CTA trading software is a method for identifying and following market trends. It is typically based on technical and fundamental analysis. These strategies have always produced positive returns. They are however very volatile. They can cause significant drawdowns, especially if major trend reversals happen.

These types programs use a systematic approach for generating signals that can be used to create futures contracts. This allows them to scale up and improve transparency. Some funds will hold trades for months or years at a time. Leverage can be used for reducing risk and increasing returns.

Trend-following programs are the most common type of CTAs. The majority of trend followers follow a position management strategy. This is a strategy that reduces losses and can be used in the short to mid-term. This means that only trades can be opened if there is a continuing trend. The trade is immediately stopped if the trend stops. These CTAs may result in drawdowns that are similar to those experienced with equity funds.

While both systematic and discretionary strategies can be similar in many ways they have their own risk management. Systematic strategies are based upon models that are coded in trading algorithms. Discretionary and human-based strategies often include fundamental analysis. As with any investment strategy, there is a potential for a lack of discipline in both approaches.

CTAs used to use a combination of fundamental and technical analysis. They also managed risk. In order to reduce volatility overall, managers will often trade a wide range of instruments. They will also take all trade decisions with regard to the entire portfolio.

In the early days of managed futures, Richard Donchian had a major influence. His Turtle Trading program was a catalyst to a multitude of CTAs and he taught a system which was used by many successful traders.

CTAs that are trend-following have a medium to short-term time horizon. In this approach, the trader makes long or short positions in certain futures markets based on the momentum of the asset. CTAs could choose to invest in the US stock markets if they believe the US equity market will recover. They may also invest in US dollars if the US economy strengthens in the coming months.

Discretionary CTAs use a more fundamental approach to making trading decisions. These programs are based primarily on human judgment and risk-management techniques. However, many have not had the opportunity to achieve optimal results. This is why many CTAs that are just starting out don't last beyond the first year.

You can choose to trade in either a systematic or discretionary manner. It is important to know the details of each CTA trading program. Each program uses a different approach and can produce varying levels of risk and reward. The best approach is one that meets your needs.

CTAs offer diversification that is excellent. CTAs can produce long-term positive returns and are not very correlated to other investments. But they can also be extremely volatile, so investors need to be cautious.

FAQ

Frequently Asked Questions

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, gather any additional information to help you feel confident about your investment decision. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Do forex traders make money?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

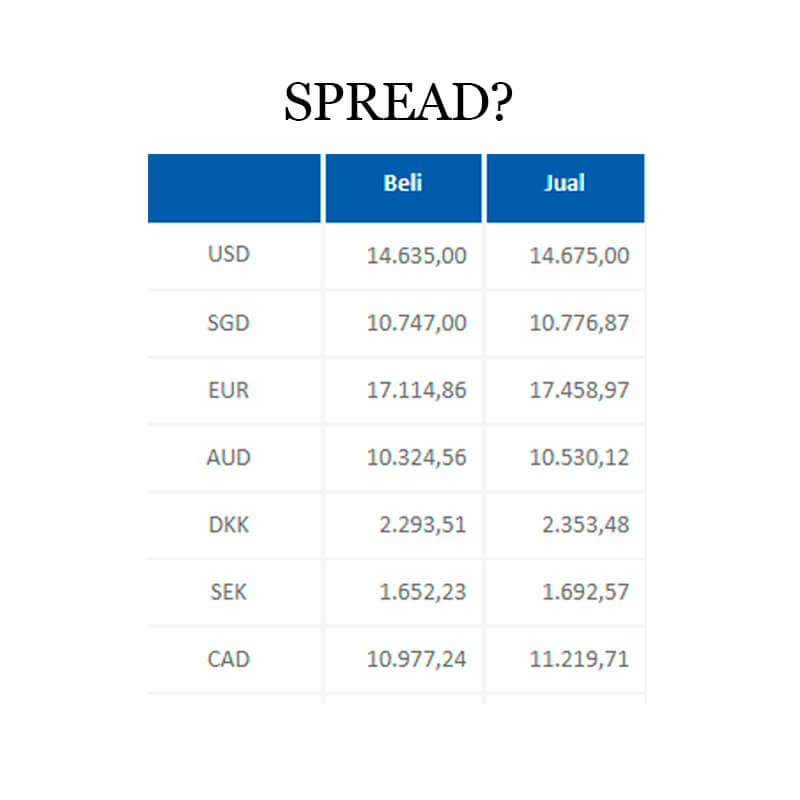

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

The decision about where to store your money can be complicated. There are many options to protect your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?