XM is an online broker offering a variety of trading options. CFDs can be traded on currencies, precious metals or energies. There are also a number of CFDs available for stocks and exchange traded funds. XM boasts over a million users.

XM has been registered as a broker with 10 European regulatory bodies. It is licensed in Cyprus by the International Financial Services Commission and Cyprus Securities and Exchange Commission. XM has a subsidiary called XM Global Limited. This is licensed by the Australian Securities and Investments Commission. XM has a presence in more than 190 countries worldwide.

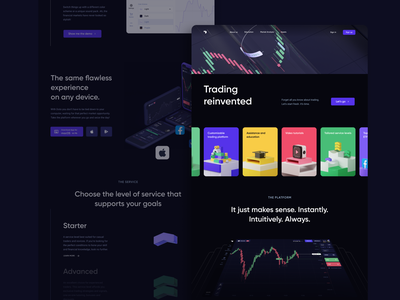

XM offers a number of account types to fit individual trading needs. These account types include Standard and Micro accounts. Both types of accounts have low minimum deposit amounts and allow for leverage. In addition, XM provides a demo account. XM offers a virtual private server service for free, that can be accessed from any location in the world.

Traders are able to withdraw money through their XM account via MasterCard, Visa Skrill, Neteller or Skrill. Payoneer is also accepted by XM. For XM to open an Account, you will need to provide accurate and current information. This includes proofs that you are real and your address. XM's websites provide multi-factor authentication to protect customer data.

XM's site offers a range of educational materials. A variety of webinars can be viewed by users. In addition, XM provides daily market analysis and trading signals. You can find many tutorials to learn more information about the broker's platforms. XM offers a manual signal tool for trading, with information on the most commonly traded instruments.

Spreads for XM brokers are lower than other brokers in their industry. For example, the average spread between major currency pairs in XM is 0.1pips. However, the spreads vary by account. Clients can have floating spreads to avoid paying excessive spreads, while still receiving the lowest prices.

XM has a different commission policy than many brokers. A deposit fee may be charged by a broker who is more competitive. Also, keep in mind that the broker's fees can vary based on your payment method. It is important to weigh the costs of sending money to brokers against the fees you will pay.

XM provides a micro account that requires a minimal deposit of $5. The micro account allows you to trade up to 300 positions simultaneously, and leverage up to 1:18. XM also offers protection against negative balances.

XM is a worldwide brokerage that serves more than 1.5million clients in 190 countries. As a result, it has a large network of financial markets around the world. Moreover, XM's services are provided in multiple languages. Apart from its website, XM offers a mobile app which can be downloaded to both Android and Apple smartphones.

XM broker is very popular with traders in America, Japan, Canada, and elsewhere. Anyone who resides in these countries should consult the relevant regulations before opening an Account. Some countries require proof of identification to open an account.

FAQ

What are the advantages and drawbacks to online investing?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, online investing does have its downsides. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Frequently Asked Question

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Where can you invest and make daily income?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need is the right knowledge and tools to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investing is a risky venture. Online investments pose risks to your financial and personal data. Take steps to reduce them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. To ensure your account security, disable auto-login on all devices. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!