Forex traders who excel at identifying profitable opportunities and implementing strategies are well-known for their ability to do so. This can be done using many methods, such as technical analysis or just trusting your instincts. However, there are some common traits that all the most successful Forex traders have in common.

George Soros is a successful forex trader. In 1992, Soros was able make $1 billion by short-selling the British pound. His success is due to his risk management and compounding skills, among other methods.

Paul Tudor Jones, another Forex trader, is also worthy of a place in this pantheon. Paul Tudor Jones, a legendary commodities broker, started trading cotton futures on the New York Cotton Exchange at age 18. He was fired after falling asleep at his desk.

Paul Tudor Jones was a successful futures trader and also founded Tudor Investment Corporation. This company trades a wide range of assets. He became one of the greatest investors of all time.

He also developed Renaissance Technologies, a money management fund. The company employs people with diverse backgrounds to implement its algorithms. This company was established to assist investors in investing in the markets using a variety online tools.

Andrew Krieger is another name well-known in the forex trading industry. While he's made his mark in the market, his most notable accomplishment is his ability use the strong dollar of the Reagan administration.

Andrew Krieger, despite his modest beginnings, rose quickly up the corporate ladder to become a millionaire in ten short years. In 1987, he made a bet against the New Zealand dollar that paid off handsomely.

Bill Lipschutz was similar. He started trading in his spare hours with a little inheritance, and a lot more hard work. He is currently ranked number two in forex trading. He claimed to have held positions worth close to $300 million in Deutsch marks over his entire career.

All of the best Forex traders are known for their ability to minimize losses and maximize gains. This skill requires patience. It is important to recognize when you are making impulsive trades and how to avoid them. Your investments will start to earn decent returns if you create and follow a trading plan that is suited to your personality.

If you aren't familiar with these forex traders, you should. They have all mastered the art of risk management and acted on a variety of opportunities to earn their fortunes. However, the most successful Forex traders are not always the richest. Even the top names in the Forex industry had to learn a lot to get where they are today. You can easily fall into deep financial trouble if you make a few mistakes.

FAQ

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

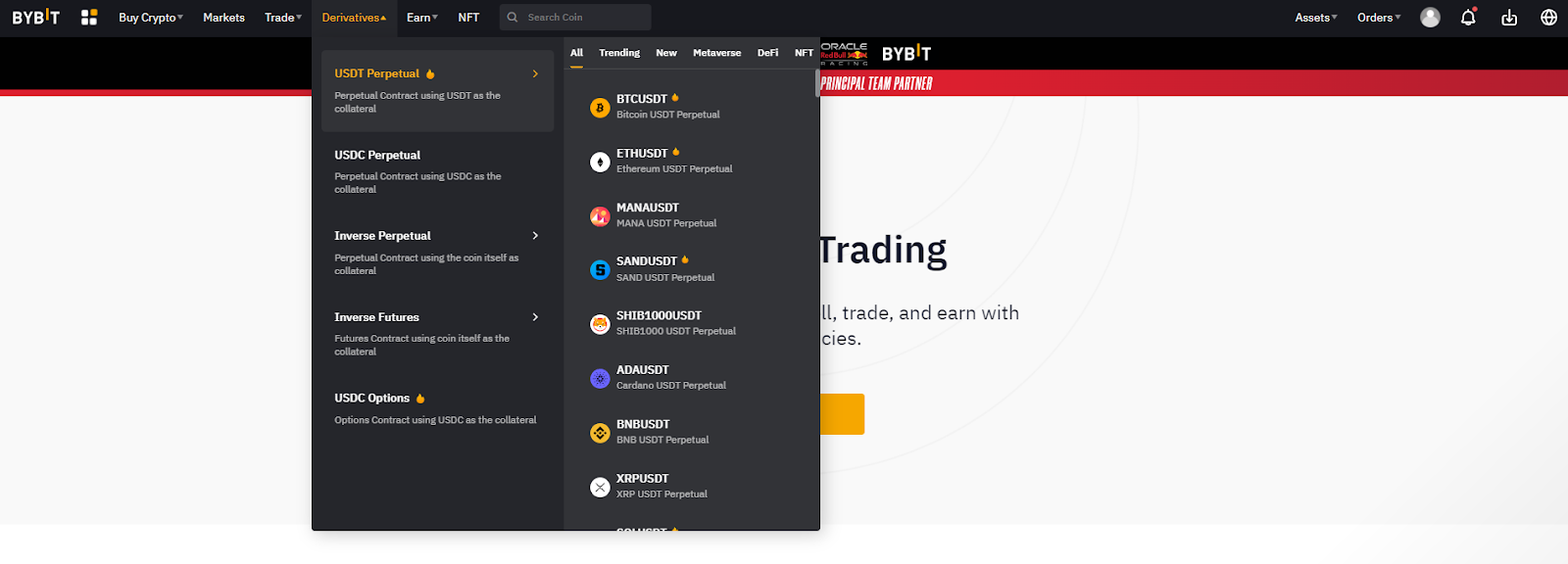

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What is the best trading platform for you?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It must also be easy to use and intuitive.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Frequently Asked Fragen

What are the four types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. There are many options to protect your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. The downside is that there may be electronic thefts.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?