Commodity trading firms play an important role in global capitalism. They are responsible for controlling key raw materials that are used in the production of goods in many industries, including oil, metals, grain, and rice. They store, transport, and process these commodities globally and trade them on worldwide markets.

They are vital in the trading and hedging of commodity derivatives. They use these tools for market disruptions and profiting from price fluctuations.

These firms are often unlisted, or family-run, so they are generally immune from the financial regulators’ scrutiny. These shadowy businesses make billions of dollars every year and exert a tremendous influence on the global economy.

Glencore is a powerful commodity trading firm based out of Baar, Switzerland. The company is one of the four most prominent global energy commodity traders and has vast assets.

It manages a third of global oil trade, and is a key physical supplier of nickel and lead. It also owns industrial facilities in Australia, the US, Europe and elsewhere.

Archer Daniels Midland in Decatur (Illinois) is another major commodity trading firm. They sell and buy multiple crops, such as wheat and barley. The company has processing plants, railcars as well trucks and river barsges that transport its products to all corners of the globe.

ADM has grown to be a major player in agribusiness. Its profits more than doubled last year, while its stock was up 28%.

Trafigura is a Geneva-based company that has many refineries around the world. It is also a major buyer in Iraqi crude. It has also been selling and buying petroleum in Syria, fueling the government's efforts to retake power from Bashar al–Assad's forces.

It was founded in 1885 in Switzerland and has been one of the most successful companies on the planet. In 2022, its profits grew to $7 billion, almost twice the amount in 2021. It is one the largest charterers and brokers of black gold in the world, with the majority of its profits coming from trading.

Public Eye found that many commodity trading companies exploit non-democratic nations to mine, grow, and export raw materials. They have grown sugarcane in Brazil without an environmental permit, deforested land Indonesian and destroyed the rainforests of Honduras.

They are also using their power to control land and people in Africa, evicting villagers to make way for coffee plantations or selling off palm oil plantations that deprive indigenous communities of their livelihoods.

This is a significant issue for the environmental community and has prompted urgent calls for action from activists across the globe. The International Panel on Climate Change has called for a global response to these issues, but it is difficult knowing how to achieve this.

This is important because these companies play a major role in the global supply chain of critical materials and can have an effect on the health of communities. They should be held accountable for all their activities, and they must also take responsibility for the environmental and human rights impacts of their operations.

FAQ

Where can I earn daily and invest my money?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

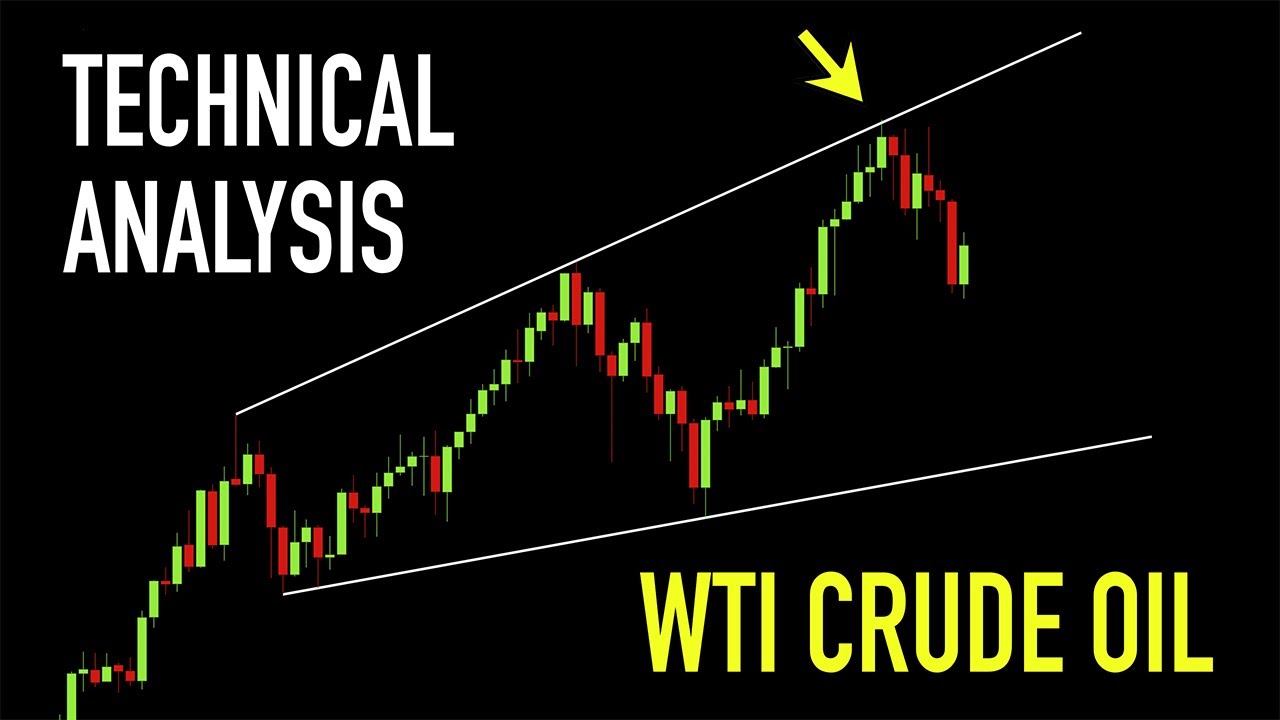

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is it possible to make a lot of money trading forex and cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts must be secure. It's essential to protect your data and assets from any unwanted intrusion.

First, ensure the platform you are using is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, make sure you understand your investment platform's terms and conditions. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Make sure to understand the tax implications of investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.