Forex fundamental analysis involves analyzing currency pairs on the basis of several factors that determine their relative worth. These factors may include the country's economy, interest rates, inflation reports, and any other data that might impact the price of different currencies.

Fundamental analysis is a time consuming and complex process but it can offer forex traders a wealth of information about the economy and the potential for profit. This tool is valuable and can be used by all traders, regardless of their experience or trading style.

Forex Fundamental Analysis: When should you use it?

Fundamental analysis is a way to forecast where a currency will move next. You can also use it to get ahead of the curve when it comes time to take advantage of volatility windows, which will allow you to capitalise on these opportunities and get in before others.

How to Use Fundamental Analysis

A broad range of factors can affect the price of currency pairs. This is how you approach Forex fundamental analysis. It is a great idea to be familiarized with the main economic indicators that influence the health and profitability of currency pairs.

One example is that if the unemployment rate in a country falls or the economy improves, its currency will likely strengthen since more foreign companies and investors will be interested to invest there.

It's also worth mentioning that when a central bank cuts interest rates, they can actually cause more money to flow out of the economy, which in turn can create economic bubbles and lead to severe market volatility. This can be a dangerous scenario for any trader, but it's not something to ignore.

Forex Technical Analysis

Focusing on technical analysis for forex traders is the most common way to make trading decisions. This analysis uses charts to analyze the trend of a currency.

Forex traders tend to focus on the most current news in order make their trading decisions. This means that forex markets will move quickly when new data becomes available.

This can prove to be dangerous if you are not an experienced forex trader or have not fully grasped the market's intricacies. It's often recommended that a forex trader should use a combination of technical analysis and fundamental analysis in their trading strategies.

When to Use Mobile Forex Trading

Mobile forex trading is an opportunity to capitalize on market conditions for traders who trade wherever they go. Using a smartphone or tablet can give you the ability to access market news and economic reports as they're released, enabling you to make informed trading decisions.

When to Use Forex Analysis

Fundamental analysis is a highly complex area of research that can prove difficult to grasp and master. But, fundamental analysis can be a powerful tool to improve your forex trading results. It can also help you avoid common errors made by newcomers in the forex market.

FAQ

Frequently Asked Question

What are the four types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

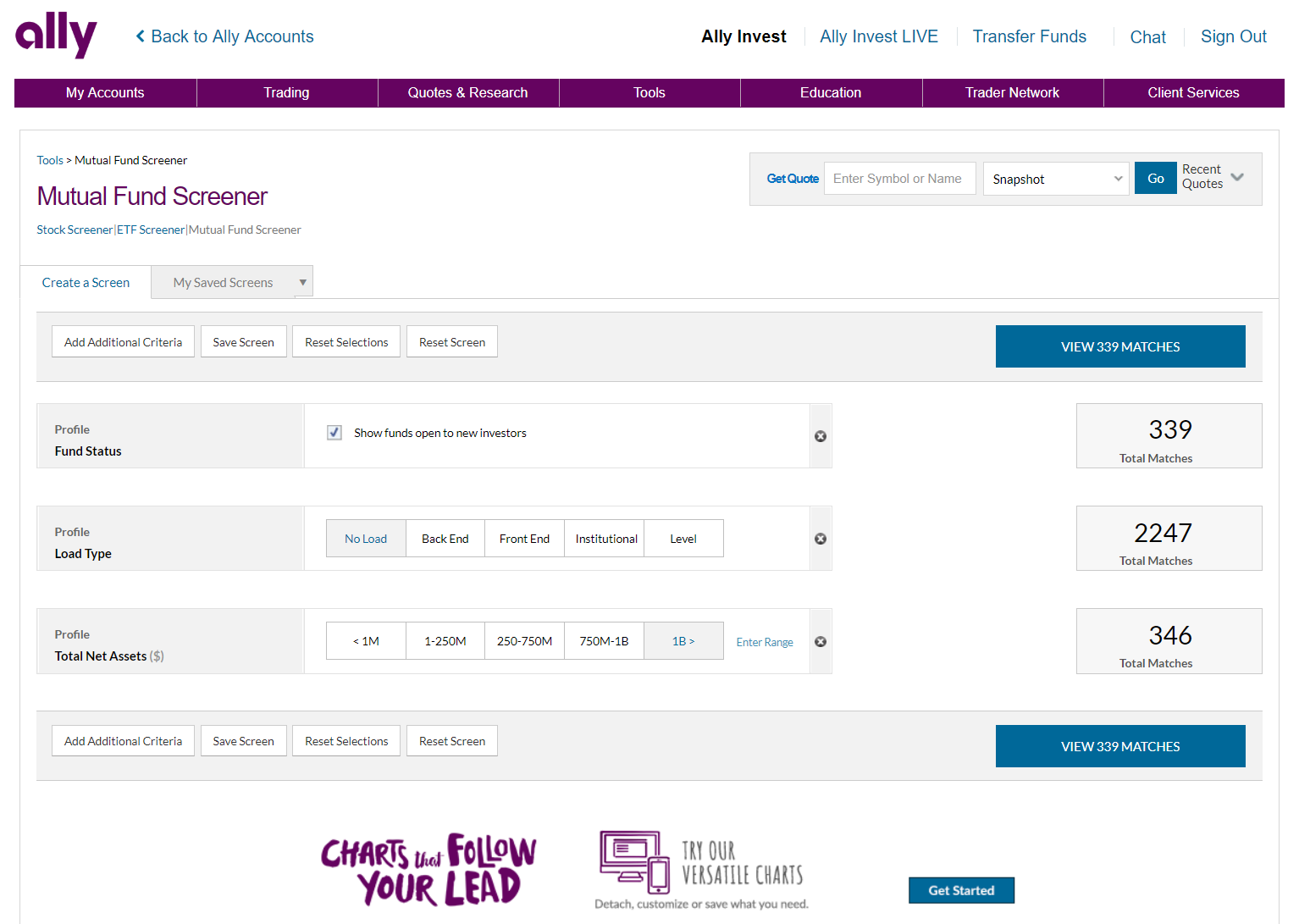

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

How Can I Invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is it possible to make a lot of money trading forex and cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Do forex traders make money?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. A strong security system is essential for your valuable assets. There are several options.

Online storage of investment assets is easy and convenient. You can access them easily from any device. However, electronic breaches can occur and there are potential risks when you use a digital option.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?