Reddit lets people share opinions and discuss topical issues on social media. It's a great place to meet other members and learn more about various topics. It helps people learn about new services and products.

Forex trading has been one of Reddit's most popular subreddits. It boasts over 2.5million members and covers a variety of topics. These include trading stocks, options, futures and currencies.

These subreddits can help you, no matter if you are a veteran trader or just starting out. These subreddits offer valuable advice and tips to help you succeed.

It is important to remember certain key facts when trading forex. First of all, you need to understand that it is a zero-sum game, so if you win, someone else will lose.

You should also consider the fact that forex has been heavily rigged. HFTs and trading software are dominating the forex market. These bots make their money by exploiting market inefficiencies. They manipulate benchmark rates by collusion and front-running clients.

Make sure you have enough capital available to cover the trades you make. You could lose more than you can afford.

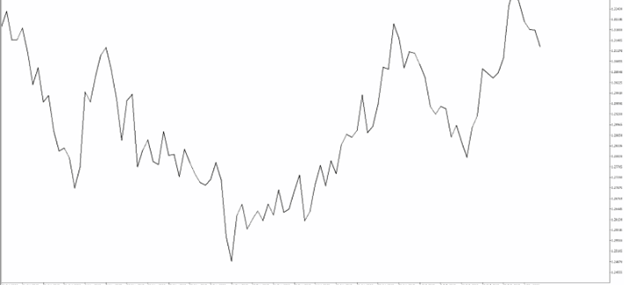

This is because forex markets are a lot more volatile than the stock market and if you don't have the time to monitor all the movements of your trades, you could lose a large amount of money in a short space of time.

The best advice is not to take on too much leverage and keep a small portfolio. This will save you from having to close out your positions due to margin stop outs.

If you're willing to put up with the occasional downs and wait, investing in small-cap stocks can pay off. Reddit's Small Caps group is a good place to get great ideas for investing.

You can even ask questions in the 'Small Caps' group to get more insight into this type of investment.

Reddit is also a hotbed for discussion about the Wall Street traders' trading strategies in 2021. Reddit's rise in popularity has brought #RedditArmy (WallStreetBets) and GameStop to the forefront. Many finance companies are keen to learn more about this community.

These forums also offer a place for traders to meet. They have AMAs that allow you to ask any question you may need.

The AMAs are usually hosted by the company founder, CEO or HR Manager and these are great opportunities to build connections with the community. They can also be a great way to get feedback from users and interact with them about marketing strategies.

You should never post any official company presentations, boring corporate videos or repetitive promotional sign up and trade posts on these forums. Reddit's community is active so such posts aren’t appropriate.

FAQ

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which is harder forex or crypto?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

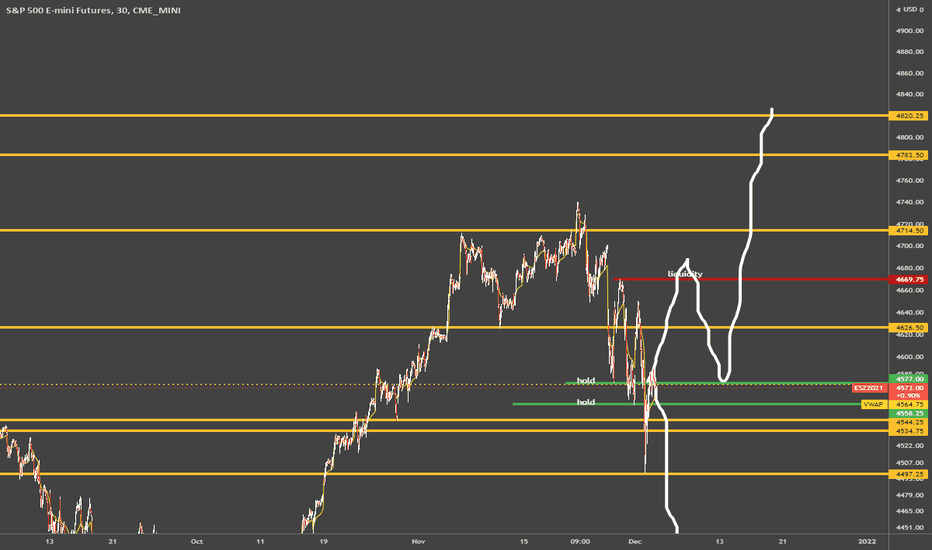

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

Research is critical when investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Know the risks associated with your investment and the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Do your due diligence and make sure you get what you pay for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.