The Chicago Mercantile Exchange (CME), located in Chicago, Illinois, is the largest options and futures contracts exchange in the world. CME markets a wide range of benchmark products across all major asset classes, including equity indexes, foreign exchange, energy, agriculture commodities and metals. CME Globex Trading System, which is used by more than 90% to trade on the exchange, was established.

CME is an international market and a top derivatives clearinghouse. CME Group, the world’s largest derivatives market, CME Clearing which provides clearing services for over-the-counter derivatives transactions, and CME Globex Trading System (an electronic trading platform used by many of its members) are the primary businesses.

Globex, an open-access trading market that is available 24/7, allows you to trade virtually anywhere in the world. It offers a broad range of unique products and traditional futures and options products traded through an open outcry method.

CME Globex, the first electronic trading platform for options and futures, was created in 1992. It was established to enhance trading efficiency, extend trading hours and complement the exchange’s open outcry systems.

Agricultural Markets

CME Group owns the Chicago Board of Trade(CBOT) Designated Contract Markets. This market offers futures on wheat, soybeans, and other agricultural commodities. CBOT, KCBT and other markets provide liquidity to traders and farmers who trade in these commodities.

CME extended its hours to 21 hrs a days on Sunday, 20 May, for a wide range grain and oilseed options and futures. This change was based on feedback from more than 4,000 farmers, commercial customers and traders.

These new hours offer traders and investors more time for managing risk in the grains and oilseed markets. This also increases liquidity and improves market performance. Liquidity improves market performance by allowing for more price discovery and movement, as well as reducing transaction costs.

USDA Reports & Trading Hours

During the next several weeks, trading in CME Group's futures markets will be influenced by the release of key agricultural reports from the United States Department of Agriculture. These reports will trigger immediate reactions that will affect prices. This could result in massive spikes or drops in trading activity.

CME Group constantly changes the rules and regulations that govern its markets. Therefore, the trading hours will also continue to change. These changes are often made as a response to customer feedback or in order to meet specific regulatory requirements.

Globex Trading Hours

CME Globex's trading platform is used for almost all of the trading. This platform handles more than 90% of CME’s total volume. It is the most popular electronic trading platform worldwide. It's also the only platform that supports all the products of the exchange, as well as its proprietary trading system, CME SPAN.

FAQ

Which trading website is best for beginners

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

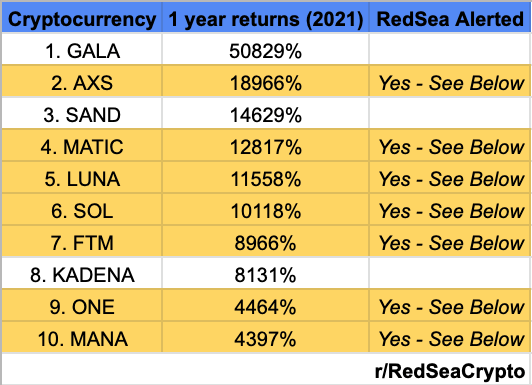

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

How do forex traders make their money?

Yes, forex traders can earn money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

While money can be confusing, the decision to where it should be stored can be just as complex. A strong security system is essential for your valuable assets. There are several options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

You make the final decision.