merrill edge crypto is an online brokerage that is part of the Bank of America financial services platform. It provides a range of investment tools and perks for its customers, including ETF and stock trades that are commission-free. It also integrates with Bank of America accounts, making it easy to transfer funds from one account to another.

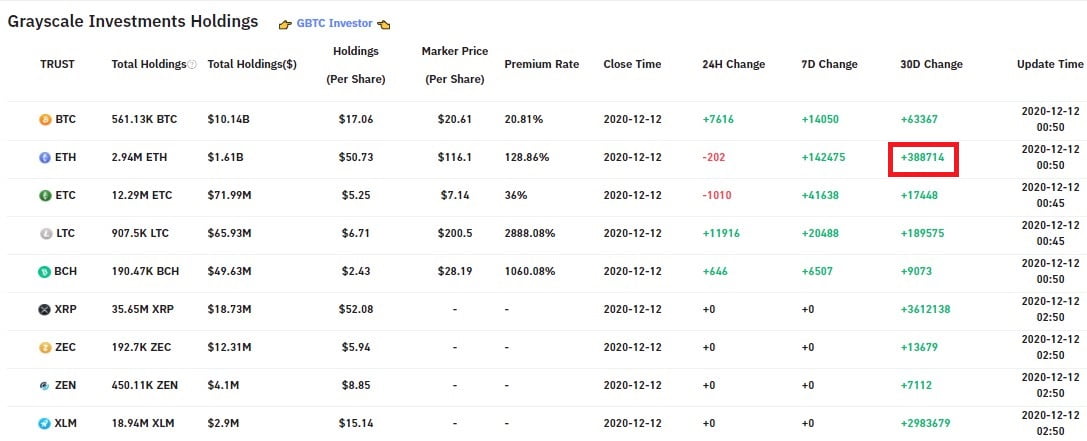

Merrill Edge does not support cryptocurrency trading, but you may be able to buy cryptocurrencies through a broker such as Grayscale Bitcoin Trust (GBTC), Arkk Invest, or Microstrategy. These platforms have low trading fees and are licensed by FinCEN for digital currency trading.

You can keep track of all your investments with a crypto portfolio tracker. It is simple and easy to use. It allows you to track price movements, identify profit and loss, and organize your investments.

It is worth noting cryptos are volatile assets that are hard to predict. Although there are many ways to reduce this risk, it is crucial that you do your research before investing.

A platform that charges no trading or deposit fees, and offers industry-leading spreads across a broad range of crypto assets, is the best platform for crypto trading. This is why eToro continues to be a popular choice with crypto investors.

It also gives you the ability to follow other traders' trades. This feature is great for learning from successful traders and can help you quickly build your crypto-portfolio.

Stocks with strong blockchain presences, like IBM, can be purchased. IBM Blockchain is a division of the company that invests in hundreds blockchain ventures.

Merrill Edge accounts cannot be used to trade cryptocurrencies, but they can be used for trading stocks that are heavily focused on blockchain technology. This strategy can help to protect your crypto exposure while also ensuring a good return on investment.

Merrill Edge also offers other types of investments if you don't like the idea of trading stocks. It's a full-service brokerage that is designed for DIY and beginner investors.

Merrill Edge provides more than the standard stock and ETF trading features. These include trading ideas, fundamental data and screeners.

To help you better understand the markets, there are a number of educational resources available, including webinars and videos. The broker also has a wealth management center with advisors available to talk to you.

The website is user-friendly and includes a secure login. You can set up alerts to receive information about certain prices and view historical data.

Signing up to open a trial account is quick and easy. A bank account or credit card can be used to open an account.

You can trade stocks, ETFs, options and mutual funds with Merrill Edge. The company's low commissions on these trades make it a good option for beginners who want to learn more about the market.

FAQ

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

How can I invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need is the right knowledge and tools to get started.

