Commodity markets play a large role in the lives of billions of people worldwide. They are a place where you can invest and also offer diversification and hedging from other financial markets. There are many kinds of commodities: food articles, ag product, metals and energy. You can even find raw materials like sugar, wheat, or soy. Traders can take part in the market regardless of its complexity.

First, it is important to recognize that the commodity market is not all or nothing. Some commodities, like crude oil, tend to be heavily weighted towards lower end of the scale. This is due in part to the fact that some oil refining units have had to remain closed because of the Arctic freeze. In consequence, oil prices have fallen.

It is easy to buy small quantities of commodities via an online broker. A good broker will provide detailed data and an analyst to help you choose what commodities to purchase. It's a good idea also to ask your broker about risk profiles. You may want to seek out advice if you're not sure about the risks of investing in commodities.

It can be difficult to calculate how much you could make but it is possible to use data to make informed decisions. For example, you may be surprised to learn that a dead cat bounce in the price of crude oil is a real thing.

Distribution of ag-related products and services is one of many problems facing the ag sector. A lot of this activity is performed in a highly fragmented and illiquid marketplace. These factors can result in a poor outcome for farmers. Some major players in the agriculture space have taken steps to address this issue.

The commodity market has been a major financial player over the past few year, but it's not immune from government policies. In India, for example, a number of reforms have been introduced. India is also strengthening its existing institutions for derivatives trade.

It is worth noting that even small companies can take advantage of the commodity market. A medium-sized manufacturer may buy a few totes on the exchange and be able to pay a reasonable amount. Larger companies might buy bulk oil on the spot marketplace at a similar rate.

The best thing about the commodity market is its fun aspect. The book Commodity Investing outlines the best strategies to maximize your returns. You will learn many smart strategies to invest in order to make more money in a highly competitive market.

The commodity market isn’t for the faint of Heart, as with all other ventures. The expectations that the US Federal Reserve might slow its rate hike cycle have led to a surge in gold prices. However, silver isn't doing as well.

FAQ

Frequently Asked Question

What are the 4 types of investing?

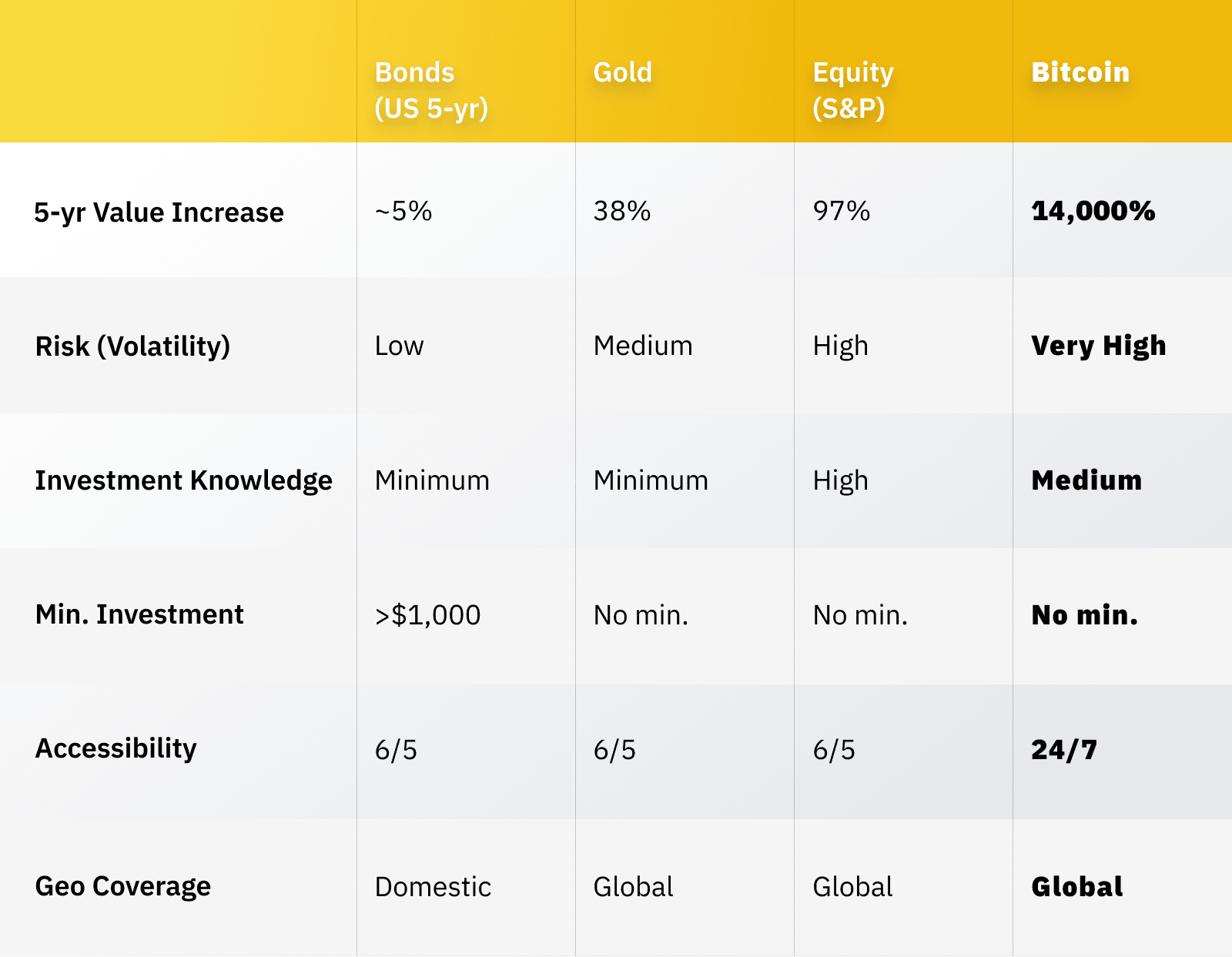

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

How do I invest in Bitcoin

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

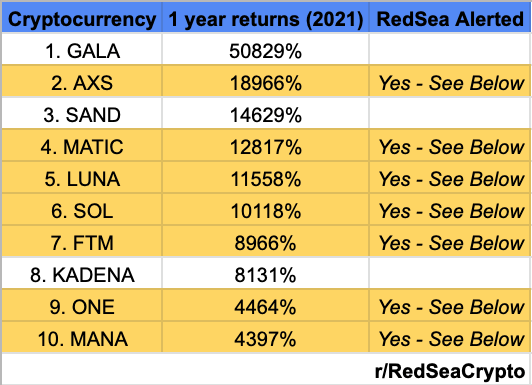

Can one get rich trading Cryptocurrencies or forex?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

Research is critical when investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Know the risks associated with your investment and the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Do your due diligence and make sure you get what you pay for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.