Non-fungible tokens, also known as NFTs are digital assets stored on a Blockchain. They can be used to create music, sound, and images. In recent years, they have gained popularity. There are now a variety of platforms that allow you to trade and purchase NFTs. The majority of these platforms focus on Ethereum.

Reddit, one of the largest social media sites in the world, recently joined the NFT scene. To this end, Reddit recently launched an NFT marketplace, which allows users to purchase a range of NFTs using fiat currency. This is a welcome addition, and it will undoubtedly drive millions of dollar in sales.

Reddit has been a major player in this space, although it is not the first site to offer NFT-based platforms. In the last few months, activity has increased on its /r/NFTmarket.

Reddit conducted an online survey to see what its users wanted from a marketplace that was NFT-based before it launched the marketplace. The survey revealed that 35% of respondents didn't think NFTs should be hurt by the presence of brands on the platform. On the contrary, 39% of respondents thought NFTs could give them more credibility and more than 70% wanted them to be purchased.

Reddit avoided the industry jargon when it launched the NFT marketplace. The term "NFT", for example, has a negative approval rating. Instead, Reddit is calling them digital collectibles.

The initial collectibles that were sold on the platform came at a modest price, between 10 and 100 US dollars. However, prices rose over time. Reddit Avatars that are the most expensive sell for hundreds. At the time of writing, three million units are in stock for the Collectible Avatars Project. Reddit avatar inventories are shrinking, which means that the secondary market for these avatars is booming.

Reddit users can buy NFT avatars with their bank card or credit card and then can store them in the Vault, the platform's native cryptocurrency wallet. These avatars may then be transferred to another platform or to another Reddit user's account. More than 2.8 million wallets were created since the beginning of the project. Additionally, 222,000 transactions have been made.

Reddit NFT Marketplace's success is also due to its large user base. Pali Bhat (chief product officer at Reddit), stated that more than three million Redditors already have a wallet. These wallets have so far held over 2.5 million vaults. Reddit boasts more users than OpenSea - the largest NFT trading exchange in the globe - which means that it has more than twice the number of users.

Reddit's transaction platform has yet to reach its full potential, despite its early success. It's a smart decision and there has been a lot of work behind the scenes.

Reddit has also made a major milestone in the development and launch of its NFT marketplace. In the short time it has been up and running, the site has outstripped its biggest competitor in user count.

FAQ

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Diversification of assets and managing your risk will make trading easier.

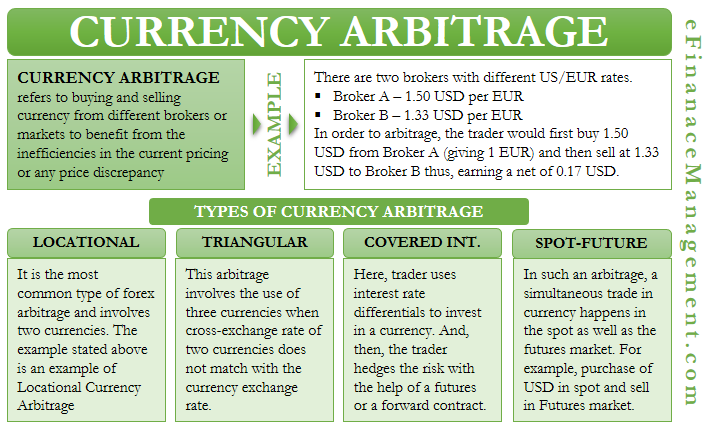

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing can help you grow your wealth and make money long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investing is a risky venture. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. You should also use different passwords to protect each account from being compromised. Finally, invest online using VPNs whenever possible. They are usually free and simple to set up.