These stocks are best to trade because they can generate significant daily price movement. They also have enough volume to support large-scale trading.

Stocks that trade on a daily basis

A stock must have high volume and volatility as well as a long-term, fundamental analysis to be considered one of the best stocks. This will ensure that the stock generates large future profits.

It must also have a liquidity stock with low impact cost and the ability respond to newsflows proactively. Lastly, it should be a company that is transparent about its operations and provides crucial information to the public.

Best intraday shares for 2022

Volatility is an important factor to consider when selecting stocks for intraday trades. Volatility is a measure of the amount of risk/unpredictability associated with a stock's value. The potential for major price changes is greater the higher the volatility.

Trend is another thing you should look for in an intraday stock. A stock that is trending upwards will move in a positive direction. It will follow a clear pattern, which is easy to explain and extrapolate.

This means that a strong trending stock will tend to stay within a certain range, and it will not move outside of this range as quickly as a weaker trending stock. This is a great way for you to maximize your return and minimize your risk.

A great example of a trending stock is Nike. It is a leader in innovation and is dedicated to connecting with customers. Its Nike Direct business has performed well and is experiencing strong international growth.

Tesla is an American multinational electric vehicle manufacturer (EV). It is valued at more than $950 billion and is rapidly growing as the world moves to clean energy.

The stock's constant media coverage and eccentric CEO Elon Musk have made it a hot topic for speculation. It can be easily triggered from a single news story, positive or negative.

It doesn't really matter if your goal is to trade for a livelihood or to make side income. What matters is that you choose the best stocks to trade, which will suit your investment style as well as your risk appetite. These tips will help you make an informed decision about which stocks are the best investments.

FAQ

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

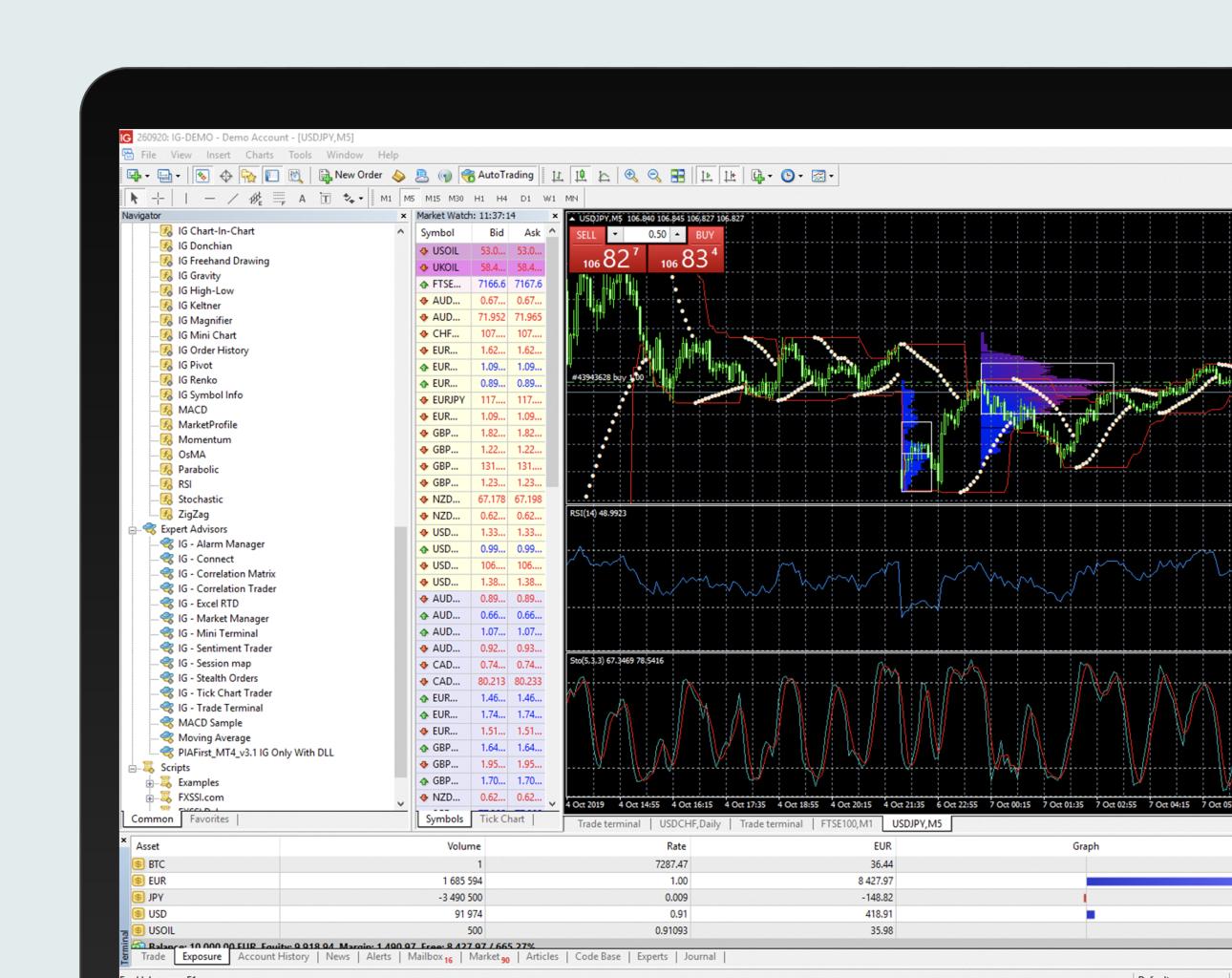

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which trading site for beginners is the best?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How do forex traders make their money?

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

When investing online, security is crucial. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Be mindful of whom you are dealing with when using any investment app. Reputable companies have good customer ratings and reviews. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!