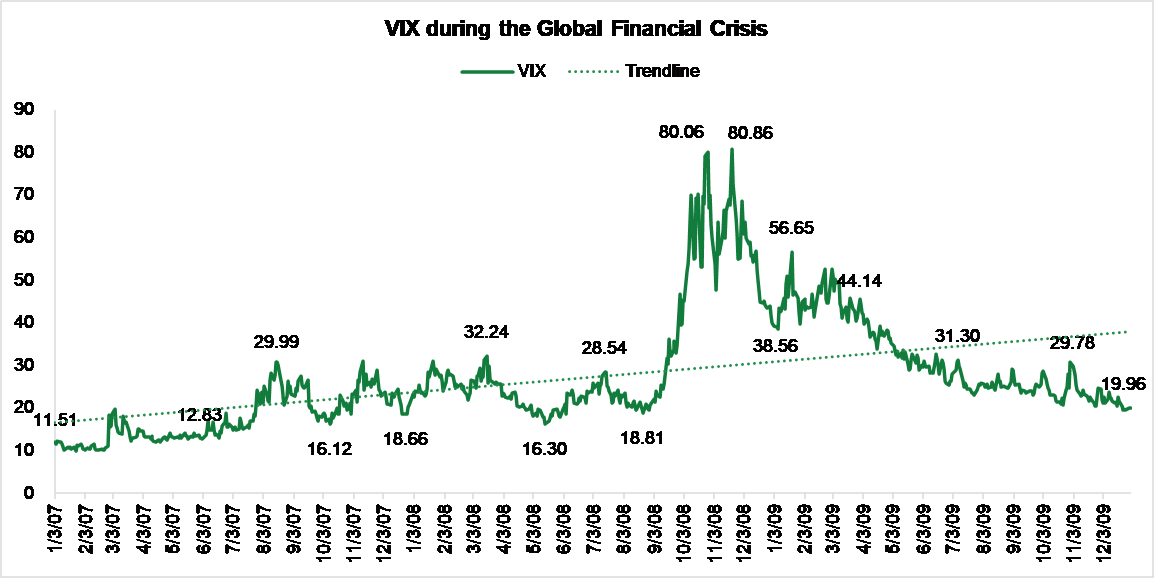

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

You must first ensure that the platform you're using has security. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

It is important to be familiar with the terms and conditions of any online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, be sure to research the company where you plan on investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.