The Invest Voyager app allows investors to trade and invest in crypto currencies. It is based in New Jersey and is regulated by the FinCEN (Financial Crimes Enforcement Network). The company plans on expanding its services to Canada and the UK.

The company focuses on crypto and equities, with the majority of its revenue coming from its merchant services business. The company also has a lending and staking program that adds $15 million to its quarterly revenue.

According to Invest Voyager, the company is expected to earn $415 million by 2021. This is an increase of $81 million from the previous year, and it's impressive to see its annual growth.

It has a mobile app that makes it easy to trade cryptocurrencies and earn rewards on your holdings. It offers a referral program where you can earn $25 for each of your referrals who sign up and trade at least 100 bitcoins.

Bitcoin Cash, Dash and Ethereum can be deposited into a wallet that you create within the app. Recurring buys can be used to automate your investment. This allows you the flexibility to invest automatically in a particular coin at a frequency that is most convenient for you.

Traders can use the platform's advanced charts to track their positions and make informed decisions. You can place limit orders and market orders. It's important to note that the app does not display the bid x ask, so it can be tricky to determine the spread when placing a limit order.

Some traders complain that the app has limited order types, making it difficult for them to trade efficiently. They are also concerned about the high fees associated with withdrawals.

Voyager's listing of many coins is not supported by the ecosystem. This is being addressed by the company, which plans to add more tokens to Voyager.

Another concern is the recent bankruptcy filing of the company, which was made public in July. The company claims that it has approximately 100,000 creditors. However, most people are still uncertain how to get their money. They also have concerns about how to claim their assets.

Voyager's Unsecured Creditors Committee tries to negotiate a plan to allow crypto holders to access their funds. However, some customers are concerned that their interests may be overlooked in the negotiation process.

The biggest problem is that the company hasn't repaid many its largest lenders including Three Arrows Capital (3AC). It has attempted to reach a settlement agreement with 3AC, but there is no guarantee it will succeed.

Voyager customers who have lost their funds may be forced to wait. People who have large amounts crypto in their accounts may find this a problem.

You should research your options thoroughly before making an investment decision. Before you decide where to invest your money, it is important that you compare the features, costs and fees of each crypto exchange. It's also important to understand the risks involved before you decide to invest in a specific cryptocurrency.

FAQ

Frequently Asked Fragen

Which are the 4 types that you should invest in?

Investing is a way for you to grow your money and possibly make more long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which trading site is best for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

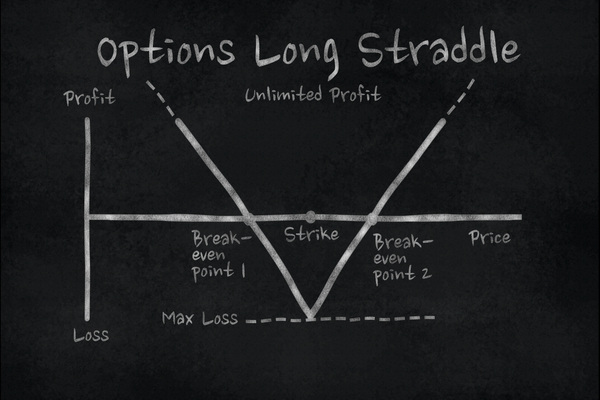

It is important that you understand the different trading strategies available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which is more difficult, forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading is a great way to get real-time market data. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. You have several options when it comes to protecting your valuable assets.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.