ECN Forex brokers offer traders the opportunity to place orders in the forex market using a non-dealing desk. They do not trade against their clients like traditional brokers. Instead, they combine price quotations from multiple banks to give their customers the best possible prices. They then pass the orders to liquidity providers, which make the quotes available to the client.

Some of the most prominent features of ECN Forex brokers include speedy execution, tight spreads, and high liquidity. These brokers also offer clients the option to trade outside of the traditional trading hours. However, in order to take advantage of this, it is important to find a reliable broker.

Pepperstone, for example, has one of the lowest average spreads among retail brokers. This makes it an ideal broker for day trading. Pepperstone also has competitive commission rates with other brokers. It is very convenient for traders that prefer automated strategies.

When selecting an ECN Forex broker, look for one with an automated system that matches your orders with other client orders in real time. An ECN system that is reliable will give you the best possible bid and ask prices.

ECN also matches your buy and sale orders with those made by other traders on the Exchange. This ensures you receive the best possible trade price. You can also set your bid and ask prices.

You should also check the platform's reliability when choosing an ECN Forex broker. You can connect your personal trading models to the broker data feed, which will make it easier to place orders. The best brokers will provide fast order execution as well as the possibility to trade on multiple markets including futures and cryptos.

When choosing an ECN Forex broker, another important factor to consider is the commission. Fixed commissions for each trade must be considered by traders. Some ECN brokers cater to smaller retail investors while others focus more on institutional clients. Make sure you ask about the list of major banks the firm uses for liquidity.

Funding is the final step in opening an ECN Account. Many brokers offer bonuses. You must meet certain conditions to be eligible for the bonus. You will typically need to trade the bonus amount of times. Before you open an account with an ECN or market maker, it's a good idea to test the platform before you trade. It is possible to then test the platform, and see how fast trading goes.

Finally, choose an ECN Forex broker that is suitable for your trading style. ECN brokers provide liquidity that is high and allows traders to trade at higher spreads. This will make it easier for scalers to profit from the tight spreads.

FAQ

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

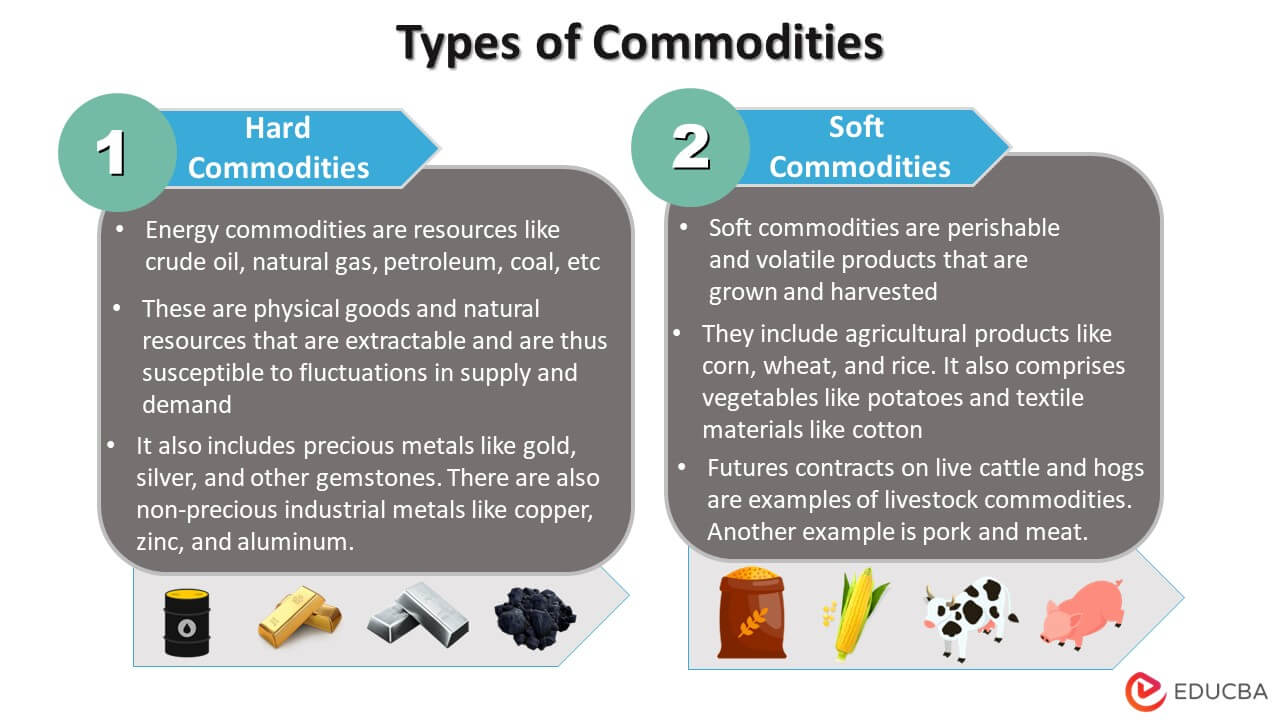

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases, it's important to do your research before making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Frequently Asked Fragen

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Cryptocurrency: Is it a good investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Are forex traders able to make a living?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

The decision about where to store your money can be complicated. Your valuable assets require a strong security system and you have a few options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?