Put is a financial derivative that works in the same way as an insurance policy. It provides the buyer of the option with the right, but not the obligation, to sell an underlying asset at a certain price within a specific time frame.

The strike price is also known as the option strike. The premium paid for the put option is also referred to as the option premium. The amount that the trader can lose on a put option is equal to the premium and the stock prices less this amount.

When to use a put options strategy

A put option is a financial instrument which allows an investor to purchase an underlying stock at a predetermined strike price, and then expire. The investment can be protected from possible loss. This option is typically purchased by an investor when they believe the underlying security's value will drop below its current market value. It can also be sold if the price has dropped too far.

Buy a put if you have stock that is susceptible to price fluctuations. This will help reduce your losses and protect your profits. But it's important to understand the risks of this type of strategy.

When to Buy a Place

The best time to buy a put is when the underlying security's price is expected to decline, allowing the trader to keep the entire premium paid for the put option. To decide whether to buy a call option, the trader needs to consider the stock’s volatility as well the expiration date.

When to Sell a Place

If the stock's value has dropped too much and the trader does not have enough money to purchase the stock, they may be able to sell the stock or put on the stock to cover their losses. The trader's losses are limited to the difference in stock price and the premium they paid. If the option expires, the put option can be offset by the rise in the underlying securities' value.

Calculating the Married Put

A bullish trading strategy known as a "married put" or "protective put" works in the same way as an insurance policy. This strategy is often used by traders or short-term investors who believe a stock will rise in price but need to be protected against sudden price swings.

Trader may have two stocks in a marriage: the actual stock stock position and a put options that allows them to sell the stock at an agreed price within a time period. The trader can exercise the option and make a profit if the stock price falls below the strike price of the put option before the contract expires.

How to Calculate the Maximum Gain, Loss and Breakeven Point for a Put

The maximum gain is the difference between the strike price of the put option and the stock's current market value. The maximum loss refers to the amount of your premium plus any fees incurred in the event that the stock's current market value increases enough that the put options expires without value. The breakeven moment is when the underlying security's prices rise so much that they cover all of your premium as well as any commissions you paid for the put premium.

FAQ

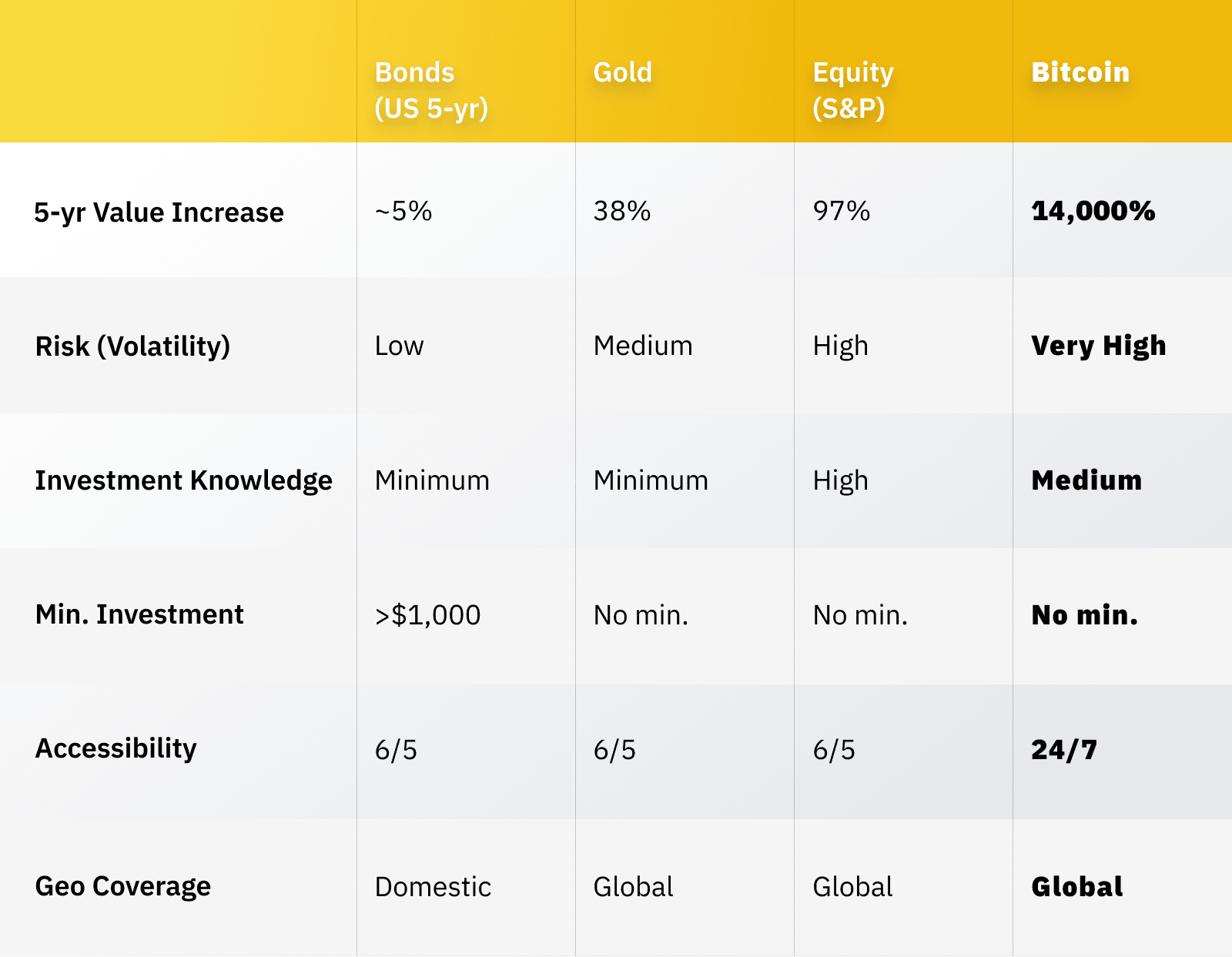

Forex and Cryptocurrencies are great investments.

Yes, you can get rich trading crypto and forex if you use a strategic approach. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

What are the pros and cons of investing online?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protect yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Unsolicited email or phone calls should not be answered. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Keep in mind that fraudsters will try everything to get your personal details. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.