Pips forex refer to small fluctuations in exchange rates between currencies. The currency pair and trade size determine the value of one pip. In most cases, it's equal to a small proportion of the currency pairing's trade value. In hyperinflation cases, however, the pip can be meaningless.

FX Trading with Babypips

A forex trader may place two pending orders at once that are opposed to each other. Traders may, for example, buy EUR/USD and then sell GBP/USD. The price of one currency is two pips higher than the other when it moves, is called a "babypip".

How to calculate your Pip Value in a Trading Account

The value of each pip depends on the currency you use to open an account. Then, the numeric value of the pips will be determined by dividing the position size by the exchange rate.

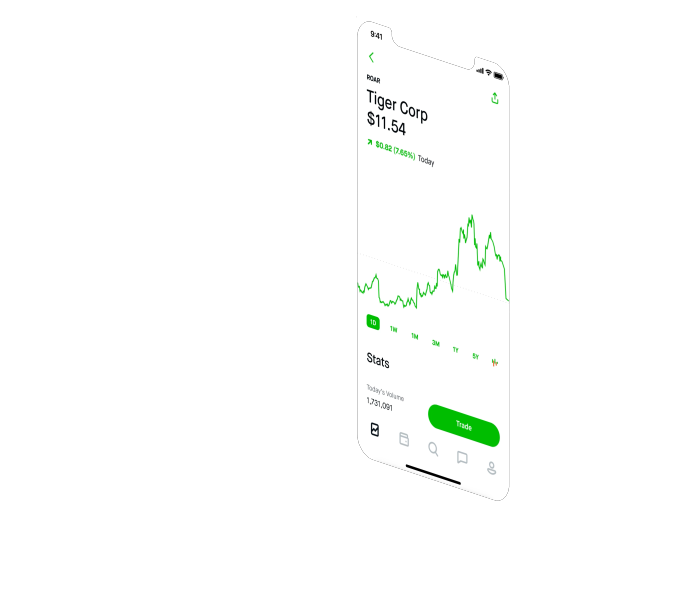

To calculate your pip price based on your trade size and account currency, you can use the online calculator. Simply enter the account currency and trade size in the fields below, and the calculator will display the value of a single pip for all Standard, Mini and Micro lots with the current market rates.

Using Leverage to Maximize Profits

It is crucial to understand how much leverage you can use to maximize your profits. Leverage can increase your lot size and, in turn, the number of pips you can make per trade. In addition, it can magnify your losses. Therefore, it is important to use moderate levels of leverage and never go overboard with your leverage.

How to Calculate Your Profits From Pip

Whether you are an experienced forex trader or you are just getting started, it is important to understand how to calculate your profits from pips. This will ensure that your account is profitable and that you don’t lose all of the funds you have invested.

An excellent place to start is to examine the major currency pairs EUR/USD/USD/JPY and EUR/USD/GBPY. This will give you an even better overview of the market's fundamentals. It can also help you understand how to best use pips.

From Pips to Dolls

The dollar will be the base currency if your forex trading account is funded in U.S. Dollars. The EUR/USD exchange rate is $10 for a U.S. dollar account and 8.92 for a euro-denominated one.

This is a common question that new traders ask. It is important to know the basics of forex pips. It is possible to lose significant amounts of money if your pips are not calculated correctly.

Understanding the difference between a point and a pip is important. A pip represents a small movement in the exchange rate between two currencies. While a point is larger and can be charted, it is easier to understand. These two currencies are distinct and traders newer to trading often fail to notice the difference.

FAQ

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Most Frequently Asked Questions

What are the 4 types of investing?

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Can forex traders make any money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

What are the advantages and drawbacks to online investing?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more difficult forex or crypto currency?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not answer unsolicited emails and phone calls. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Lastly, always remember "Scammers will try anything to get your personal information". Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It is also important that you use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.