After hours trading is a trading option that happens outside of normal trading hours. It is open both to institutional and retail investors. The number of participants is significantly lower than in regular market hours. That makes it more volatile and less liquid. Spreads are also more wide. Traders need to use a limit or order when placing a trade.

Even though after-hours trading can present risks, there are many benefits to taking advantage. If you're an experienced trader, there may be opportunities this market opens up that you wouldn't have otherwise. If a company is affected by new legislation, for example, you might be able to buy or sell stocks. These events can have a major effect on the stock price when the market opens the next day.

Another advantage of after hours trading is that you can analyze stocks in depth before the market closes. A period of consolidation may be identified before the earnings report is available. Your shares can be sold at a much higher price than they would on the regular market. The downside is that you won't be able to execute your order if there aren't many buyers or sellers on the market. Limit orders can be used to limit your cash balance.

Regardless of how you choose to execute your after hours trading, you need to take the time to understand the risks involved. Stocks investing can be time-sensitive. This means that you need to be able respond quickly to market changes. A lack of liquidity during the after hours can mean that you won't be able to close your position at a profit. If you don't have enough money by the deadline, your limit order could be cancelled.

After hours trading does not allow you to lose more than the regular market. The bid-ask spreads can be wider than during the regular market, making it harder to get a price that suits you. Long-term traders may be willing settle for a lower price in order to close the position without incurring losses. Short sellers might not want to pay for a price too high to close their trade.

Another risk is that there may be fewer traders who trade after hours. Although there is less volatility due to fewer sellers and buyers, it can make it more difficult to find a price that meets your needs. Even if the price is good, you don't know if it will be available.

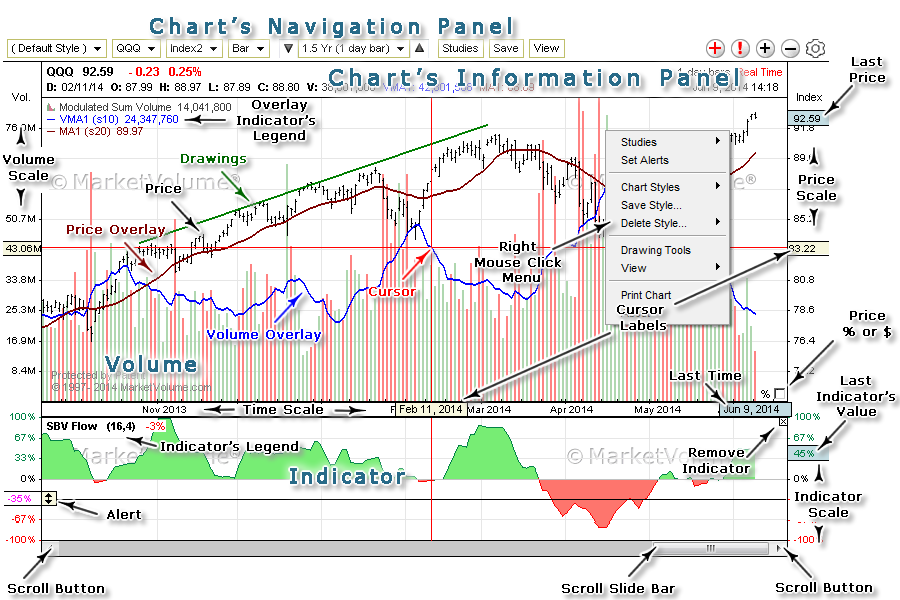

When trading in the after hours, you should keep a close eye on live graphs, news, and charting. This will help you identify potential breakouts and break-outs, as well as past performance. Stocks will move strongly following earnings announcements. You can also expect more dramatic price swings.

FAQ

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

Forex traders can make money

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protect yourself. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Don't respond to unsolicited calls or emails. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Lastly, always remember "Scammers will try anything to get your personal information". Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.