You should expect volatility when investing in crypto. In a matter hours, the value of a cryptocurrency can fluctuate dramatically. If you're not prepared you might not be able make a profit selling your coins. This can lead to a big loss.

Make sure you have everything in order before you start investing in cryptocurrency. You should have an emergency fund and a portfolio that is diverse. Keep your credit score high. A decline in credit scores can lead to major damage.

Cryptocurrency investments can provide you with a high return, but they are extremely risky. To reduce the risk, it is essential to be educated. You should read articles and whitepapers on the topic. These will give an idea of your investment case and potential risks. Before opening an account, be sure to research everything.

Lack of regulation is one problem with crypto. Although many cryptocurrencies have cash flow or hard assets backing them, there are still many that don't. Since the crypto market is so volatile, you'll need to be prepared for significant losses.

You need to understand the tax implications of investing in crypto. For instance, if your income from crypto investments is earned by a US resident you will have to pay capital gains tax. But this is just one of the risks. There are many scams in the industry that can be dangerous.

Security is another important aspect to consider before you invest. You should be cautious when investing in cryptocurrency exchanges. Some exchanges offer secure storage options, but you'll need to check them out before you make a purchase.

Other risks include privacy issues. Your personal information will not be protected, unlike stocks. A hardware wallet is recommended as it is more secure. Keep up to date with developments in your cryptocurrency.

It is possible that you will fall short of your financial obligations. This could result in foreclosure or repossession of your property, and it can also affect credit scores.

A new coin purchase can be a great opportunity. But don't overdo it. The impact of a 10% drop on the price of a coin is much greater than that of a 95% decrease. The same goes for selling coins early, which can result in a large return.

Although investing in crypto can help diversify your investments it is not for everyone. Particularly if you don't know much about the industry, it is important to take your time to learn more. Finding a trustworthy educational source is the first step.

Once you have a good understanding of the industry, it is time to start looking for a job. You should do your research and create a plan to take over your new job. Don't be afraid to talk to others, since they can give you an unbiased view of the market.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Trading with money you can afford is a good way to reduce your risk.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

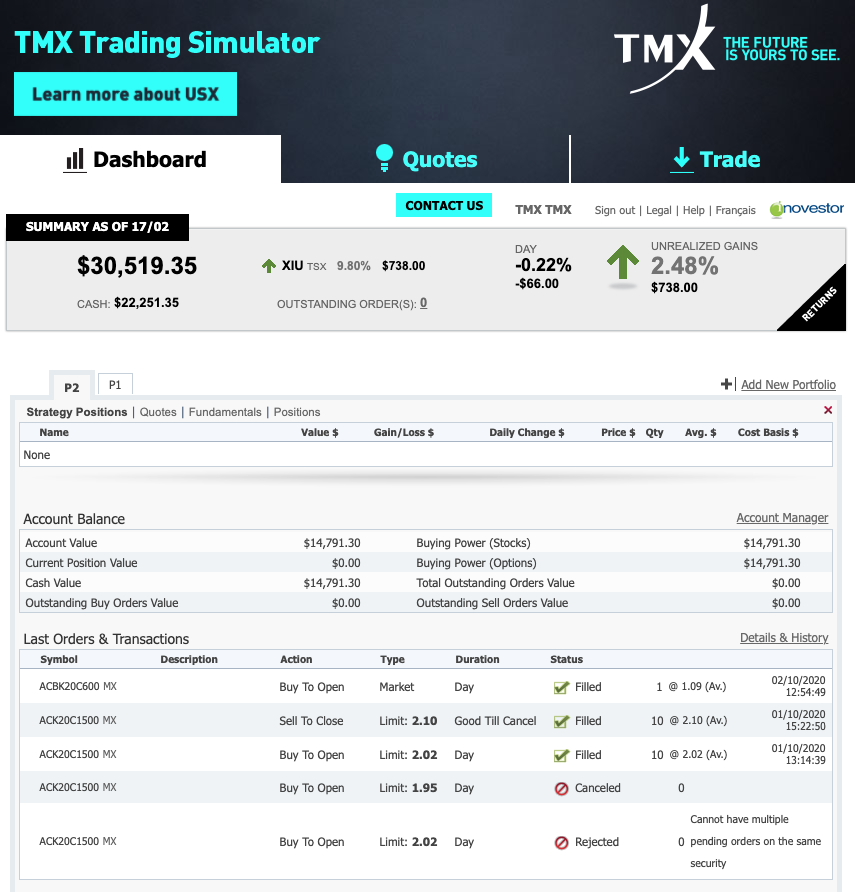

Which is the best trading platform?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Are forex traders able to make a living?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Some investments may also require a minimum investment or other restrictions.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protecting yourself starts with you. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Never respond to unsolicited phone calls or emails. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, thoroughly research investment opportunities independently.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Lastly, always remember "Scammers will try anything to get your personal information". Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

Also, it is important to invest online using secure platforms. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.