Futures trading of agricultural commodities is a form risk management that allows farmers to sell their produce at a certain price in the future. These markets provide liquidity for traders who can place trades 24 hours a day. Farmers can increase their income by using this market.

Indian's only Indian exchange for trading commodity derivatives is the National Commodity and Derivatives Exchange Limited. It operates from an independent board of directors and has offices in all parts of India. The exchange traded 27 commodity contract, including 25 Agri-futures contracts, as of March 2018.

Agricultural commodities are the main livestock and produce we use in our daily lives. These include grains and dairy products as well as lean meats. These products often have an annual supply-demand cycle. You can also use many of the byproducts in your daily life. Some of the most popular agri commodities in India include soya oil, crude palm oil, and wheat.

Agrifutures can be used to enhance the overall marketing performance for farmers. Agri-futures can also be used to reduce harvest season risk. A futures contract can be sold by farmers to hedge their risk before harvest. They can then sell their produce at a reasonable price. They can even modify their cropping plan to reflect futures market price changes.

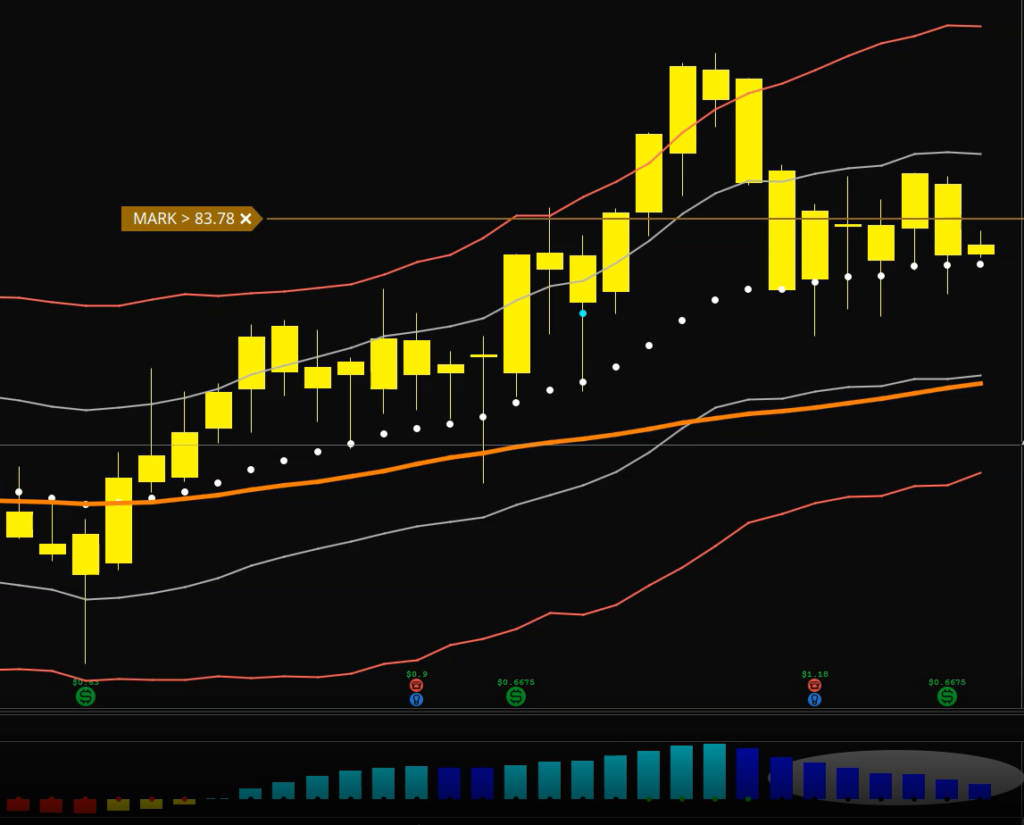

Futures trading is an extremely profitable business for farmers. But there are also risks. Traders should always be aware of these risks. There are many strategies out there, but it is important that traders do their research before making any investment in agrifutures. Traders might be able to look at the historical charts for specific commodities.

Having an online trading account is a quick and simple process. When you're ready to trade, you can buy or offer a futures contract. Because these contracts are standard, they can be settled without delivery. But, it is possible to hedge against long positions or offset short positions.

Futures trading in agricultural commodities has another advantage: it frees middlemen from their grip. This is especially true for small farmers. They are heavily dependent on traditional marketing channels and pay high commissions. They can reduce their dependence upon these middlemen and earn more money by trading in futures.

There is a lot of information about the agricultural futures trade online. You can view historical charts to see the trends and price changes. It is important to understand the agricultural production cycle before making a decision. Additionally, it is important to know the differences among feed and other food commodities.

The main difference between agri- and food commodities is their inability to be grown all year. Most crops are planted only during specific times of the year. The weather can impact supply and demande.

FAQ

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which is safe crypto or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

What are the pros and cons of investing online?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protecting yourself starts with you. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Don't forget to remember that "Scammers will attempt anything to get personal information." Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.