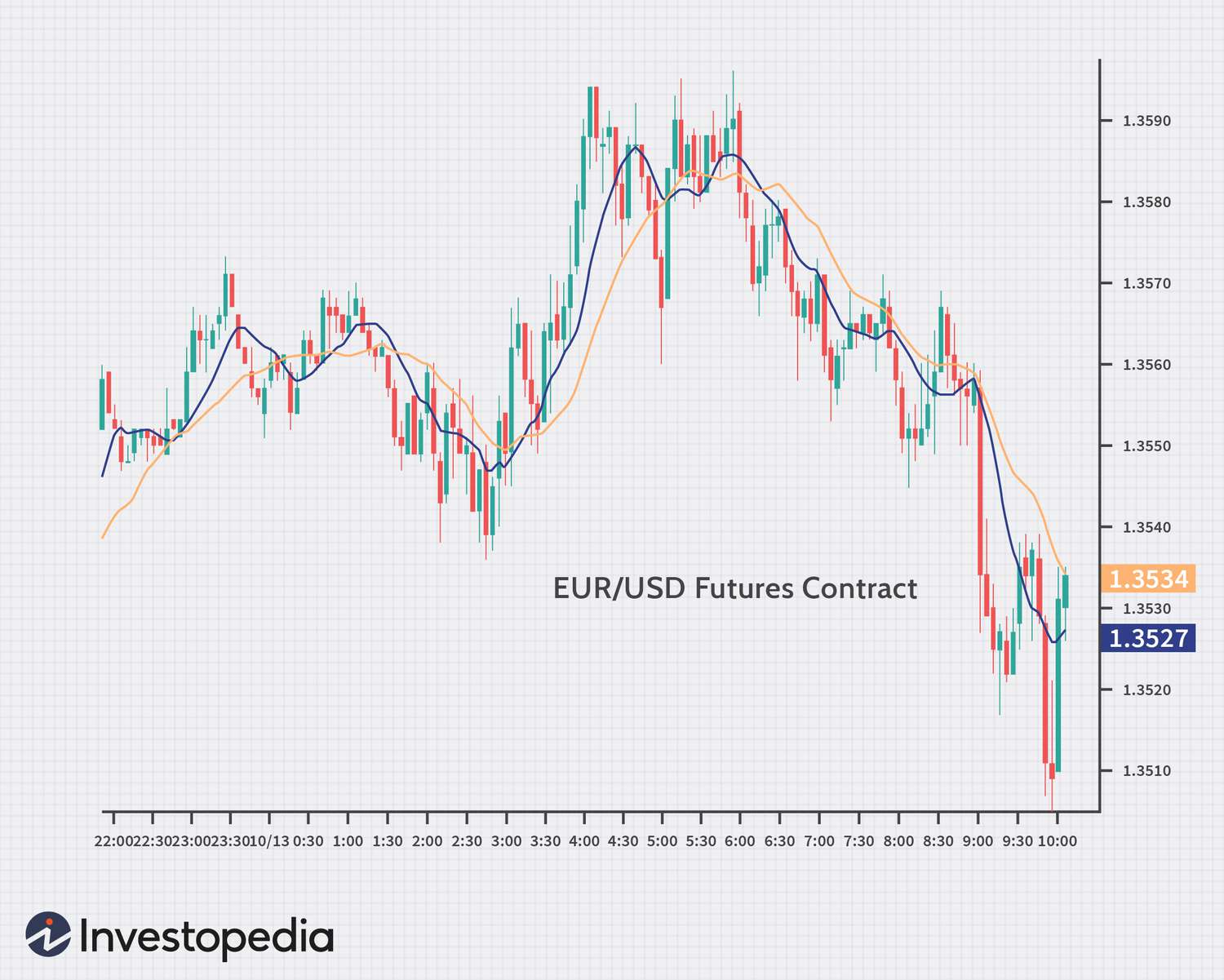

Many players can have an impact on the foreign market exchange rate. The forex spread's most significant factor is liquidity. Liquidity is the number of traders that are trading a particular financial instrument. The gap between the ask and bid prices will be greater if there are fewer traders. This means that traders will need to pay more money to buy or sell currency.

The three main trading periods on the foreign market are: morning, mid-afternoon and late evening. There are three major trading sessions. They are in the morning hours and mid-afternoon. And late into the evening. These are the most active trading times. These hours are more active for forex traders so traders should be ready to place orders.

Broker spreads may vary between traders. They can either offer a fixed spread or a variable spread. Fixed spreads tend to be more advantageous for traders. Fixed spreads are more favorable for traders but they can also be risky. Brokers might be required to adjust their spreads when there is significant market movement. Therefore, it can be difficult to maintain an even spread.

Low spread means that there is a small gap between the ask and bid prices. A low spread also indicates high liquidity. But, a low spread can be misleading. Sometimes, traders may pay a different price for the exact same currency pair. Fees, margins and inactivity fees are just a few of the hidden costs.

A market maker is a broker who acts as a counterparty. Typically, these brokers provide fixed spreads. Market makers will notify traders when a certain price isn't suitable for a trade.

Spreads can be offered by Forex brokers in two forms. Variable spreads are the chili pepper to fixed spreads. ECN brokers allow you to trade in multiple currency markets. Spreads offered by ECN brokers can be subject to fluctuations in currency demand and supply.

Non-dealing desk forex brokers offer variable spreads most of the time. These brokers obtain pricing information from various liquidity sources, and pass it through to their customers. The spread can affect the cost to execute a trade so it's important that you choose the right forex broker.

The spread size can also be affected by market volatility, economic conditions, and risk. A forex broker with a wider spread will probably charge more than a fixed rate spread. Spreads will be higher if traders book euro trades in the Asian trading session.

Forex spreads are also important to know when it comes to commissions. A lot of brokers will charge you for opening an objection. You will also be charged a markup spread on top of the Raw Spread. While the fees and commissions are small, they can be a big deal if you are trading a large volume of currency. Before you trade, make sure to verify the website.

FAQ

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many options.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is safe crypto or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

Which platform is the best for trading?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Research is critical when investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Know the risks associated with your investment and the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Conduct due diligence checks to make sure that you're receiving what you paid for. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.