Discover bank cd is an internet-only bank offering a wide variety of savings options. The bank offers CDs with competitive interest rates and money market accounts which combine the features of a checking and savings account. You also have the option of a number of credit cards, including one with an outstanding cashback program.

Discover Bank offers certificates of deposit (CDs) for a variety of terms and ownership types, from three months to 10 years. These certificates of deposit can be a great way to save for a long-term goal because they pay more interest than savings or money market accounts.

Discover's CD rates can be compared to online banks and savings accounts don't have a monthly fee. But, Discover's requirement for a minimum deposit can make it difficult for some.

CDs typically pay a fixed, or sometimes a higher than average, interest rate over the term of the account. This is generally between six and ten monthly. The interest is paid until either the term ends or the CD is sold. You can withdraw any funds you've accumulated during the term, without incurring a penalty.

The term length will determine the early withdrawal penalty. These penalties can vary from a few month's simple interest for a shorter term to 24 months' interest if the term is longer. Before you agree to a CD you should review the early withdrawal penalty and compare it with other types savings accounts.

CDs are a safe place to save your money and earn interest, but they can be complicated to understand. This guide provides a comparison of CDs to ensure you are getting the most for your investment.

CDs pay a higher rate of interest than other savings accounts, and there is less chance of losing your money. FDIC-insured CDs offer protection so that you can get your money back even if your bank goes out of business.

Discover Bank offers a range of CDs to suit your needs, including traditional CDs and IRA CDs. Both types offer tax advantages, which can be very useful for retirees.

A Discover Bank CD will lock you in to a low interest rates for a period of time. These accounts allow you to build a CD ladder, so you can earn more interest as your account matures.

Discover Bank's CDs offer competitive APYs, some even offering rates that are better than those offered by other online banks. There are many term length options so you can choose the best CD for your short-term and long-term goals.

Daily compounding can boost growth on these CDs and allow you to see your money grow more quickly than with monthly compounding. It's important to note that these amounts represent possible final earnings at the end of each term, so your actual earnings may be lower or higher.

Discover Bank CDs are attractive options for those who need to save money for a specific financial goal. These accounts have flexible terms which can be convenient if your goal is to buy a house or go on vacation.

FAQ

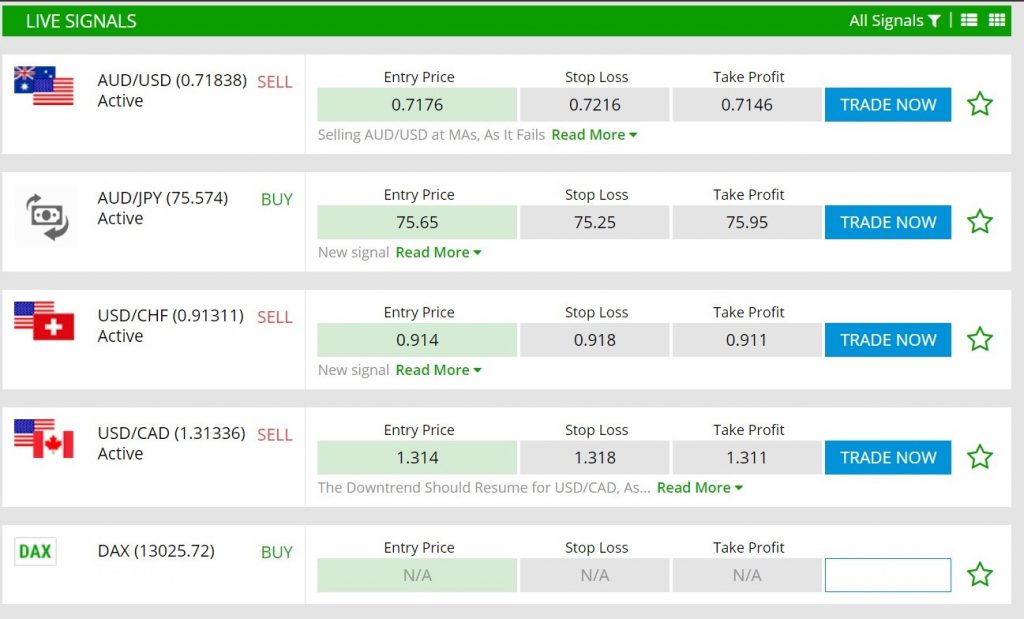

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, make sure to understand the risks associated with each strategy.

Can forex traders make any money?

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

Online investments require security. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Start by being mindful of who you're dealing with on any investment app or platform. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. You should also use different passwords to protect each account from being compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!