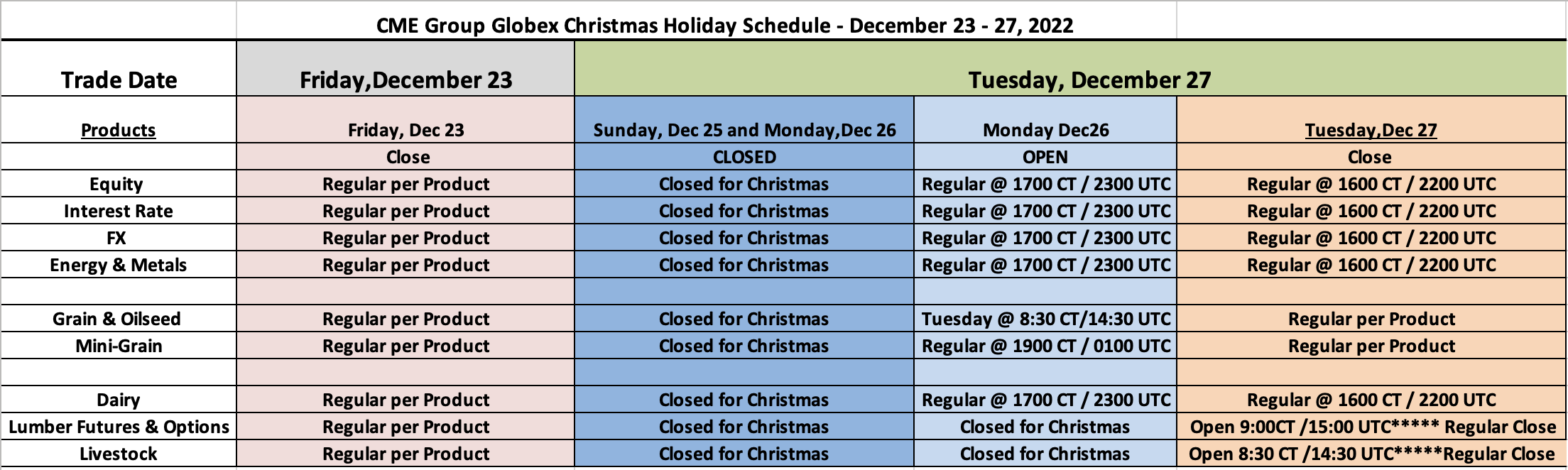

Chicago Mercantile Exchange (CME), which is located in Chicago in Illinois, is the largest options- and futures-contracts exchange in the world. CME markets a wide range of benchmark products across all major asset classes, including equity indexes, foreign exchange, energy, agriculture commodities and metals. CME Globex Trading System was also developed by the CME Globex Trading System. This global electronic trading platform is used to trade more than 90% of the exchange's total volume.

CME is a major derivatives clearinghouse. CME Group is the largest global derivatives market; CME Clearing provides clearing and settlement services to exchange-traded derivatives contracts; and CME Globex Trading System which is used by the majority of its members.

Globex is an open-access trading platform that operates around the clock. It offers a broad range of unique products and traditional futures and options products traded through an open outcry method.

CME Globex, the first electronic trading platform for options and futures, was created in 1992. It was developed to supplement the exchange's current open outcry trading system, improve trading efficiency, and extend trading times.

Agricultural markets

CME Group manages the Chicago Board of Trade and Kansas City Board of Trade Designated Contract Markets. These markets offer futures on corn and soybeans as well as other agricultural commodities. The CBOT and KCBT markets provide liquidity for farmers and traders in these commodities, and are designed to deliver the highest levels of transparency and integrity during important economic events.

CME increased its hours to 21 hours per day on Sunday, May 20, for a variety of oil and grain futures options and options. The change was based upon feedback from more than 4000 farmers, traders, and commercial customers.

These new hours give investors and traders more time to manage risk in grain and oilseed markets. Liquidity improves market performance by allowing for more price discovery and movement, as well as reducing transaction costs.

USDA Reports & Trading Hours

CME Group futures markets will be affected over the next several weeks by key agricultural reports released by the United States Department of Agriculture. Initial reactions to these reports will be reflected in prices immediately, which could lead to huge spikes in trading activity.

CME Group is continually changing its rules and regulations to govern its markets. This will mean that trading hours will keep evolving. These changes are usually made to address customer feedback or to meet regulatory requirements.

Globex: Trading Hours

CME Globex is the platform that handles almost all of CME’s electronic trading. It trades over 90% of its total volume. It is also the world's most important electronic trading platform. It is also the only system that supports all of the exchange's products, including its proprietary trading system, CME SPAN.

FAQ

Can one get rich trading Cryptocurrencies or forex?

Yes, you can get rich trading crypto and forex if you use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, make sure to understand the risks associated with each strategy.

Where can I earn daily and invest my money?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

It is important to realize that there are several ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investing is a risky venture. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Reputable companies have good customer ratings and reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!