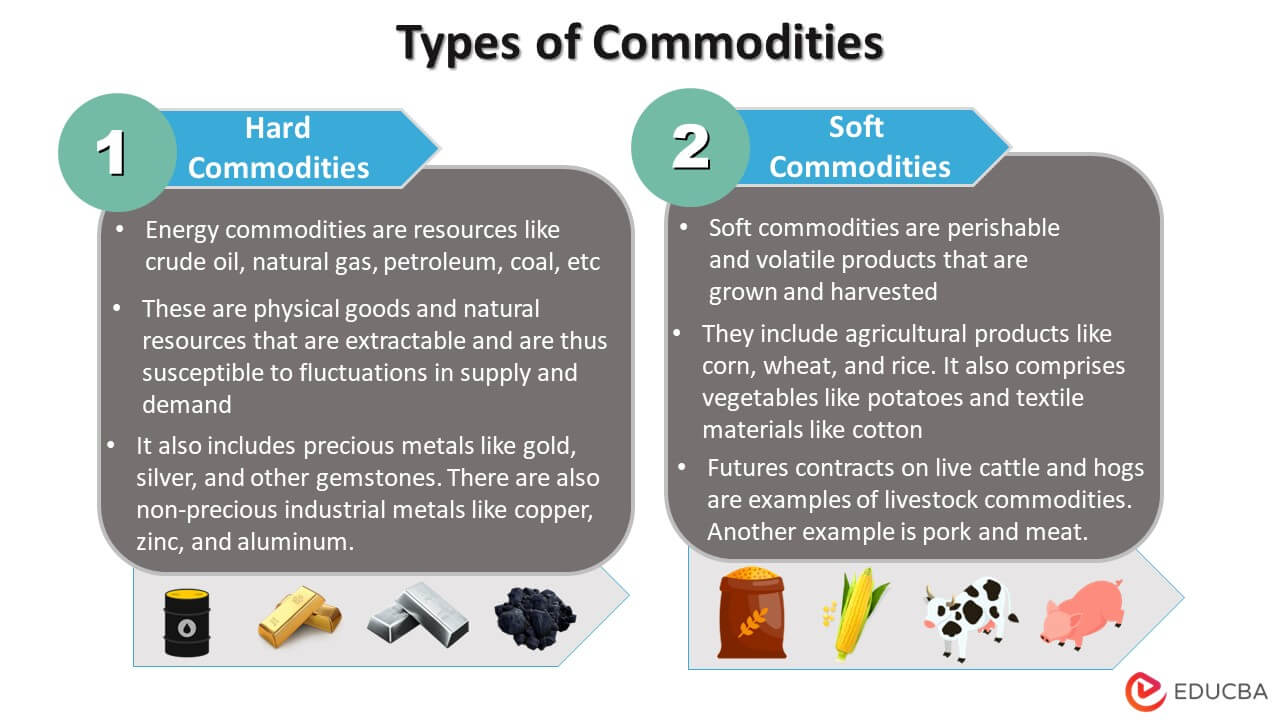

Billions of people around the world live with commodities markets. Not only are they a place for investors, but they also provide diversification and hedging to other financial markets. There are many commodities available, including food articles and ag products as well as metals, energy and raw materials such sugar, wheat and soy. Traders can get involved in the market despite its complexity.

It is important to realize that the commodity market does not have an all-or-nothing approach. Some commodities like crude oil tend to be heavier towards the bottom of the market. Because of the cold Arctic freeze, some oil refining plants have had to close. As a result, prices have been moving lower.

It is easy to buy small quantities of commodities via an online broker. A trusted broker will provide you with data and a dedicated research analyst to help guide you in your decision-making. A broker can also provide you with a risk profile analysis. If you're not familiar with the risks associated with investing in commodities, it may be a good idea to seek advice.

It can be difficult to calculate how much you could make but it is possible to use data to make informed decisions. You may be surprised to find out that the price of crude oil can bounce around like a dead cat.

Distribution of ag-related products and services is one of many problems facing the ag sector. Most of this activity takes place in a highly fragmented market that is often not liquid. These factors can lead to a less than ideal outcome for farmers. Some major players in the agriculture space have taken steps to address this issue.

Although the commodity market has played a significant role in the financial sector for the last few years, it is still vulnerable to government policies. India is an example of a country that has implemented a variety of reforms. Moreover, the country is strengthening its existing institutions in the derivatives trade.

It's also worth noting that even the smallest of companies can benefit from the commodity market. A mid-sized manufacturer might purchase a few totes from the commodity exchange and pay a good price. Larger manufacturers might purchase bulk oil on-the-spot market at the same price.

