Axie infinity is a crypto game that has emerged over the past few months. The game is built on Ethereum. It uses a Ronin Ethereum Sidechain. Smooth Love Potion, a unique non-fungible token. While it isn't fully featured, the game has its own staking/trading systems and a strong ecosystem. This is one the most innovative new players in crypto gaming, and the potential for growth is incredible.

Smooth Love Potion and the Axie Incentive shards are the currencies used in the game. But they aren't the only cryptocurrency that circulates. Small Love Potion (Non-fungible Token - NFT) is also included in the game. These tokens are used to reward players who complete level-related achievements. They do not have a direct connection to the Axie Infinity Shards' cost, but they are an excellent way to earn currency.

Aleksander Larsen was a Norwegian hacker who also enjoys playing games and founded Axie Infinity at the end of 2017. His previous experience as a programmer with the Norwegian Government Security Organization was also a part of Lozi and Sky Mavis. The game is rapidly growing in popularity, with more than 1,000,000 users. Its main selling feature is the ability for players to simultaneously earn passive income. The game's monthly monetary rewards are currently at more than a million dollars.

AxieInfinity features a range of technologies and features including an XP Hub, automated orders, token staking, and a mating Hub. You can take part in the game's community via many payment methods to increase your chances of winning. You can use PayPal, Visa or MasterCard to store your coins. To store your coins, you can use a digital wallet such as MetaMask.

Axie Infinity is not the only crypto game on the block, but it's certainly the most innovative one so far. CryptoKitties, War Riders and Chainmonsters all make notable crypto games. These games can be accessed via browsers or mobile devices. But while all of them may be worth a look, Axie Infinity has the patented Ronin Ethereum sidechain and its own native token, Smooth Love Potion, that really are the way to go.

The AxieInfinity is only one component of an ecosystem that also includes a mobile game and NFT-based trading and staking systems. Axie Infinity offers an interactive website, where players can see the game's stats as well as other features. However, this website is purely for fun as Axie Infinity's actual game is currently in beta. This game will be available sometime this year. You can still play Axie Infinity or buy or stake the tokens. A good crypto wallet will allow you to make the most Axie Infinity coins. Trezor is another popular option.

FAQ

Which is harder, forex or crypto.

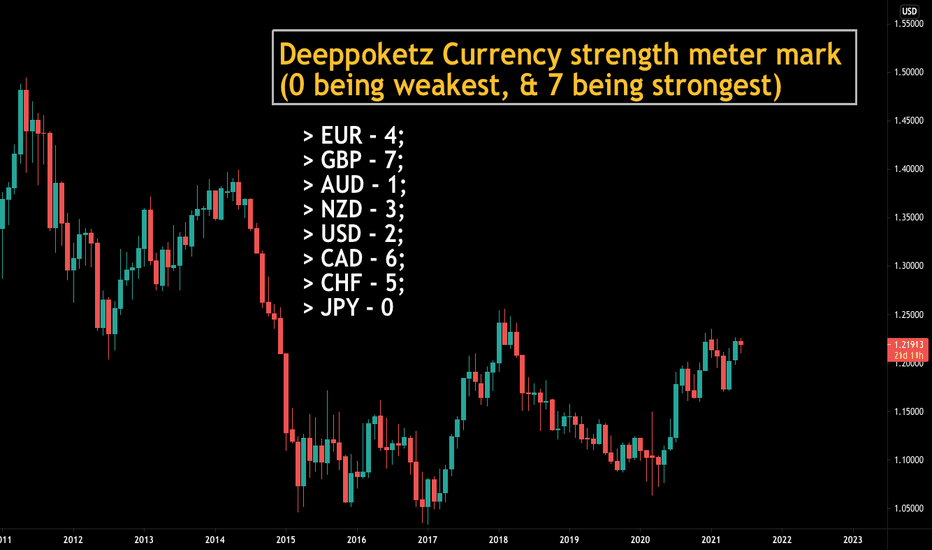

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Do forex traders make money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

It is important to do your research before investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Know the risks associated with your investment and the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Do your due diligence and make sure you get what you pay for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!