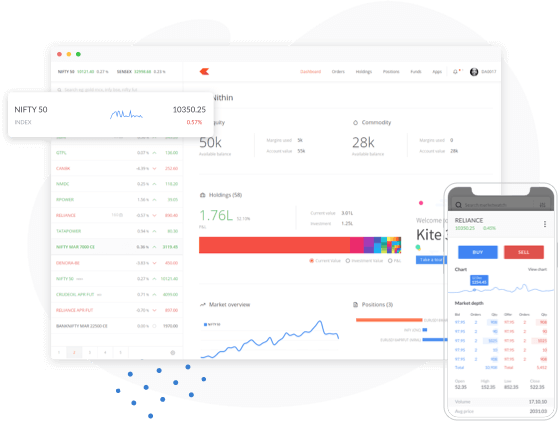

There are many charting software options that traders can choose from. Some of these systems are designed for professionals while others are for individual traders who want to gain a more sophisticated level of insight into the market.

Many of these software programs allow you to customize many of the features and tools. This can make software more useful for traders.

Futures, stocks and forex

Many of these programs offer a wide range of technical indicators and patterns that can be displayed in their programs. These can be very useful in identifying potential trading opportunities.

These programs can be downloaded free of charge and can also be accessed online or on mobile via a specific app. These can be particularly useful for those who are looking to stay connected with the market at all times.

These programs offer the ability to automate trades as well as back testing. This will allow traders to feel more confident about their strategy and reduce their reliance on trial and errors, as well as increasing their odds of making profits.

Investing can be difficult and complicated. This is why you need a reliable charting tool. This will help you to understand how the market is moving, and what the likely outcome is.

Trading View is an online charting service that offers a wide range of tools and features. It is also a popular choice for traders who use multiple devices.

There are three different accounts to choose from on Trading View, Basic, Pro and Premium. The Basic account is the most economical and can be used to meet all your needs. However, the Premium account provides more advanced features as well as a greater range of data.

The Basic account allows for one chart per layout but can only have three indicators. This is a good way to get started using the tool. It also has server-side alerts and global data.

MultiCharts is a program that allows traders to broaden their horizons. This platform has been around since over 20 years.

It has a wide range of features that are perfect for both beginners and experts, including one-click trading, high precision back testing, brute force and genetic optimization. You can also get live support and video tutorials from the company to assist you with your questions.

Trend Trader Pro, a popular trading program that can help you increase your profits in the forex market, is highly recommended. It offers a range of features and was created by a highly-experienced trader. It has been tested by thousands of traders and can be a great tool for achieving consistent and profitable results in the forex market.

The course Learn How to Trade the Market covers all aspects and topics of trading. It helps traders find the right setups, build trading strategies, and manage their open positions. This book also teaches traders how to improve their trading psychology.

FAQ

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

One option is investing in real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Online investing requires research. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Be skeptical of promises of substantial future returns or future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.