You need to be familiar with the following information if you are interested in trading nfts. First, you must connect your wallet and OpenSea platforms. After that, you can begin searching for NFTs available to purchase or to bid on. After you have found the token you want, you can either buy it at a fixed cost or make an offer.

OpenSea's easiest way to purchase NFTs is to buy them at fixed prices. However, it's worth considering making an offer. This option is only available for some NFTs, and it can be useful for acquiring rare and difficult-to-find tokens. However, you'll need to pay a fee to OpenSea for doing so, and it can be difficult to win an auction.

NFT trading on OpenSea is a great option for anyone who wants to take advantage of the burgeoning market for non-fungible tokens (NFTs). NFTs are digital assets that can't be mined and can't be manipulated in any way. They can be used in a number of ways, including social media, games and gamification.

OpenSea has the world's largest NFT exchange and provides a wide range of tools for traders to trade NFTs. They support many blockchains, such as Ethereum and Polygon.

To trade NFTs on OpenSea, you must first connect your cryptocurrency wallet to the platform. This can be done using a wallet like MetaMask, or downloading an app like MetaMask Plus.

Once you have connected your wallet to the NFT, you will see two options: "Add to collection" or "Place bid." Clicking the latter will let you place a bid and select the amount of money that you'd like. If you succeed, the NFT can be transferred to it.

OpenSea allows you to easily sell NFTs. OpenSea allows sellers to accept offers for their NFTs, and then they can sell them at the price that they have set. Although they will still be charged a small commission, this is significantly less than any other platform fees.

The transaction will be recorded on Ethereum's blockchain after you have sold your NFTs via OpenSea. This means that you can use Etherscan to verify your ownership of the NFT.

The blockchain is the public leadger of all transactions occurring on the network. It allows you to see if any NFTs have been traded on other exchanges and marketplaces. This can be used to verify the ownership of your NFTs, and confirm that they have not been sold by mistake.

Keeping track of your NFTs is easy on the OpenSea mobile app. Connect your profile and search for NFTs previously collected. You can also discover new assets by tapping the "Discover” button in the main menu.

OpenSea's platform is the largest in the market and has been a pioneer in NFT trade for years. OpenSea offers both buyers and sellers a large selection of NFTs across a variety of blockchains. It also offers a range of services to help people find the right NFTs for them, from gamification to user support.

FAQ

How do forex traders make their money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

What are the pros and cons of investing online?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which trading site for beginners is the best?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Is Cryptocurrency Good for Investment?

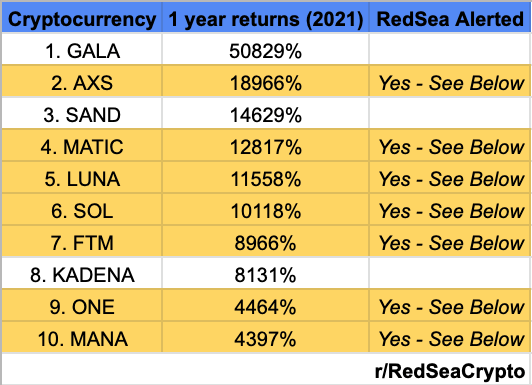

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which trading platform is the best?

Many traders may find it challenging to choose the best trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down the search for the right platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

Should I store my investment assets online or do I have other options?

Money can be complex but so can the decisions about how to store it. You have several options when it comes to protecting your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. The downside is that there may be electronic thefts.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?