Cnet stocks, also known as ecommerce stocks, can be a great way for investors to get involved in the growing online retail sector. They are a popular choice for day traders because of their potential for volatility, but long-term investors also can turn a profit with these stocks as they have the opportunity to rise over time.

It doesn’t matter if the goal is to build an investment portfolio or to just learn about the ecommerce sector, it is important to be aware of what you are getting into. There are many e-commerce stocks that investors can choose from.

Composerve is the first stock to invest in e-commerce stocks. It offers software and other services to help businesses make a website. The platform is completely free and offers a range of services that will help businesses grow their online presence.

Global-e is another stock that you should consider for ecommerce. They offer a cross-border solution to ecommerce that allows retailers access more consumers around the world. The platform makes use of big data and localization to improve sales and conversion.

The stock in e-commerce has gained nearly 40% over a year, even when its peers have been hit hard by the market's fall. Wall Street analysts give the company a strong buy rating. They continue to report strong revenue growth.

Roblox is a popular virtual world for children that is loved by millions. It's a major player in the metaverse, a new space in which companies are trying to profit from the power of augmented/virtual reality technology.

Checking Roblox's financials is the best way to see if Roblox is worth your investment. This can be done by comparing the company’s earnings and revenues with other gaming companies.

You can also see the company's successes and read about the company's current CEO. You can also compare it to other companies in its sector.

CompuServe is a leading technology services firm that offers a range of services to businesses. It offers services such as cloud computing, digital marketing and software development. It also offers a range of other services that can be used to help grow your company and make it more profitable.

Investing with these stocks is risky. Only invest money you can afford. It is important to research these brokers and make sure you do your due diligence.

Compare brokers by fee and asset type to find the best one for you if you are interested in investing in CNET stocks. It's also a good idea to review your trading account regularly to see how it's performing.

There is a lot of potential for growth in the e-commerce industry, and many major players are still at their growth stages. Investors have reduced their exposure to high-growth companies in e-commerce over the past few months due to inflation and higher interest rate. Thankfully, there are still plenty of bargains to be had in this fast-growing space.

FAQ

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, online investing does have its downsides. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

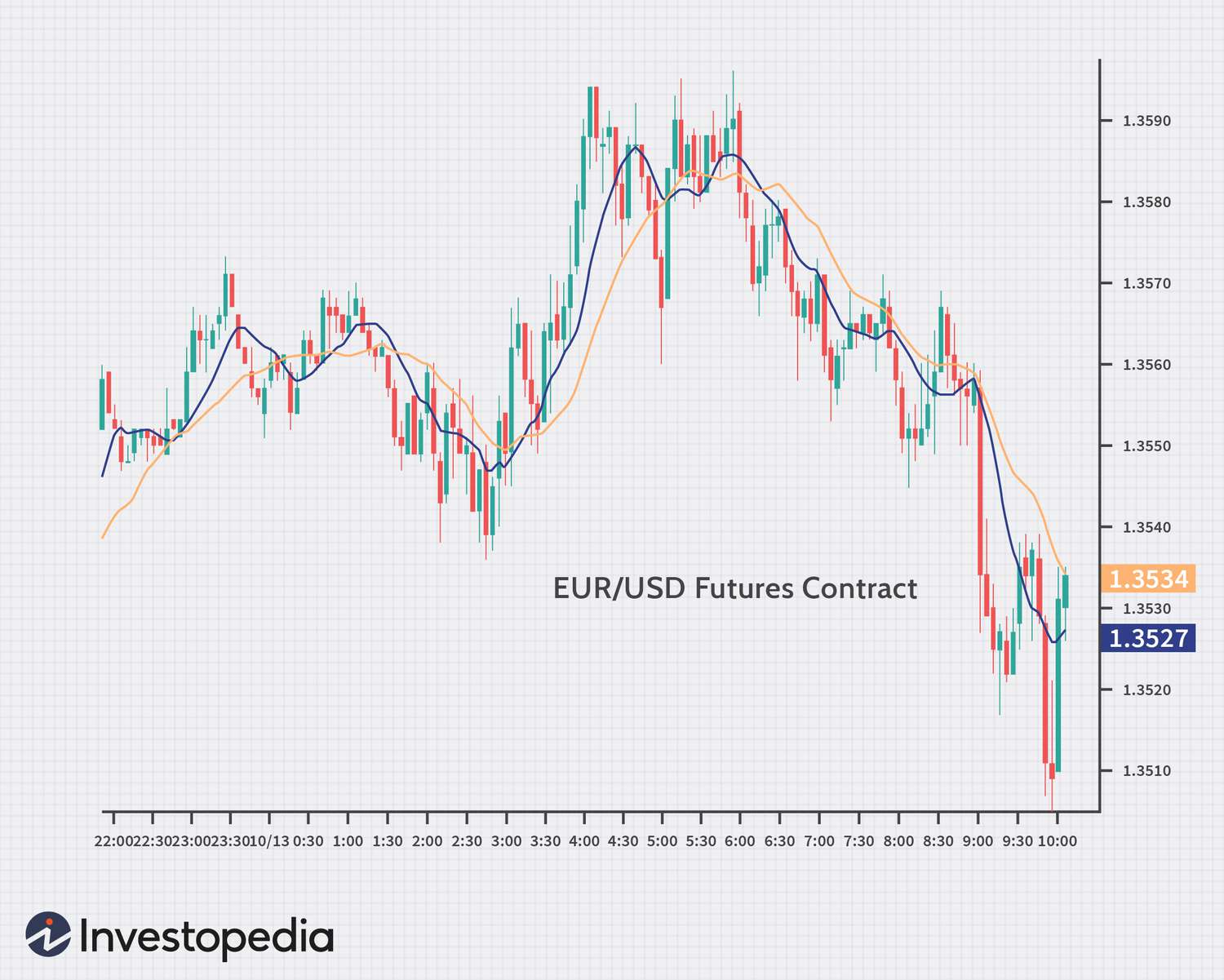

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Frequently Asked Question

What are the 4 types?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing property can bring steady returns as well as long-term appreciation. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Can one get rich trading Cryptocurrencies or forex?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

When investing online, security is crucial. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Begin by paying attention to who you are dealing on investment platforms and apps. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last but not least, make sure to use VPNs when investing online. They're often free and easy!