Trade Desk stock prices rose 6% Wednesday in premarket trading after the advertising technology firm reported strong quarterly results and gave an optimistic outlook that exceeded analysts expectations. The company is expecting to post a 2.82% year-over-year profit margin and 0.20% for the entire year.

The company also indicated that revenue growth will be around 13%. This is well ahead of the expectations. It should be driven by an increase in demand for its cloud-based technology that ad buyers use across multiple devices to create and optimize digital advertisements.

This platform allows ad buyers optimize their ad spend to get the right ads in front if the right shoppers at the correct time. The company's technology is used to run digital advertising campaigns, which include display, video, audio and native ad campaigns.

E*TRADE: This brokerage firm is known for its superior trading technology, and has an extensive range of options analysis tools. In addition, it offers trade journaling and automated trading strategies.

TD Ameritrade: This broker is known for its outstanding trading platform, and it offers excellent market commentary and analysis. The broker also has a large library of educational content, including a quarterly magazine, thinkMoney.

Ticker Tape Portal: The Ticker Tape Portal is a rich source of information on daily markets, savings, retirement and trader education. Its articles cover a wide range of topics and are largely sourced from the TD Ameritrade network.

Mobile: TD Ameritrade Mobile offers all the features that you would expect from an online broker, including all the customizable options. You can chat with a live trader and place orders all from your smartphone or tablet.

Quote Overview: The quote page offers a quick view of the current price and trades. It displays historical prices, news and Cboe BZX pricing.

Desktop Charting: Thinkorswim Desktop Charting is as advanced as TradeStation. There are dozens and dozens real-time charts that stream data. Trader can overlay economic events and company announcements to project the future.

Research: Thoughtorswim's extensive library of technical studies contains hundreds. This database is based upon proprietary algorithms and is regularly updated. The database's news coverage and technical studies are supported by research from top academic journals.

Stock Advisor: The Stock Advisor service is a popular investment advisory and research firm that specializes in market-beating stock picks. Its recommendations are based on a rigorous research process and have outperformed the market by an average of 10% per year since inception.

Public: This app is great for new investors and it's simple to get started. It is easy to use, intuitive, and simple to add shares of your favourite companies to your account.

The Trade Desk is a company that has a lot of traction in the digital ad market, and it has a solid growth outlook for the future. The strong ad sale growth and strong financial performance of Trade Desk should result in a rise in share prices over the long-term. The company is also a leader in programmatic advertising, which means it has a unique position in the rapidly growing digital ad industry.

FAQ

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Which trading site for beginners is the best?

It all depends on how comfortable you are with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You only need the right information and tools to get started.

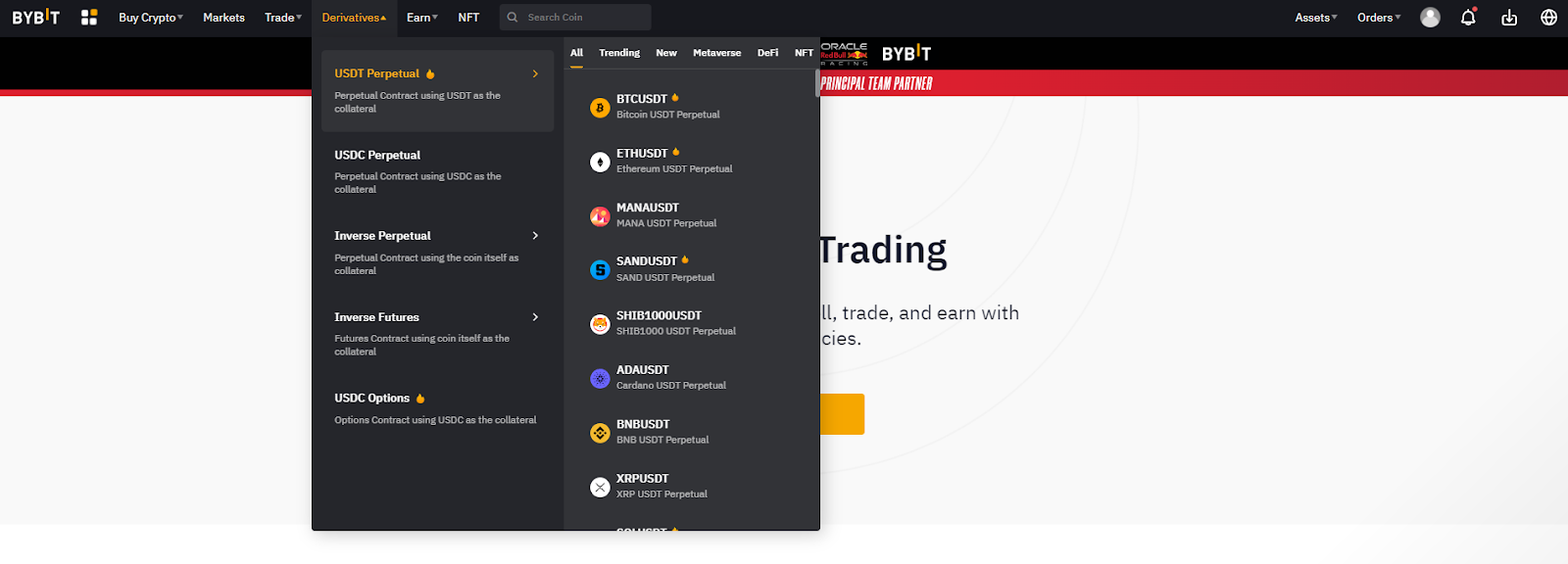

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, gather any additional information to help you feel confident about your investment decision. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which trading platform is best?

Many traders may find it challenging to choose the best trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This will help you narrow your search for the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Frequently Asked questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When investing online, research is essential. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before opening an account, confirm the exact fees and commissions on which you might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.