Tesla option prices have moved lower as investors and analysts cut their estimates for the electric vehicle manufacturer's quarterly results. This could reduce profit margins and put pressure on shares. CEO Elon Musk has reiterated his desire to make a $44 million take-private deal with Twitter Inc ( TWTR).

Tesla has lowered the prices of most models across all models, including the base Model S sedan. According to the automaker's input costs, they have risen, which will likely lead to higher vehicle pricing in the short-term. Model S sells at $99990, down by approximately $5,000. Model X Plaid Plus is priced at $149,900 up about 10,000.

The company's Model 3 sedan and SUV, which are entry-level, is still on sale for $7500 federal tax incentive until the end. This is a big deal for customers as they would otherwise have had to wait for delivery in spring 2020 to receive the car at this price.

Although it's a positive sign, investors will still have to deal with established automakers Ford Motor Co. F & General Motors Co. GM. These companies offer more affordable vehicles in an era where oil and gas prices are rising. But, this is likely to have negative effects on future earnings.

Tesla's share prices have fallen 40% since July, when they were at an all time high of $170. The stock has been plagued by a three-for-one split, as well as the company's plans to buy Twitter, which has also weighed on sentiment.

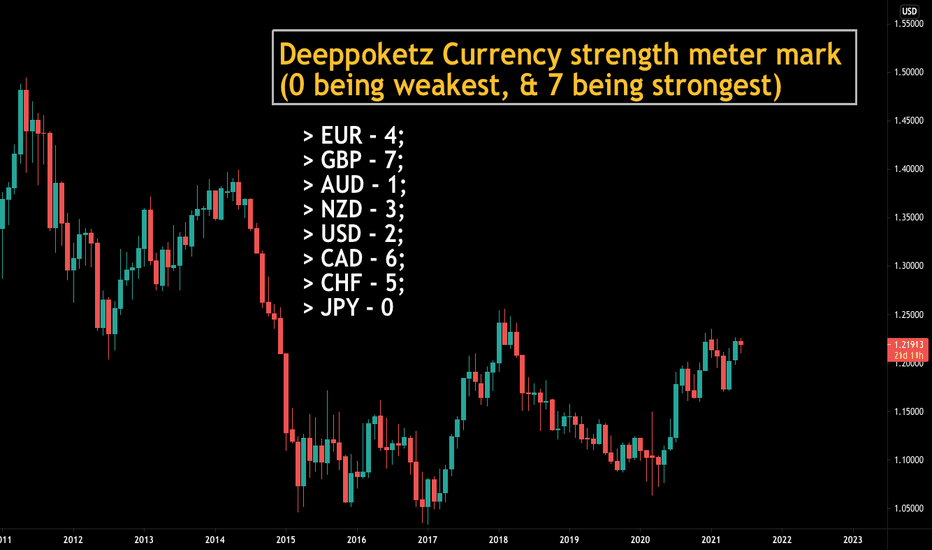

Trading tesla options has become popular in recent years, with speculators trading bullish call and put options to hedge their exposure to the price of a stock they believe will go up or down. Those who trade options have the opportunity to make extra income from their speculative positions, and they can do so with any number of strategies.

1. Trade the Stock with a Strategy That's Based on the Market Trend

Tesla's shares have been on the decline for much of the year, and traders are looking to cash in on any potential rally as the company prepares to report earnings after the market closes Wednesday. It's because of this that the stock has been flooded with trading volume, particularly for bullish options aiming to make a move post-earnings.

2. Buy a Put to Lower Risk

Purchase a put is the best and cheapest way to purchase Tesla stock. These options are often sold in small numbers of 100 shares. They also give the holder the ability to sell stock at a specified price in the future.

A put can be a great way of protecting your portfolio against future price drops and also help you to build your long-term position with the shares. However, it's important to note that buying a put can be risky, as it can cost you if you lose your money or fail to sell the stock at the desired price. You should only purchase a put if you have the funds to make a profit.

FAQ

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

It is important to research both sides of the coin before you make any investment. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Frequently Asked questions

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

How do forex traders make their money?

Yes, forex traders can earn money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protect yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Don't forget to remember that "Scammers will attempt anything to get personal information." Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.