The Tesla option prices are now lower due to analysts and investors lowering their estimates of the quarterly results for the electric vehicle manufacturer. This will reduce profit margins for Tesla in the short term, and could lead to shares falling as CEO Elon Muss reiterates his desire close a $44 billion takeover deal for Twitter Inc ( TWTR)

Tesla dropped pricing for most models, including its base Model S sedan, in January. According to Tesla, the automaker stated that its input costs have increased which will result in higher vehicle prices in short-term. The cheapest listed Model S now sells for $99,990, down about $5,000, while the pricier Model X Plaid Plus model starts at $149,900, up about $10,000.

The company's Model 3 sedan and SUV, which are entry-level, is still on sale for $7500 federal tax incentive until the end. This is a big deal for customers as they would otherwise have had to wait for delivery in spring 2020 to receive the car at this price.

This is a positive sign for investors but it also means that the company will need to compete with established automakers such as Ford Motor Co ( F ), and General Motors Co( GM ), who offer more affordable models in this era of rising oil and gas prices. But, this is likely to have negative effects on future earnings.

Tesla's share value has dropped 40% this year after falling from an all-time record of over $170 in July. The stock has been plagued with a three to one split and plans by Twitter to buy it, which have also weighed on sentiment.

Trades of tesla options are becoming increasingly popular. Speculators can trade bullish put and call options to hedge their exposure against changes in the price of stocks. Options traders have the chance to make extra income with their speculative investments. They can use any strategy they like.

1. Trade the Stock using a Strategy Based on Market Trends

Tesla's shares are in decline throughout the year. Traders are hoping to capitalize on any rally as Tesla prepares to report earnings on Wednesday. This is why the market has been flooding the stock with volume, especially for bullish options which target a move after earnings.

2. A great way to lower risk is to buy put.

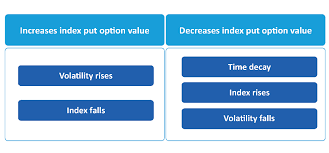

The cheapest way to invest in Tesla stock is to buy a put. These options are often sold in small numbers of 100 shares. They also give the holder the ability to sell stock at a specified price in the future.

A put can be a great way of protecting your portfolio against future price drops and also help you to build your long-term position with the shares. It is important to remember that buying a put can come with a risk. You could lose your money, or not sell the stock at the price you want. You should only purchase a put if you have the funds to make a profit.

FAQ

What are the advantages and disadvantages of online investing?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which trading platform is best?

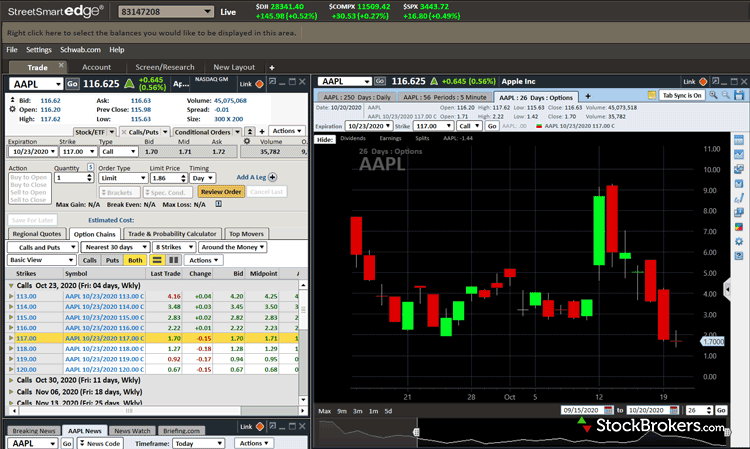

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down the search for the right platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Forex and Cryptocurrencies are great investments.

Yes, you can get rich trading crypto and forex if you use a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

Should I store my investment assets online or do I have other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. There are many options to protect your valuable assets.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

Alternately, you can keep your money in physical forms such as cash or gold. However, it is less secure and more difficult to track and requires more maintenance for storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?