It is important to realize that there are several ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

It is important to research both sides of the coin before you make any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

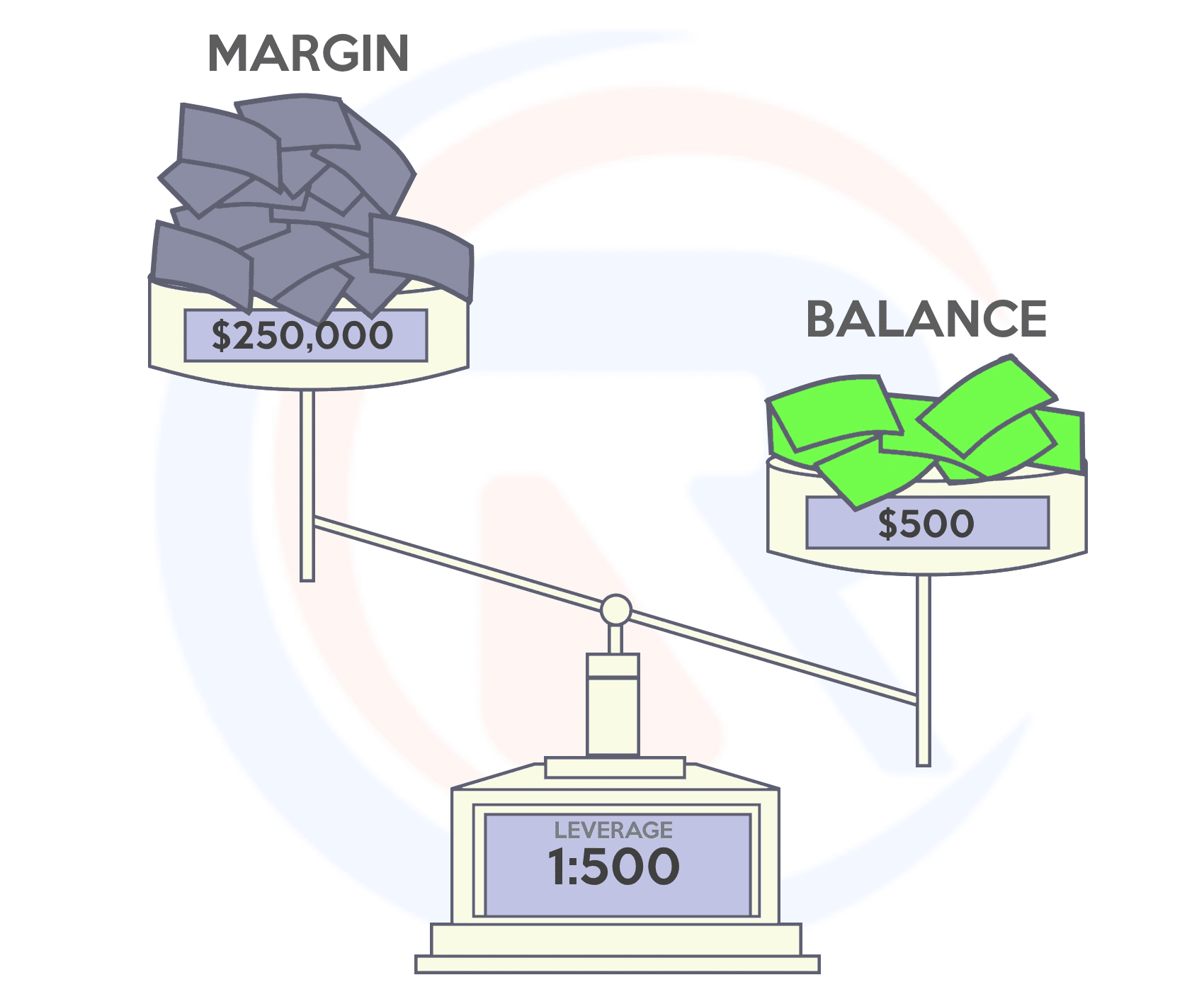

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protecting yourself starts with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Remember that scammers will do anything to obtain your personal information. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Before you make any investment, read and understand the terms of any website or app that you use.