NVIDIA is an technology company that manufactures, sells and services graphics processing units (GPUs). These are high-performance processors used to create realistic images. They are well-known for being able to complete complex tasks, including machinelearning. It also offers services in artificial intelligence, cloud computing and robotics. Santa Clara is the headquarters.

NVIDIA, a leader in high-end graphics processing units, has been around since its founding. It sells GPUs in a range of industries, including gaming. Although initially it was a maker of video cards it has since expanded its offerings into high-performance computing and artificial intelligence. Its primary business is making graphics cards for consumers. The company has also made key acquisitions to increase its product range.

NVIDIA competed in the GPU market with Matrox, ATI Technologies and other chip makers during the 1990s. NVIDIA purchased 3dfx Interactive's assets, a prominent video-card manufacturer, in 2000. NVIDIA had already been working on the GeForce 256 and RIVA graphic processors. However, it was the GeForce 256 GPU that really gained a reputation as a top-tier graphics chip. GeForce 256 had superior performance because it featured more advanced 3D graphics.

NVIDIA was founded in 2000 to address the growing demand for GPUs for AI. The company developed the CUDA programming language, which allows programmers to access the processing power of GPUs by programming directly into the hardware. This enables developers to implement massive parallel programs that can run high-performance floating-point processes. NVIDIA's GPUs are used for machine-learning by computer scientists, researchers, and other professionals.

In addition to its core line of GPUs, NVIDIA also has a line of supercomputers, called DGX. These machines feature GPU hardware and deep learning software. In 2016, the company introduced its first DGX line.

The company is investing in AI, robots, and cloud computing. Its products are also used by the automotive, professional visualization, gaming, and other markets. Other products include mobile processors that can be used on smartphones and tablets.

Although NVIDIA is known for its focus on graphics processing units and other products, the company has been expanding into the design of CPUs for mobile phones. NVIDIA announced plans to buy UK-based chip designer ARM earlier this year for $40 billion in Sept 2020.

During the past few years, the company has fought off a number of challenges, including the rise of Intel and AMD. NVIDIA has experienced disruptions in its supply chain. The company has found a way around these issues. It recently diverted ninety-five percent of its waste away from landfills during major construction projects.

NVIDIA's GPUs are not the only products. The company also offers a range data center technologies. Nvidia Spectrum is a part of this range. The Spectrum was designed for the next generation Ethernet platform. It includes a ConnectX-7 SmartNIC, and DOCA data centre infrastructure software. These products provide data center security that is highly effective.

FAQ

What are the benefits and drawbacks of investing online?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

How Can I Invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are many options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases, it's important to do your research before making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

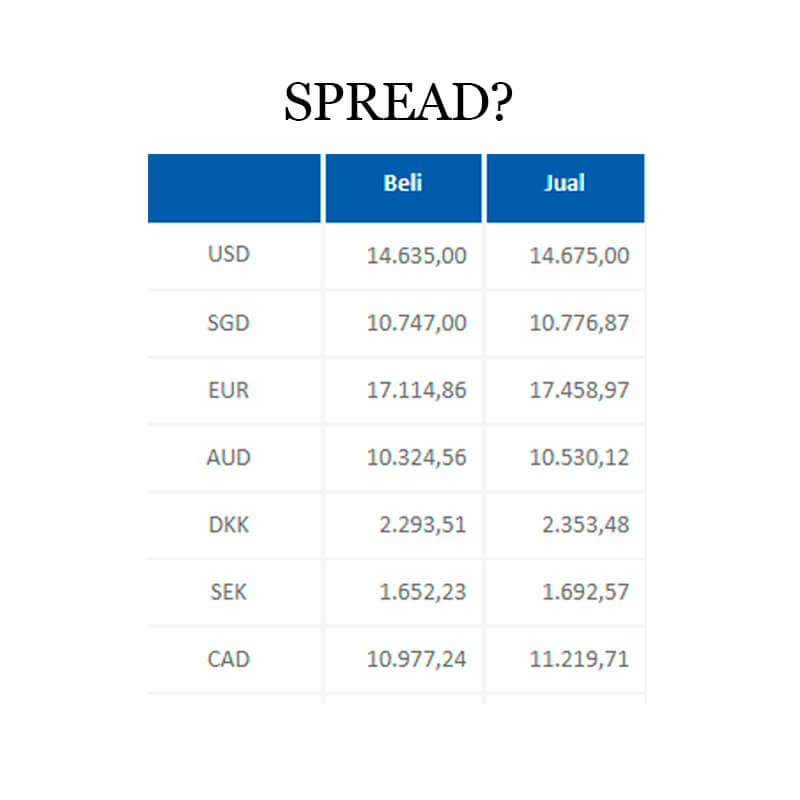

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts should be safe. It is crucial to safeguard your data and assets against unwelcome intrusions.

You must first ensure that the platform you're using has security. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, you should be aware of tax implications for investing online.

These steps will ensure your online investment account is protected against any possible threats.