Investing in blockchain technology is a growing trend as more and more companies adopt the tech to improve their business processes. Banks and other institutions use blockchain technology to improve efficiency. Startups that use blockchain technology to build their brand are also included.

There are many ways to invest in Blockchain. These include buying cryptocurrencies such as Bitcoin and Ether, or investing in an ETF that tracks a group of companies in the industry. Venture capital firms that specialize in blockchain investing also have options. Your investment timeframe, risk tolerance and type of company are all factors that will influence which of these options you choose.

Buy crypto – cryptocurrency is one of the most popular ways to invest in blockchain. It's also the easiest. Every time you purchase or sell a block of coins, you are making an investment in the underlying blockchain. It is important to understand the risks involved in this type of investment. There are many software bugs and scams that could lead to large losses.

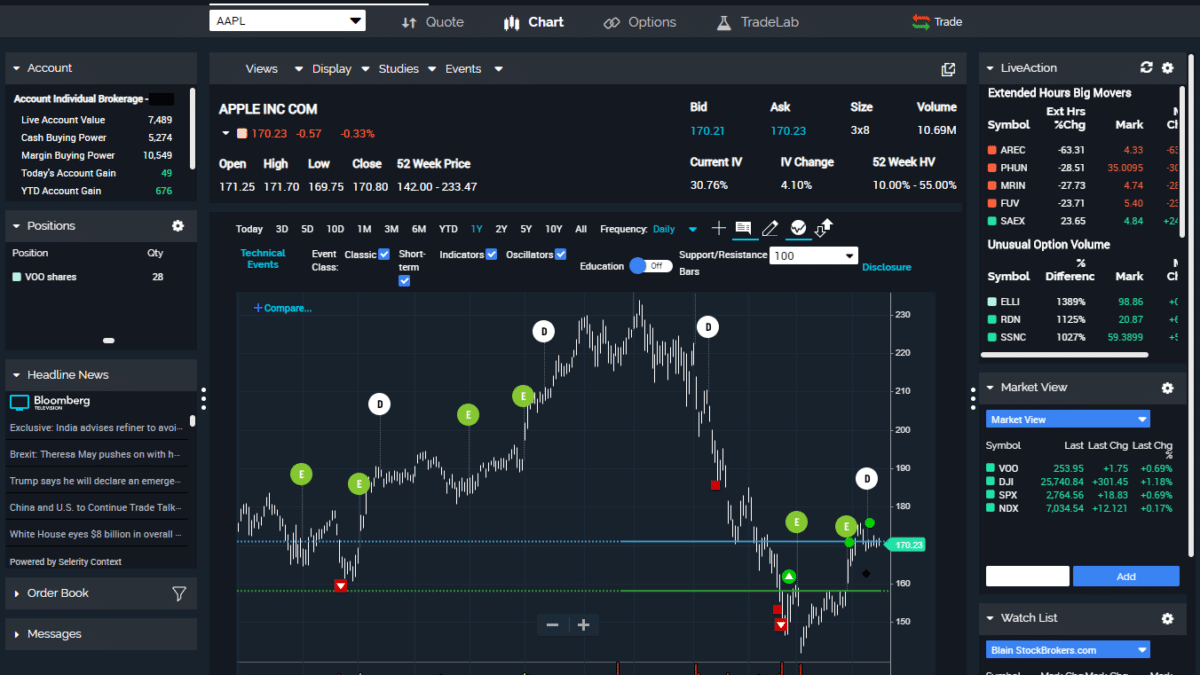

Shares in blockchain stock - investing your money in shares of companies that use blockchain technology is a great way of getting exposure and increasing your chances of making a profit over the long term. Companies that are using blockchain to create new uses and developing products and services for it are the best to invest in.

You can purchase blockchain stocks through an exchange or through a broker. If you are looking to invest in a particular company, you should read up on its business model and the potential for growth.

There are several types of blockchain stocks, ranging from early-stage venture capital firms to established businesses that have been using the technology for years. They are the most successful ones, and those with a proven track record of success.

Stock indices, or ETFs, are funds that offer exposure to a variety of companies in the Blockchain industry. They often cost less than buying individual stocks. For example, the Nasdaq Blockchain Economics Index is curated by an exchange in order to provide you with access to the top companies in the field.

IPOs or initial coin offerings are a good way to buy into a brand new company that isn't yet publicly traded. These investments are typically accompanied by a fair amount of public discussion, and they can be an excellent opportunity to pick up tokens that could become part of your portfolio in the future.

A variety of exchange-traded mutual funds that are focused specifically on the blockchain sector were launched in recent months. They offer another avenue for you to invest into this fast-growing market. One such fund is the Amplify Transformational Data Sharing ETF.

Although there are many ways to invest in Blockchain, the most effective way to do so is through exchange-traded funds. These funds, which are regulated, allow investors to make easy investments in the blockchain industry without needing to purchase or sell any crypto. They also offer the added benefit of being able to diversify your holdings, and are a good way for people who want to dip their toes into this market without spending too much cash.

FAQ

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Do forex traders make money?

Forex traders can make good money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading is not an easy task, but it can be done with the right knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Frequently Asked Questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Trading forex or Cryptocurrencies can make you rich.

Yes, you can get rich trading crypto and forex if you use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

Online investment is not without risk. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!