The Commodity Futures Trading Commission, (CFTC), is making changes to its regulations. These amendments will include changes to the Real-Time Public Reporting Requirements. They also amend Swap Data Recordkeeping Requirements and Reporting Requirements. This is to improve accuracy and consistency in the data that firms report.

After the financial crisis, CFTC established mandatory reporting requirements for OTC derivatives. However, not all rules are clear. Many companies have started asking questions about the Technical Specification, and other aspects of these Rules. The CFTC has created a "Rewrite" which addresses the problem and includes a range of new reporting fields. It also reflects suggestions made by the industry.

The CFTC's transaction-reporting regulation is designed to make sure that firms provide correct and up-todate information. The regulations provide a deadline of seven days for corrections. Notifying the Commission in writing is required. Moreover, firms are required to have controls and other procedures in place to help ensure that the data is accurate.

The International Organization of Securities Commissions and Committee on Payments and Market Infrastructures have agreed on a number of key data elements. The International Organization of Securities Commissions and the Committee on Payments and Market Infrastructures have agreed to a number of key data elements. Firms are encouraged to submit all fields required by each jurisdiction. It may take time but this will be beneficial for both regulators as well as firms.

ReWrite made one of the most significant changes. The number of Schedules used to fill out the Form CPO/PQR has been reduced. The Schedule B, for example, requires more detailed information about each pool. All reporting CPOs must submit the Revised Form every quarter. Previously, only Schedules B and C were required.

Another change was the introduction of a capital rules. This change is meant to allow the CFTC to better monitor its operations. This is the first time that the Commission has changed its rules. It will be crucial to ensure that they don't depart from existing practices.

ReWrite also includes other changes such as an extended reporting timeline and different message formats. These changes had been in the making for some time. However, the CFTC waited to make them official. On December 10, 2020, the Final Rule is effective. Officials at CFTC explain that they will be working to "good shape", the new rules before they become law.

Other changes involve eliminating the requirements for certain reporting thresholds. This is part of a larger rewrite of the CFTC's regulations. In addition, the Dodd Frank Act has been revised in light of the financial crisis.

The CFTC's staff outlined that the Commission was interested in the activities of CPOs and their pools. They were specifically interested in how CPOs interacted and the relationship between CPOs, intermediaries and other parts of the financial sector. The Commission also wanted to know more about the population of registrants, and how they interconnected with the entire financial system.

During the discussion, Quintenz thanked all staff members for their hard work. She stressed the principled approach taken by the Commission in developing the rules. Commissioner Quintenz said that the commissioners had worked tirelessly to ensure this.

FAQ

What is the best forex trading system or crypto trading system?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

How do forex traders make their money?

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

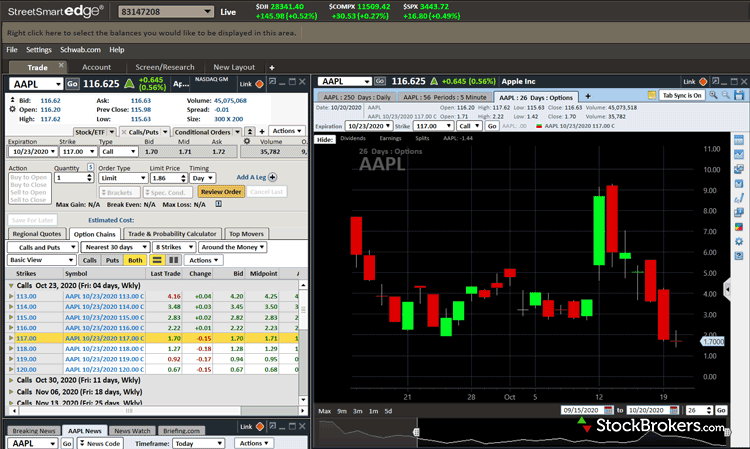

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When you invest online, it is crucial to do your homework. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before opening an account, confirm the exact fees and commissions on which you might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.