DappRadar is an app store that allows users to discover and track decentralized applications. It includes a variety useful functions like portfolio management, payment options, and stakestaking. It claims to support over 8,000 dapps and has around 4 million users per year.

DappRadar will launch a native token called RADAR. This token, referred to as the RADAR token on Ethereum blockchain will be used for payment. RADAR token holders will have access to DappRadar's PRO section. This section offers exclusive analysis, new collections, and early access. As a bonus, RADAR holders can also participate in the staking mechanism and claim rewards.

While the overall purpose of RADAR is to reward users, the token will also serve as an incentive for users to contribute to DappRadar. This includes voting, staking and proposing recommendations. Furthermore, RADAR holder can assist in product decisions.

RADAR is a staker that can be used to support the Ethereum network's dapps. Similarly, DappRadar holders can vote for initiatives and participate in the DappRadar community. The token will be used as a governance token in the DappRadar DAO. RADAR can be used to enable the platform, which will provide better portfolio tools as well as broaden its coverage.

DappRadar has been made open-source. It has partnered in the LayerZero protocols to make smart contracts work across all chains. DappRadar will be able to eliminate gas fees from the Ethereum blockchain through this protocol.

DappRadar reports that the total number and usage of DappRadar dapps has increased by 396 percent since the beginning of the 2021 quarter. Dapps are used daily by more than 2.4million unique wallets. For this reason, the company believes that the multichain blockchain industry is the future. The company aims to build an ecosystem that both benefits users and developers.

Currently, there is a total of 10 billion RADAR tokens in circulation. DappRadar intends to expand the token's usage and is working on the second phase of its platform. RADAR can also exchange on the Web3 Network, aside from its staking function.

DappRadar also offers four utility tokens to its platform. These include Contribute2Earn. Boosts. Portfolio. and Polygon. Users can opt to get these services by either purchasing them on the marketplace, or by acquiring them through an airdrop.

DappRadar has just announced a cross-chain token Staking Mechanism. It is a remarkable innovation. It eliminates bridge assets which dramatically reduces stake fees. This protocol also ensures that all chains have a smooth user experience.

DappRadar was a pioneer within the multichain Blockchain sector. DappRadar aims to be the leading platform that allows users to find and analyze decentralized apps. The company is committed to offering the world's largest app store.

DappRadar continues to work on a full-scale dapp shop. Dapps will be able to gain more power and unlock new possibilities with a stronger community.

FAQ

Frequently Asked Question

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

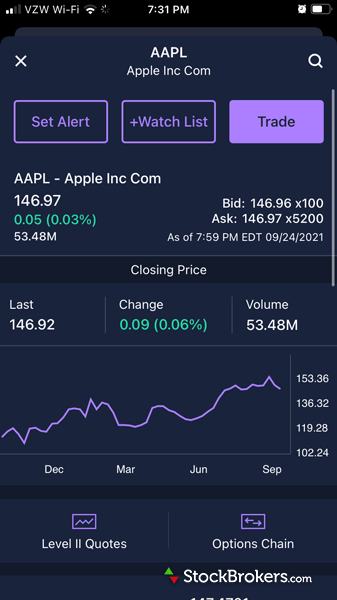

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts are a matter of safety. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, make sure that your platform is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It is important to be familiar with the terms and conditions of any online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, be sure to research the company where you plan on investing. Look at user reviews to get a feel for how the platform works. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.