Day trading is a way to make extra money trading stocks. You can buy and sell stocks in the same trading day. Although it can provide a great opportunity to make extra income, it is important to fully understand the risks before you begin.

Before you start day trading you will need to decide your risk tolerance. You also need to set a trade and daily risk limit. It is important to know how to manage your account.

The Best Day Trading Platform UK

A good day trading platform will give you a wide range of markets and assets to choose from. A variety of educational and tools will be available to help you succeed in trading.

It is also important to look into the fees and commissions of your chosen platform. They can have a major impact on your profits. You want to maximize your profits by choosing a day trading platform offering low fees or commissions.

The Best Day Trading Software

An app that allows you to quickly track market trends and execute trades will be a must. It is also important to look for one with intuitive user interface and a broad range of analysis tools. Some day trading apps are available for free, while others require a subscription. Before making a decision, it's a good idea that you test out several different day trading applications.

The Top Websites for Day Traders

It is important to keep up with current news, and be informed about any developments that may affect the stock price of a company. One bad earnings report may cause a stock drop in value, while FDA approval for a novel drug could propel the share prices higher.

Before you invest any money, it's essential to establish your strategy and carefully plan out each of your investment holdings. This will ensure that you don’t make rash trades or trade in unattractive situations.

This is done by defining an exit point and entry point for each position. A defined entry point makes it easier to trade in a consistent way.

In addition, having a clearly defined exit point will provide you with the security of knowing that you aren't putting your whole portfolio at risk by randomly exiting or entering positions. It will also help you to keep your emotions in check and avoid getting too emotionally invested.

The Right Strategy

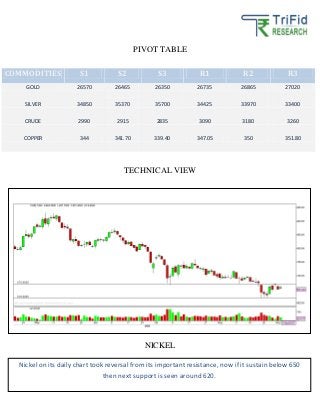

You can use many strategies to day trade, including daily pivots, momentum, and contrarian. Each strategy can be successful for a different type investor.

The best strategy for your situation will depend on your individual preferences and skills. Once you have found the best strategy for you, it is time to start practicing and gaining experience.

FAQ

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Which is harder, forex or crypto.

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Frequently Asked Questions

What are the different types of investing you can do?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts are a matter of safety. It is crucial to safeguard your data and assets against unwelcome intrusions.

You must first ensure that the platform you're using has security. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Check your account activities regularly to be alert of any unusual activity.

Thirdly, it's important to understand the terms and conditions of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, be sure to research the company where you plan on investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Make sure to understand the tax implications of investing online.

These steps will ensure your online investment account is protected against any possible threats.