Crude oil is one of the most liquid commodities. Crude oil is highly traded and can be used to make many things. There are many uses for crude oil, including making gasoline, plastics, petroleum, and pharmaceuticals. Based on global demand and supply, the price of the commodity fluctuates almost every second.

You can trade oil in two ways: futures or options. Futures involve buyers and sellers entering into a contract that allows them to deliver or buy oil at a future date. In exchange for the oil, the buyer agrees on a price. Oil prices can fluctuate, so traders should consider risk management before they invest.

Oil futures are the easiest way to buy and trade oil. They are also very popular with speculative investors. However, trading futures requires large margins. To trade, brokers may require 10% or more. Traders should find a broker that fits their needs. Before opening a real account, traders are advised to test their strategy on a demo account.

Oil is volatile. A beginner should limit their exposure. A trading strategy based upon technical and fundamental analysis is one way to help a beginner understand the market. Traders can spot the most crucial turning points in the market by studying factors that influence supply and demande. Breakout strategies are also available to traders in order to profit from market fluctuations.

Oil futures are traded on both the New York Mercantile Exchange and the Intercontinental Exchange. These exchanges are the "big three" major oil markets in the U.S. These exchanges' official websites are great for beginners who want to learn more about the industry.

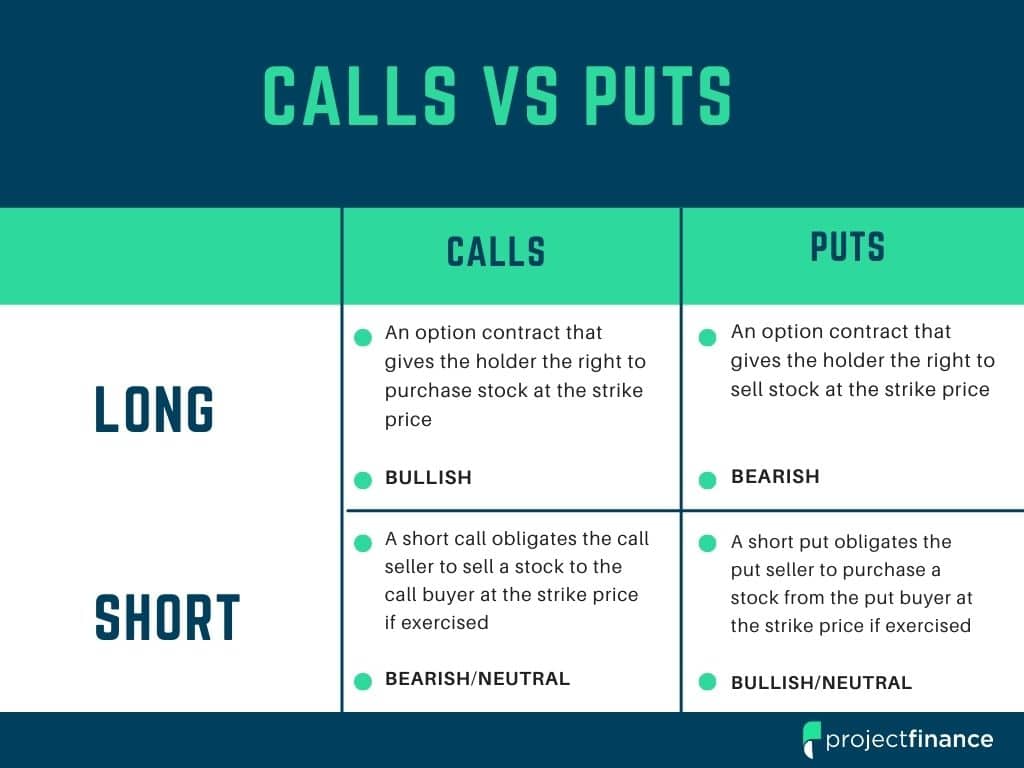

Options can be compared to futures. However they do not require selling of the underlying property. After the option expires the buyer or the seller have the right to purchase or sell the asset.

If you're not familiar with the oil market, you may be surprised to find that the Organization of the Petroleum Exporting Countries has a significant share of the global oil supply. OPEC's primary objective is to manage the global supply of crude oil. Traders have the opportunity to observe the meetings and gain an insight into how oil prices will react.

Apart from the obvious benefits, oil trading has several other advantages. These include higher stock prices, the ability of hedging against adverse price movements, and the possibility to make a substantial profit in a falling market.

Options and futures are great options for trading crude oil. You can buy and sell 1,000 barrels of crude oil by investing in futures. This allows you to profit from price changes and decreases, while protecting your investments.

FAQ

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

What are the benefits and drawbacks of investing online?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

It is important to do your research before investing online. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Learn about the investment's risk profile and review the terms and condition. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Conduct due diligence checks to make sure that you're receiving what you paid for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.