Forex brokers facilitate buyers and sellers by providing a marketplace. They are complex computer systems that connect traders from all over the world. You need to ensure that you only trade forex with a reliable broker. These brokerages can be regulated through a variety of regulatory bodies. In the US, a licensed forex broker must be registered with the Commodity Futures Trading Commission. This agency oversees US commodity options and futures markets.

There are many brokers in the United States. Each broker has its own requirements but you should find one that suits your needs. Many of the top brokers offer multiple forex pairs and excellent customer support. You should also look for a broker that can accommodate your trading style.

One of the most common types of forex brokers is the ECN broker. They are designed to bring transparency to the currency market. They facilitate direct communication between buyers and sellers, and ensure that clients' trades are completed efficiently and accurately by allowing them to do so. The most common currency pairs are EUR/USD or GBP/USD.

ECN brokers will not only have low spreads but also have access traders on the interbank markets. These firms can offer more precise spreads and faster execution than conventional brokers due to their technology. ECNs sometimes charge a commission to spread their spread.

You will need to decide how much money you can afford before you open an account with a forex broker. Many brokers impose minimums for deposits, and some will limit withdrawals to certain amounts. Remember to factor in the time required to get your money back. Some brokers will take at least three business days to process your refund, while others may require you wait longer.

It is important to investigate the reputation of the broker before you can find the right one. Reputable brokers operate worldwide and are subject to supervision by multiple regulatory agencies. It is important to understand how your broker operates and how to avoid scams. Use the broker finder to help you locate the right one.

FXCM is the best forex broker in the US. They offer low spreads and ECN accounts with many features, including a hybrid STP/ECN execution.

Ally Invest is another US-regulated forex broker. They are regulated by the CFTC and SIPC, and their website is ideal for active traders. Interactive Brokers also offers several account types, ranging from portfolio margin to high leverage trading.

You should remember that the forex market can be very risky. Before you begin, you will need to learn some strategies and techniques. You shouldn't get caught up in the market's volatility. Traders should learn to manage their emotions.

FAQ

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

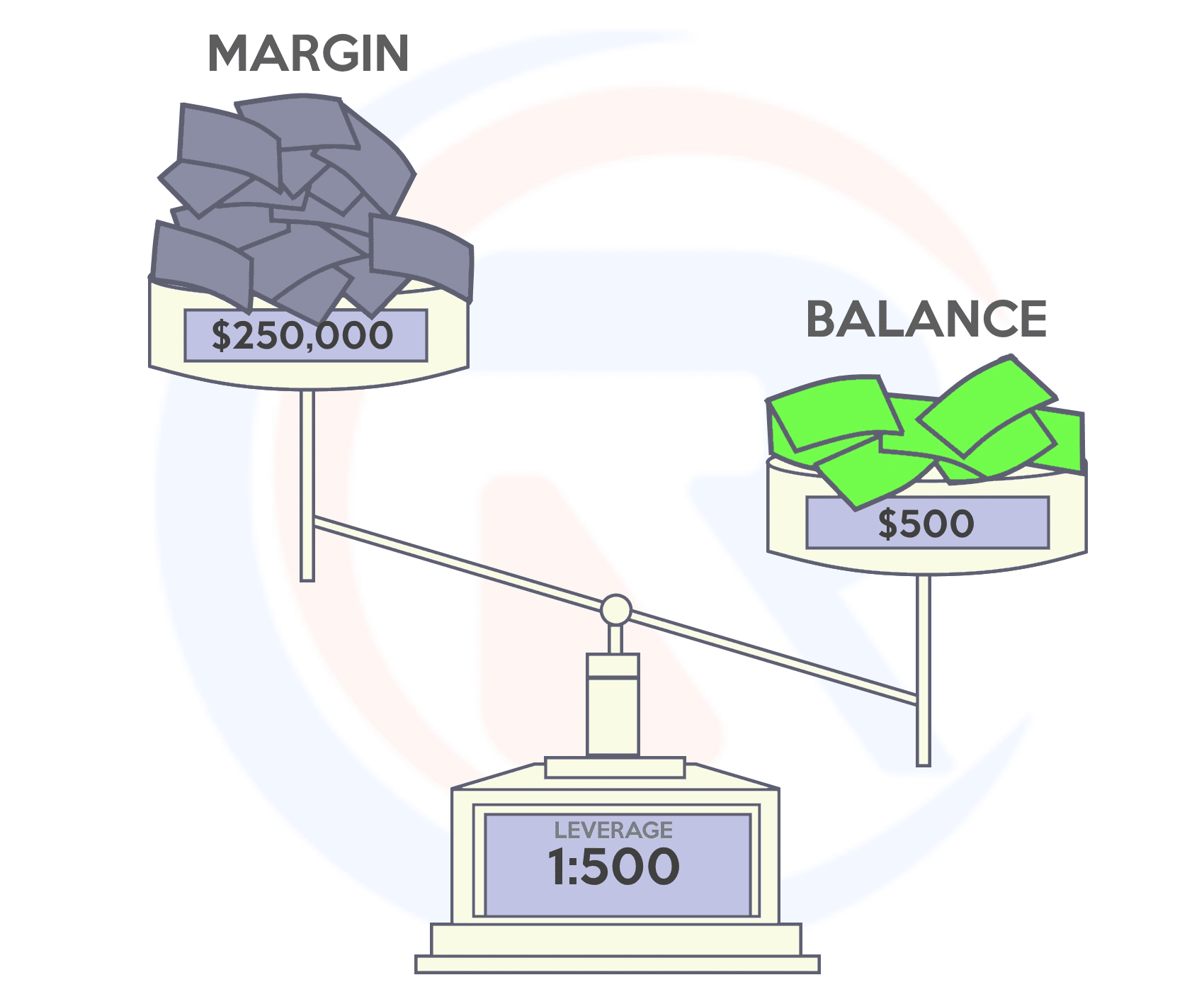

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investing is a risky venture. Online investments are a risky way to protect your financial and personal information.

Start by being mindful of who you're dealing with on any investment app or platform. Reputable companies have good customer ratings and reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last but not least, make sure to use VPNs when investing online. They're often free and easy!