Crude oil trading refers to the buying and selling of crude oil. If done correctly, this type trading can be lucrative. There are risks involved that could lead to you losing your investment. You need to be careful before entering this market.

First, you need to understand what oil is and how it is traded. This will help to understand how to make the most of crude oil prices.

There are many methods you can use to trade oil. Futures contracts are probably the most widely used. They allow you purchase and sell exact amounts of oil for a fixed price at certain dates in the future. If you want to speculate on future price volatility, this can be very useful.

CFDs are another popular way to speculate on oil prices. This strategy is great for speculators because it allows you to profit quickly from price movements without actually owning the commodity.

Day trading is a short term strategy that seeks to make a profit from the rapid price movements in the crude oil markets. This strategy is especially useful when there are major economic announcements or geopolitical events that cause sharp price fluctuations.

Scalping allows you to trade on price volatility by opening and closing positions faster. Although this is a great way of profiting from market movements quickly, it is not recommended for everyone.

Trend trading is another way to trade crude oil. It allows you make profit from short-term price movements. This is done through the use of technical analysis tools to determine long and short price trends. Once they spot a trend ending, traders will open positions and close them.

Momentum oscillators can be a crucial part of crude oil trading strategies as they enable you to measure the strength and direction of price trends. They are great at identifying market exhaustion and reversal points.

You can use momentum oscillators to analyze the price of WTI crude oil futures on any intraday time frame. These indicators can also be used with technical analysis tools to help you create a solid strategy for trading crude oil.

Combining technical and fundamental analysis is the best way to trade crude oil. This means that you'll be looking at supply and demand in the crude oil market as well as other factors such as global growth, the dollar and alternative energy sources.

Also, it is important to remember that seasonality must be taken into consideration when trading this commodity. This is because crude oil tends to fluctuate during different periods of the year.

There are many options for trading crude oil. However, it is important to pick a strategy you can keep with over time. While you need to be aware of the potential risks, it is possible to make a lot of money long term if your strategy is followed and you do your research.

FAQ

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Are forex traders able to make a living?

Yes, forex traders are able to make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Where can i invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

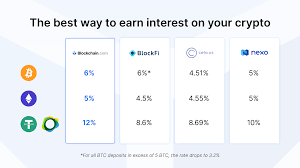

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, find any additional information that may be necessary to make confident investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

What are the advantages and disadvantages of online investing?

The main advantage of online investing is convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. There are many options to protect your valuable assets.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

Alternately, you can keep your money in physical forms such as cash or gold. However, it is less secure and more difficult to track and requires more maintenance for storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?