However, the best thing about the commodities market is its ability to be a lot fun. If you follow the correct strategies (which are outlined within the book Commodity Investing), you'll be able maximize your returns. Along the way, you'll pick up a wealth of savvy investment strategies that will help you make more money in a crowded financial market.

The commodity market is not for the faint-hearted, just like any other venture. It's not surprising that gold prices have risen on the expectation that the US Federal Reserve may slow down its rate raising cycle. However, silver isn't doing as well.

FAQ

Frequently Asked Questions

What are the four types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

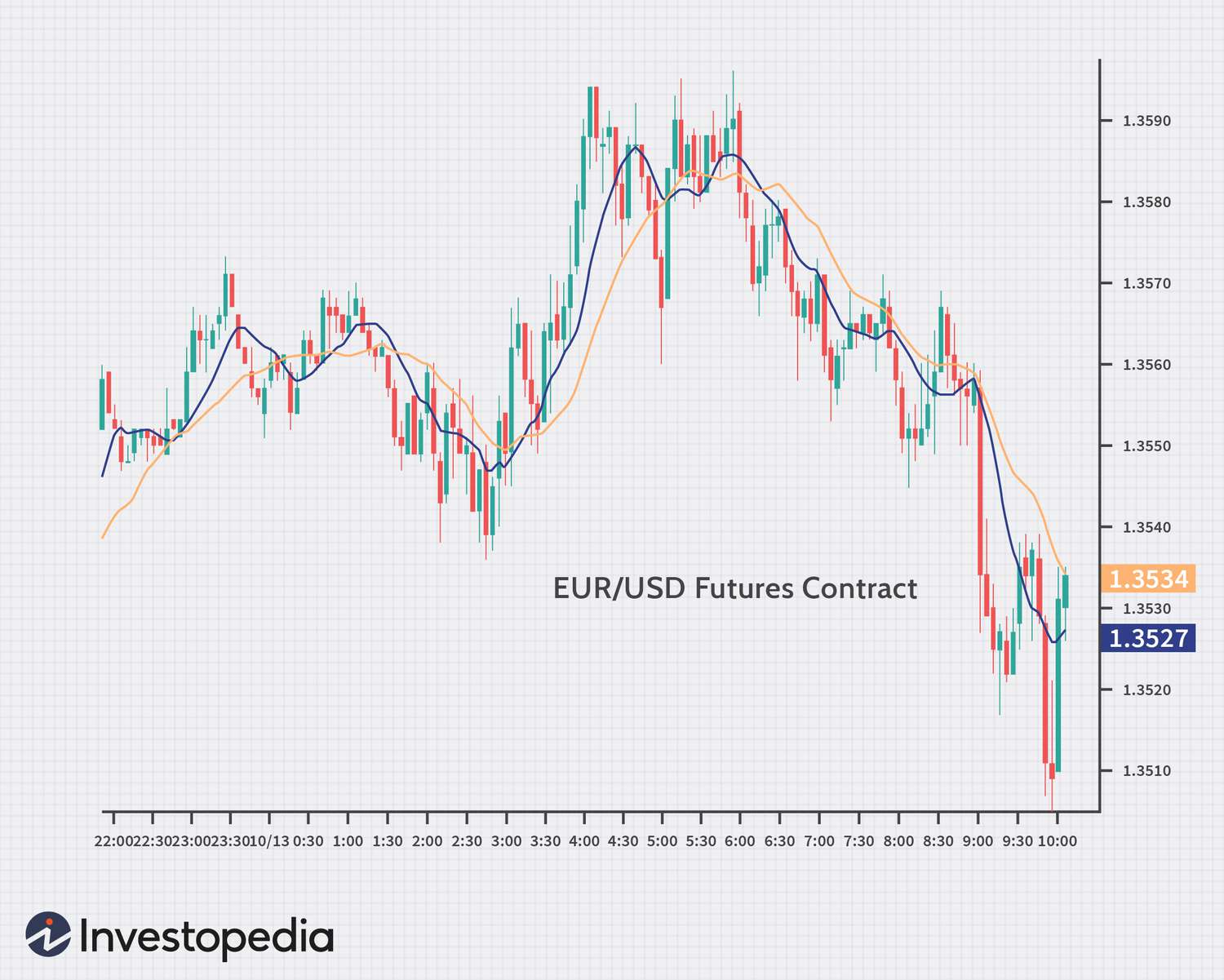

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. Protecting your assets and data from unwanted intrusion is essential.

First, ensure the platform you are using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It is important to be familiar with the terms and conditions of any online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will ensure your online investment account is protected against any possible threats.