FTX US is a subsidiary to FTX. This new offering allows users to trade hundreds of stocks and exchange-listed securities with no fees and no minimum balance requirements. Tiered account systems are eliminated by the offering. All domestic customers of FTX USA will have access to it by the end of this summer.

FTX Stocks is a part of the FTX US currency trading application. It is a zero-commission stock trade platform that routes all orders through Nasdaq. This stock market is regulated. In addition, FTX Stocks will offer free market and enterprise data, allowing investors to access the same information they would find on a traditional stock exchange.

Residents of Puerto Rico, the Virgin Islands, the United States and the United States have access to FTX stock. Residents can fund their accounts with either fiat-backed steadycoins or regular dollar deposits. Trade in fractional shares of selected securities is also possible. These options are not available on the FTX main site, but can be found on the company's mobile app.

FTX stocks allows users to invest US-listed securities such as stocks, ETFs and American depository receipts. They will be able to trade with no fee, and FTX will waive fees on fractional trades. FTX is a FINRA Member broker-dealer. This means it can provide customers access to traditional brokerage services. FTX Stocks also offers a mobile and web-based interfaces. FTX will route all orders through the Nasdaq, ensuring fair and transparent transactions.

FTX US was founded in 2000 and has since grown to more than 1.2 million customers. While FTX's main focus is on cryptocurrencies it recently added a wide range of stocks to its offerings. Its main goal is to be a one stop shop for retail investors. FTX also wants to offer stock options trading to its customers. The new service is still under regulatory review and it's not yet available to all investors.

FTXUS announced plans to launch a non-commission stock trading platform in June. The offering is currently in private beta to select US customers. Users will be able to fund their FTX Stocks accounts with dollar deposits or fiat-backed stablecoins. Embed Clearing LLC - a specialized white-label brokerage company that offers trading in US exchange listed securities, including stocks, ETFs and bonds - will eventually manage all FTX Stocks customer account.

FTX is able to attract a variety of celebrities and major donors despite a recent decline on its share price. Jake Thacker is one such supporter. He has also sourced some funds from other crypto-trading platforms. Another is Ryan Salame, a big Republican donor who is a former executive at FTX.

Sam Bankman Fried is the founder and CEO of FTX. He could face charges in the U.S. for wire fraud and securities fraud. He is likely to also be extradited.

FAQ

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Frequently Asked questions

What are the 4 types?

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is best forex trading or crypto trading?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Where can I invest and earn daily?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. You can access your investments online from any location with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

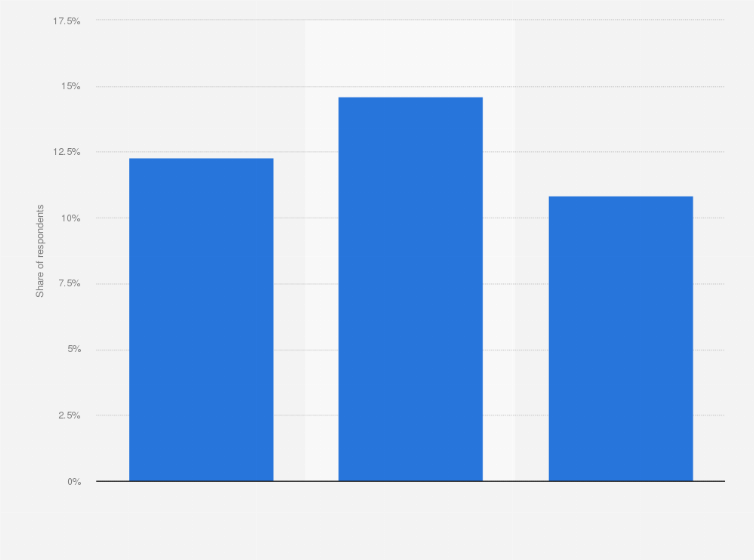

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts require security. It is crucial to safeguard your data and assets against unwelcome intrusions.

You want to ensure that the platform you use is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, make sure you do thorough research about the company before investing. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, you should be aware of tax implications for investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.