The VIX (volatility index) is a market indicator that measures expected volatility for the future. This indicator is useful for both investors and traders, as it allows them to predict market movements.

The vix can serve two purposes: it can be used for market sentiment analysis and as an investment you can use to hedge against stock market risk. This is a great way to diversify your portfolio and reduce risk.

5paisa

Vix is a great service that allows you to experience volatility in the markets. It can be offered by many different companies. Traders have the opportunity to take advantage of volatility and invest in stocks they believe will rise, or fall.

Avatrade

The volatility index measures market volatility for the next 30 calendar days. It uses options prices to estimate market uncertainty, and it is one of the most popular ways for traders to diversify their trading strategy.

Rksv

The VIX is an index of stock markets that investors use to gauge the volatility level in the S&P 500. It is a powerful tool that can be used to gauge the health of the markets and the overall trend of a company.

Zackstrade Review

There are many ETFs that offer VIX exposure for traders. Although the VIX is an excellent tool for diversifying your portfolio, you need to remember that it is highly speculative. You should only invest money that is comfortable losing.

VIX Trader's Handbook

It can be challenging to navigate the market. Every day new factors are introduced that can have a significant impact on a company's business or the entire market. But experts know how to read the signals and determine what is coming next.

Although it is difficult to understand the vix's workings, the basic idea behind it is that it uses options prices for volatility calculations. This is calculated using a variety of factors including average and variance.

What Does the Vix Signify?

The vix is an indicator that measures the level of market uncertainty and fear. It is also known to be the 'fear indicator'. It increases during times of high volatility when investors and traders buy options.

They believe the market will rise in price, and want to make a profit.

A low vix level is usually a sign that investors are less stressed and the market is relatively calm. This is a good time for shares to be bought in companies with long-term plans and expected increases in value.

This can also be an opportunity to sell shares of a company at a time when the price is likely to drop. This can lower your risks and increase your odds of making profit.

FAQ

Most Frequently Asked Questions

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

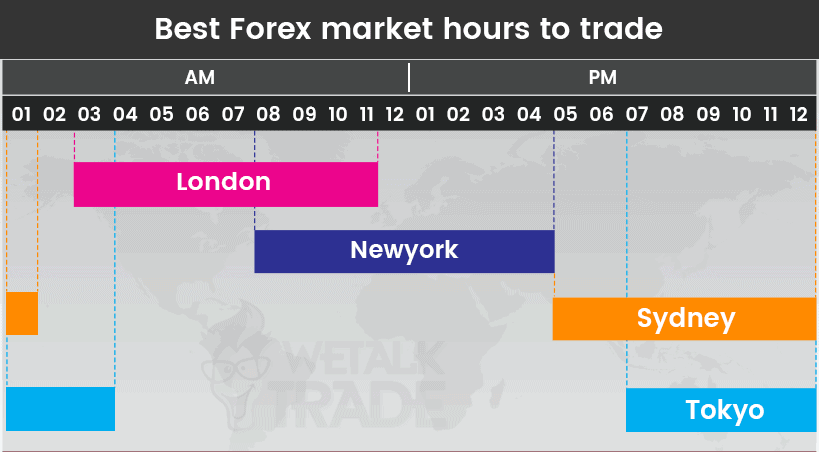

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Security is essential when investing online. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

It's important to be aware of who you are dealing directly with on any investment platform or app. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds to them or give out personal information, do your research.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. You should also use different passwords to protect each account from being compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!