A great way to build wealth over time is to buy shares in a company. Whether you're just starting out or looking for ways to boost your portfolio, it's important to remember that risk is a part of the equation. Keep an eye on the stock market to ensure you're not buying stocks at too high a price.

It is important to determine how much you are willing to invest. It's best to diversify your investments rather than trying to hold onto one stock. You won't lose a large portion of your investment in a single stock.

You can buy a company's shares by using a broker, by a direct stock purchase plan, or by purchasing a stock on the open market. Each method comes with its own set of advantages and disadvantages.

It is important to learn about the company's history, management, products and performance before you decide to invest. The internet is an excellent source of information. The company's presentations can be viewed on their website. Attending an annual meeting will give you a better understanding of the company. It's a good idea read quarterly reports and subscribe for news alerts.

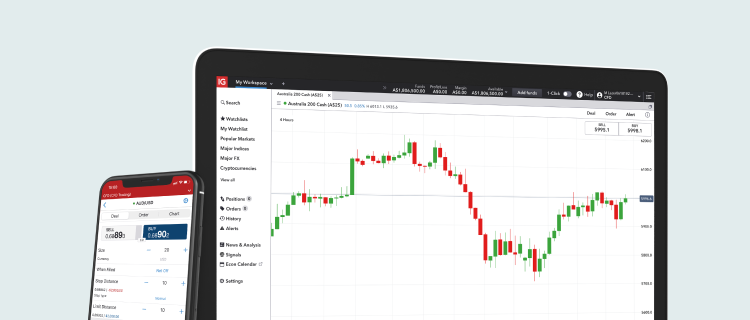

The process of purchasing stock is simple. Simply log in to an online stock trading platform. After that, you'll need to decide how many shares you want. After entering the number, you will need find the section of your platform that shows the company name, ticker symbols, and price. Once you've found the company's stock, you'll need to click 'Buy'.

Stocks are one of the most popular ways to make money. Each type of investment is not guaranteed to yield a profit. Margin investing is generally a bad idea. You'll not only be losing money, but you will also be taking on significant risk.

A brokerage account online can be a great place to buy stocks without paying huge commissions or fees. Some brokers will accept credit/debit or Paypal payments, while others require a minimum of $20. Many of these accounts have the same functionality as traditional brokerages.

Another way to buy stock is through a full-service broker. Many brokers will allow investors to choose from a range of investment options. You can also get advice from brokers about when to sell or buy your investments. They may also be able to offer low-cost trading options.

Some investors use brokers for a wide range of reasons, from the convenience of having a personal account to the advantages of using an intermediary. Some investors prefer to purchase and sell their investments directly. Before you sign up for your broker, make sure to read the pros and cons.

If you aren't sure whether you want to purchase a stock, you have the option of a dividend reinvestment program. These plans allow you the flexibility to invest in multiple stocks and share the costs with other investors.

FAQ

Frequently Asked Question

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are many options.

You can also invest in real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. A strong security system is essential for your valuable assets. There are several options.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?