The Invest Voyager app allows investors to trade and invest in crypto currencies. It is located in New Jersey. The FinCEN (Financial Crimes Enforcement Network) regulates it. The company plans to expand its services into Canada, the UK and Europe.

The company's primary focus is crypto and equities. Its merchant services business accounts for the bulk of its revenues. It also has a staking and lending program that adds about $15 million to quarterly run rate revenue.

According to Invest Voyager's latest earnings report, the company expects to generate $415 million in 2021. That's up from $81 million in the year before, and its yearly growth looks quite impressive.

It has a mobile app that makes it easy to trade cryptocurrencies and earn rewards on your holdings. It also has a referral program that pays you and your referrals $25 each when they sign up and trade at least $100.

Bitcoin Cash, Dash and Ethereum can be deposited into a wallet that you create within the app. Set up recurring purchases to automate your investments. This enables you to invest automatically in a coin at a frequency that works best for you.

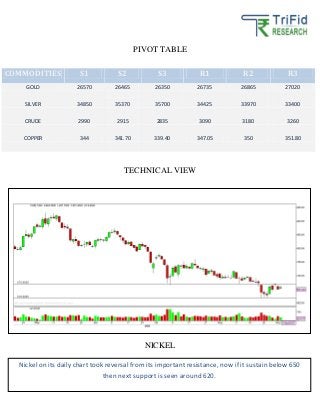

Traders can use the platform's advanced charts to track their positions and make informed decisions. They can also place market orders or limit order to place their trades. The spread can be difficult to calculate when placing limit orders.

Some traders complain that the app's limited order types make it hard to execute their trades efficiently. They also have concerns about the high fee on withdrawals.

Voyager isn't able to support many of these coins. The company is trying to address this by adding more tokens to the app.

The company's recent bankruptcy filing in July is another concern. While the company claims to have around 100,000 creditors it is still not clear how they will get their money back. They are also concerned about how to proceed with claiming their assets.

Voyager's Unsecured Creditors Committee tries to negotiate a plan to allow crypto holders to access their funds. However, some customers are concerned that their interests may be overlooked in the negotiation process.

The company has not paid many of its largest lenders, including Three Arrows Capital (3AC), which is a major problem. Although it tried to settle with 3AC, it is not certain that it will succeed.

Voyager customers may need to wait for funds to be refunded. If you have a lot of cryptocurrency in your account, that could be a problem.

As a result, it's important to take the time to research your options before making an investment decision. Before you make a decision on where to invest, compare the costs of different cryptocurrency exchanges. Before you invest in any cryptocurrency, it is important to fully understand the risks.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which platform is the best for trading?

Many traders may find it challenging to choose the best trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

Real estate is another option. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many offer interactive tools to help you understand how trades work.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

When investing online, security is crucial. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Start by being mindful of who you're dealing with on any investment app or platform. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!