Non-Fungible Tokens are digital objects that have a unique identity. NFTs are built using the Ethereum blockchain but can also trade on other platforms. They are known for their rarity and originality. They are hard to replace, unlike other digital goods. NFTs are gaining in popularity at a rapid pace.

NFTs are commonly used for buying or selling. There are many NFT markets. Rarible is the most well-known, offering everything you need to trade NFTs. These include tools to assist you in researching and creating your own NFTs.

Other types of NFT marketplaces include NFT Trader, OpenSea and Larva Labs. These sites are all connected to main crypto exchanges, and they operate on their respective decentralized networks. This allows them make trades for users. To purchase and sell NFTs traders can use Ether or credit card.

NFT Trader was started by a small group of entrepreneurs in January 2021. Users can send and get tokens to each other and use smart contracts to transfer assets. NFT Trader has seen a lot of NFT trades since its launch.

OpenSea is the most important NFT P2P marketplace. It has access to over 80,000,000 individual NFTs. Using the OpenSea platform, traders can purchase or sell digital assets and collectibles. Their network was designed to be simple to navigate and features a user-friendly interface. The site offers cross-chain support as well as a marketplace.

Axie Infinity - Another popular NFT platform. Players can purchase and sell in-game items and collectibles, including in-game pets called Axies. Sellers will pay a fee and buyers will only pay for the gas. This ecosystem is completely owned by users and has a combined value of over $3.94 trillion.

MakersPlace is an online creation platform that provides artists with a community. You can submit new artists through the Discord channel. Future resale agreements will give registered artists a 10% commission. The platform has seen some of the most successful artists earn millions in profits. MakersPlace currently receives a 15% commission for NFT sales.

Larva Labs is one of the most complete NFT ecosystems. The network features every aspect of the NFT cycle and is distributed decentralised. They have a unique tokenization method that allows anyone who wants to create a NFT. You can also create custom public blockchains. You can manage your user account permissions using these.

Binance NFT is another popular NFT marketplace. It was built in the Binance exchange and brings together enthusiasts and creators. In Q3, $10.7 billion was generated worldwide by the NFT sector.

In the last two year, NFT industry saw steady growth. NFT has plenty of potential. Numerous alternative chains are now stepping in to the NFT arena.

These NFT marketplaces offer a great way to make the most out of your collection, whether you're new to NFTs and/or an expert. Each site has its unique offerings. You might choose the one that meets your needs best.

FAQ

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

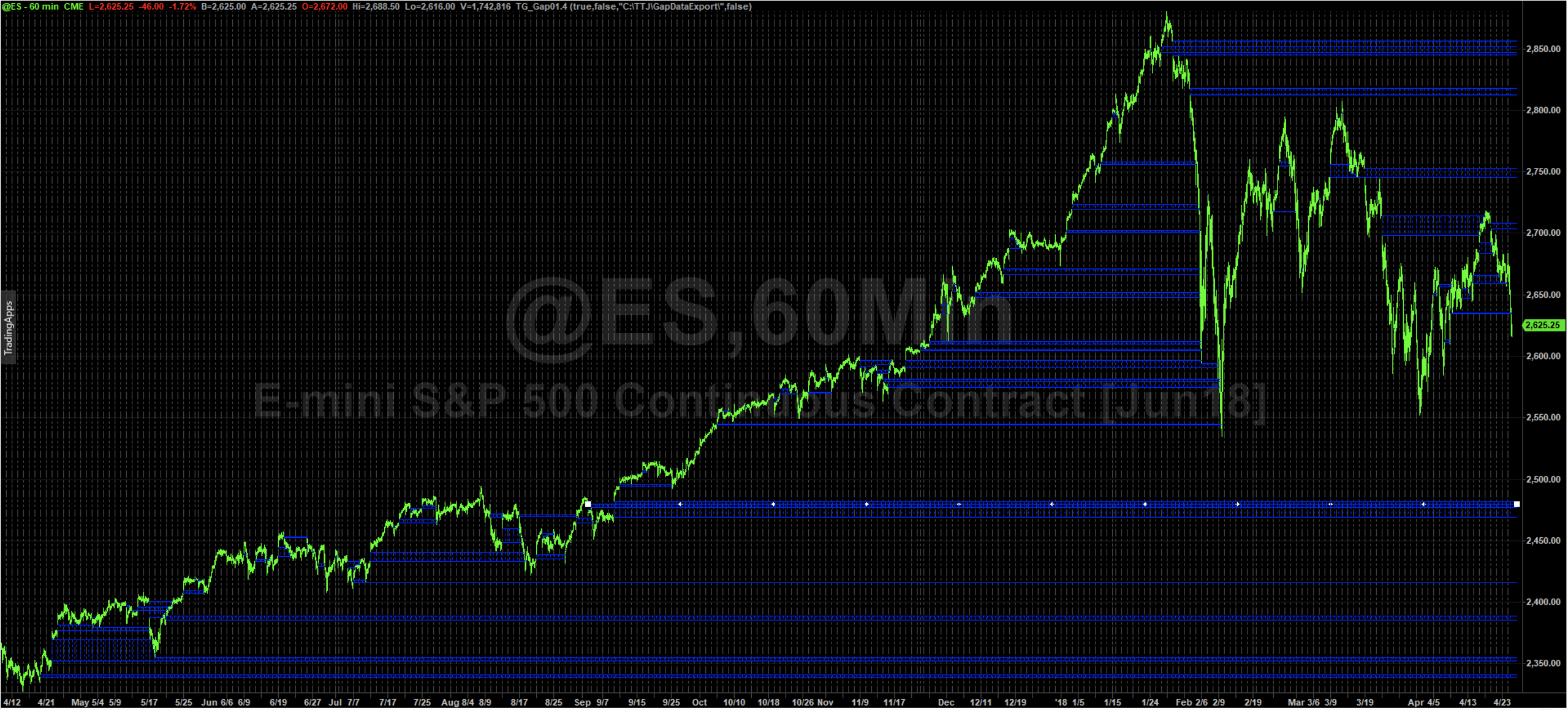

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Which is harder forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, gather any additional information to help you feel confident about your investment decision. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Online investing requires research. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.