Immutable X is a marketplace that provides gas-free NFT trading with scalability and security. It's built on Ethereum blockchain. Transactions are verified using ZK Rollup. It has a scale of up to 9,000 transactions per second and does not charge any gas fees when trading and minting NFTs.

Zero-Knowledge Rollup is a layer-2 protocol which validates NFTs and does not add transaction data to the Blockchain. Instead, it stacks thousands of transactions into one proof, called the zkSTARK verification. This lowers transaction costs by allowing faster transactions.

NFTs have experienced a boom in trading volume and value over two years. But the Ethereum blockchain's current architecture can not handle that volume. Many NFT projects have moved to layer 2 platforms like Magic Eden or OpenSea.

They do have some issues though, such as high transaction costs and limited scalability. For example, NFTs can be transferred from one account to another in a few seconds but the transaction costs can add up very quickly when you're dealing with a large number of transactions.

Immutable X created a scaling solution for this problem. It allows NFTs (not minted with gas) to be traded and minted while keeping the security of the Ethereum network. ZKRollup is used to verify and process transactions.

Immutable X can mint NFTs with zero gas costs and up to 9,000 TPPS using a Zero Knowledge Rollup Smart Contract. This is the first layer-2 scaling solution capable of handling the NFTs' scaling requirements. It is a gamechanger in NFT technology.

Immutable X offers speed and scalability, as well as carbon neutrality for NFTs minted through the platform. Cool Effect and Trace have formed partnerships to offset the platform's carbon footprint.

Gods Unchained has been the foundation of trades on the platform. The team is looking to expand its portfolio with games like Ember Swords, Illuvium and Guild of Guardians. All these games can increase ImmutableX market volume and improve the overall trading activity.

These games can also be ranked, traded and traded on Immutable X with ERC-721 and ERC-1155 EFT token standards. This makes it possible for users to buy NFTs from multiple developers.

It is maintained up-todate and user-friendly by regularly updating the platform's visual interface. In the future, the Immutable X team plans to launch a wallet connect feature and a NFT calendar.

As well as a robust UI, the Immutable X platform is also backed by a token that can be staked and used to reward users for their actions on the platform. It is called IMX. There are 2 billion tokens in total.

IMX token owners can vote on the proposals made by the community to make their voice heard. The more IMX tokens you have, the greater your voting power. This makes Immutable X more likely to be adopted and improves the quality of the service.

FAQ

Where can I invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

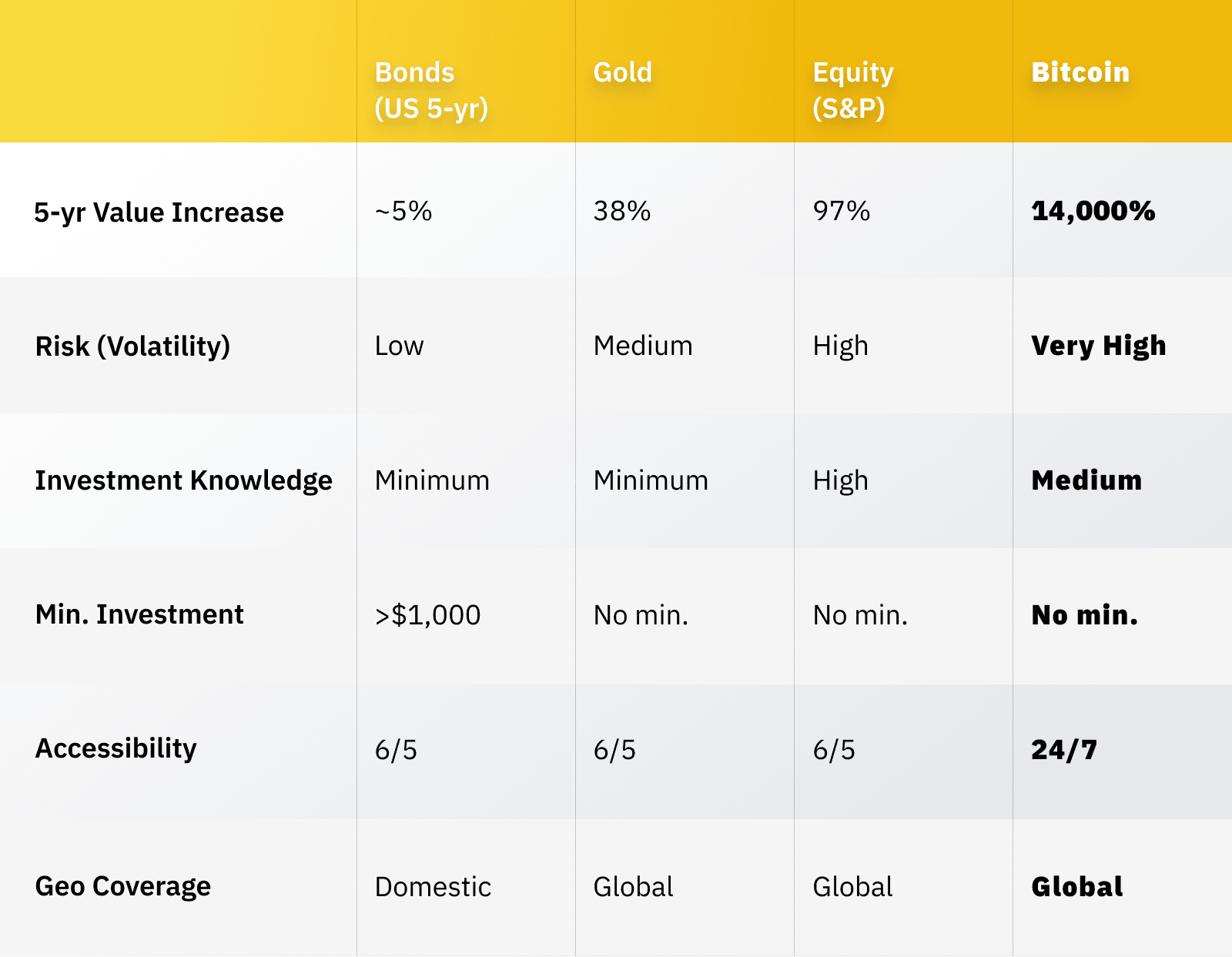

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the advantages and drawbacks to online investing?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

When investing online, security is crucial. Online investments can be dangerous. You need to know the risks and how to mitigate them.

You must be mindful of who your investment platform or app is dealing with. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. You should also use different passwords to protect each account from being compromised. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!