Futures market prices can change rapidly. The market can be lucrative but also has its risks. Therefore, traders must take steps to minimize these risks. This includes knowing about the various futures trading strategies. Choosing the right strategy can improve a trader's chances of making money.

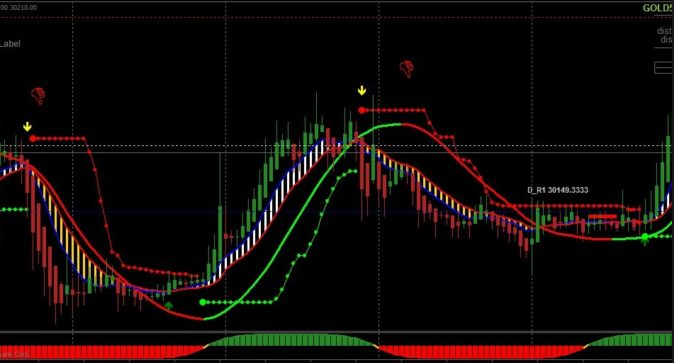

Trend following is a very popular strategy for futures traders. This strategy involves buying assets that are trending higher and selling those that have fallen in price. This technique is used by professionals and hedge funds. However, if done improperly, this may have the opposite effect.

Another option is long trading in futures. To be successful, a trader needs to invest in assets that will increase in value. These assets may include stocks, commodities bonds, currencies or bonds. A successful long position can last for days, weeks or even years.

Short trading is another popular futures trading strategy. A short trader borrows security, then repurchases it at less expensive prices in the future. The trader takes the difference. The short trader must, unlike the long trader who is willing to take on trading risk.

You can also use trend following or option spread to trade futures. Combining these strategies can give you flexibility and help you manage risk.

While some of these strategies might be the best for you, you still need to be aware of the risk factors involved in the market. Before you begin trading, it is essential to be aware of what you are entering. A plan can help reduce risk and prevent many of the common errors.

Slippage is another aspect of futures. Slippage can happen when an order is placed that is too large and the market does not fill it. Although it is unavoidable, it can be demoralizing. So, it's always a good idea to use stop-loss orders.

If you are a newbie to the futures market, the best way to reduce the risks is to diversify your investments. Commodities, especially, offer leverage, so a small margin deposit can have a significant impact on your trading account. It is a bad idea to place too many bets on one market. This could lead to a loss.

If you have the patience and persistence, you could even make a fortune in the futures market. All you need is the right knowledge and the right strategy for futures trading. Many seasoned futures traders have several strategies to maximize their profits. Also, it is important that you observe the strategies of other traders and follow their lead. Avoid costly mistakes by following a clear and unorthodox trading plan.

Futures trading is a highly rewarding career. But it is an art, as with any other endeavor. You can use stop-loss orders to manage risk, whether you're an experienced trader or a beginner.

FAQ

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is more difficult forex or crypto currency?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

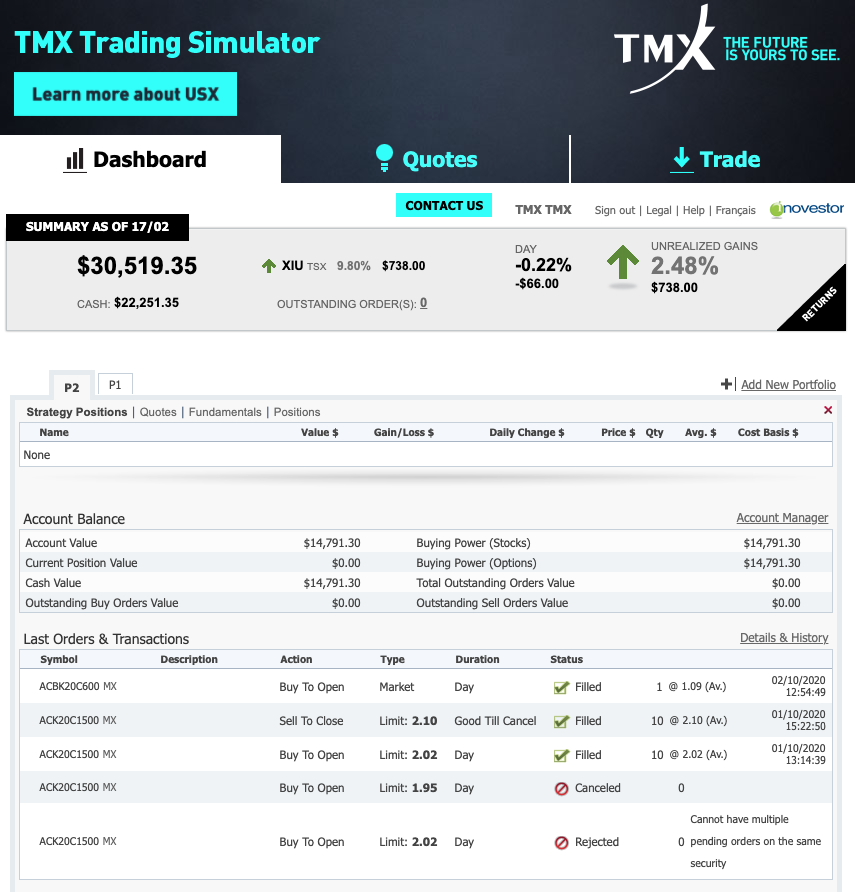

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Forex traders can make money

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Can one get rich trading Cryptocurrencies or forex?

Yes, you can get rich trading crypto and forex if you use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Security is essential when investing online. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Be mindful of whom you are dealing with when using any investment app. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!