One subset of stocks that can invest in cryptocurrency currencies are cryptocurrency stocks. These assets include businesses that operate crypto exchanges, provide data analytics services for clients using these numbers, and/or create the computer equipment necessary to mine cryptocurrency.

These stocks can be traded on different exchanges than traditional stocks. However, they are still volatile and large. Because cryptocurrencies are volatile, the prices can fluctuate wildly and even the smallest changes can result in a decrease or increase in revenues and profits for companies with strong exposure to crypto assets.

This growing technology is an excellent way to invest in a stock with crypto exposure. However, like any investment, there can be risks. Unlike stocks, cryptocurrencies are not insured or backed by a government, and they are susceptible to price swings. For investors who are looking for a long-term investment, cryptocurrencies are not a good choice.

There are several publicly traded companies with a keen interest cryptocurrency. Some have made direct money through their participation in digital asset markets, while some have partnered with such companies. As a result, their stock has performed well over the past few months.

The electric car manufacturer Tesla is one of the most well-known stocks. With its shares trading at more than $1 trillion, Tesla has grown to be the world's largest EV company in its roaring years. It has become a major player in digital payments, with its recent announcement of accepting Bitcoin to settle mortgage payments only adding to its momentum.

MicroStrategy (a company that heavily participates in the cryptocurrency space) is another. The company made a name for itself producing graphics cards, and it has since expanded its use of that technology to the mining of cryptocurrencies. In addition to mining, it is also involved in the financial service sector, specializing in the provision of analytics and payment solutions for large organizations.

PayPal, a company that has been long involved in digital payment processing, is another notable company with a crypto-related tie. PayPal, a company that has long been specialized in digital payments, recently introduced tools to its app that allow users easy access to digital currencies.

The CME Group is a major financial services provider and operates the largest financial derivatives exchange in the world. CME Group is a large financial services provider that trades currencies, commodities, energy and offers a full-featured platform for trading derivatives of the largest cryptocurrencies.

Important is the COIN Unit announcement. This unit will combine trading custody, data analytics, and custody into one product. These innovations combined are expected to increase efficiency in the crypto ecosystem.

Bitfarms Ltd. is another notable stock. Bitfarms Ltd. is a Canadian-based company that runs mining operations in North America. It also provides data analytics and installation services. Its Value grade is A. Stronghold Digital Mining Inc. is also included on the list.

FAQ

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

Real estate is another option. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down the search for the right platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Frequently Asked questions

What are the different types of investing you can do?

Investing can help you grow your wealth and make money long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

How can I invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

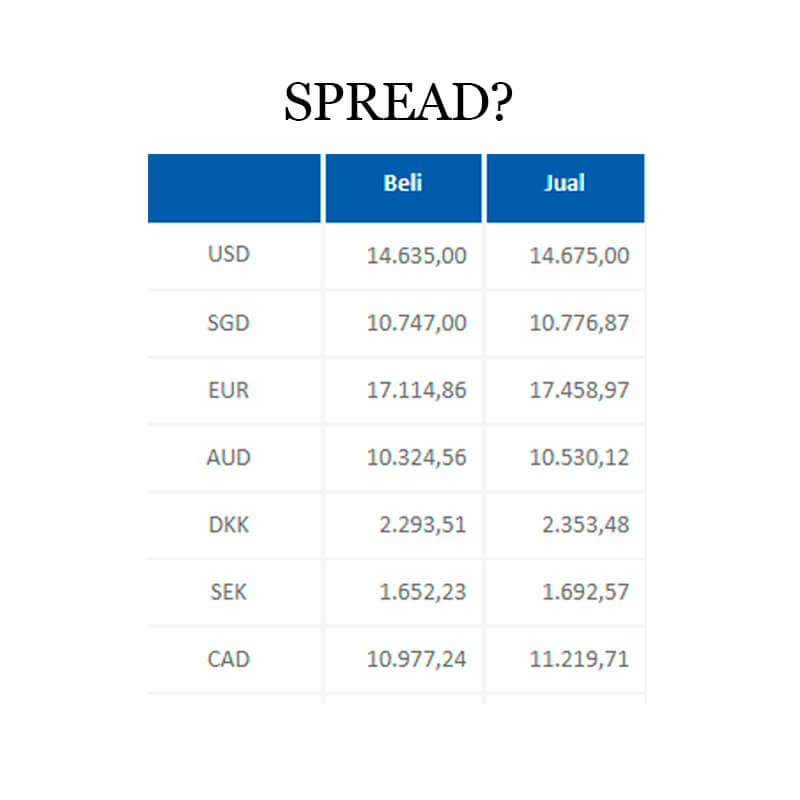

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

Online investing requires research. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Do your due diligence and make sure you get what you pay for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.