Intraday trade is a term for trading strategies used by traders to profit from intraday price movements. These strategies consist of placing orders to buy shares and sell them during a certain day. These trades usually take place within a limited time frame and are often exited before the market closes.

Intraday trades are highly volatile. It is not for everyone and requires high levels of dedication, discipline, and patience.

Successful intraday trading involves a combination of technical analysis and fundamental research. This approach is especially useful in situations where a stock is sensitive to news like important earnings reports.

It is also important that you study the stock's historical data to discover patterns. This will allow you to determine whether the stock is likely follow a particular trend, and what types of entry and exit points might be best.

Many traders use technical instruments to spot price trends and find support and opposition levels. For example, the Relative Strength Index (RSI) can be used to identify whether a stock is overbought or oversold.

You can also trade based on news events, range-bound or scalping as intraday strategies. These strategies require a thorough understanding of market conditions such as liquidity and a broker who has access to a variety of powerful tools.

Range-bound trades are an intraday strategy that capitalizes on small price fluctuations throughout the day to achieve small gains and profits. This strategy involves identifying the threshold levels at which share price rises or falls and then entering long positions when those levels are reached and then selling them when they fall below them.

The liquidity and size of a stock are important factors when trading. Liquidity matters because you can lose money on intraday trading if your stock lacks liquidity.

The second key factor to consider when trading in this way is ensuring that your trades are closed before the market closes. This protects you from being caught in a losing situation and helps to manage your risk.

The third important factor to consider when trading in this way is the ability to control emotions. It is easy for intraday traders to lose control of their emotions. This will ensure that you trade with a clear-cut profit goal in mind and stick to it as your trades progress.

FAQ

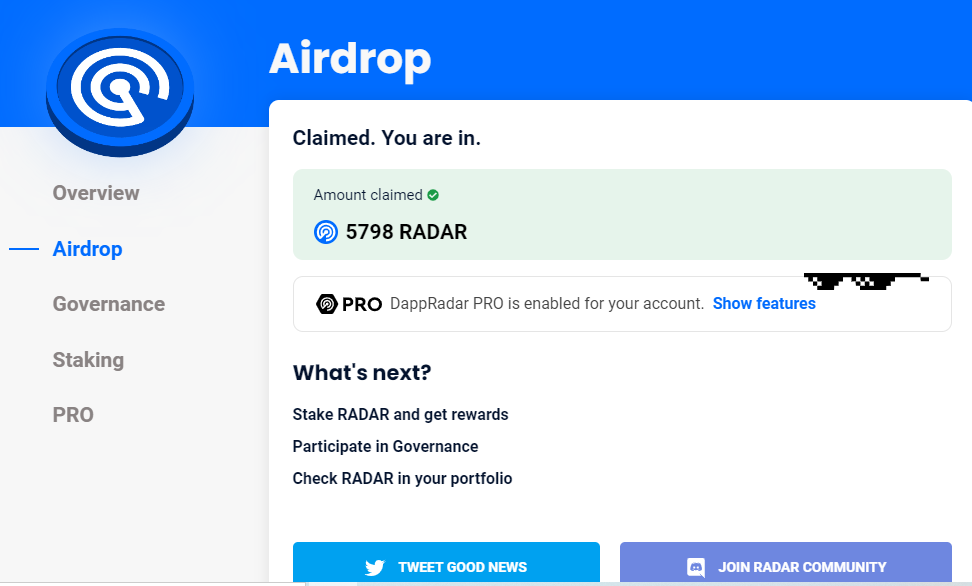

Cryptocurrency: Is it a good investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

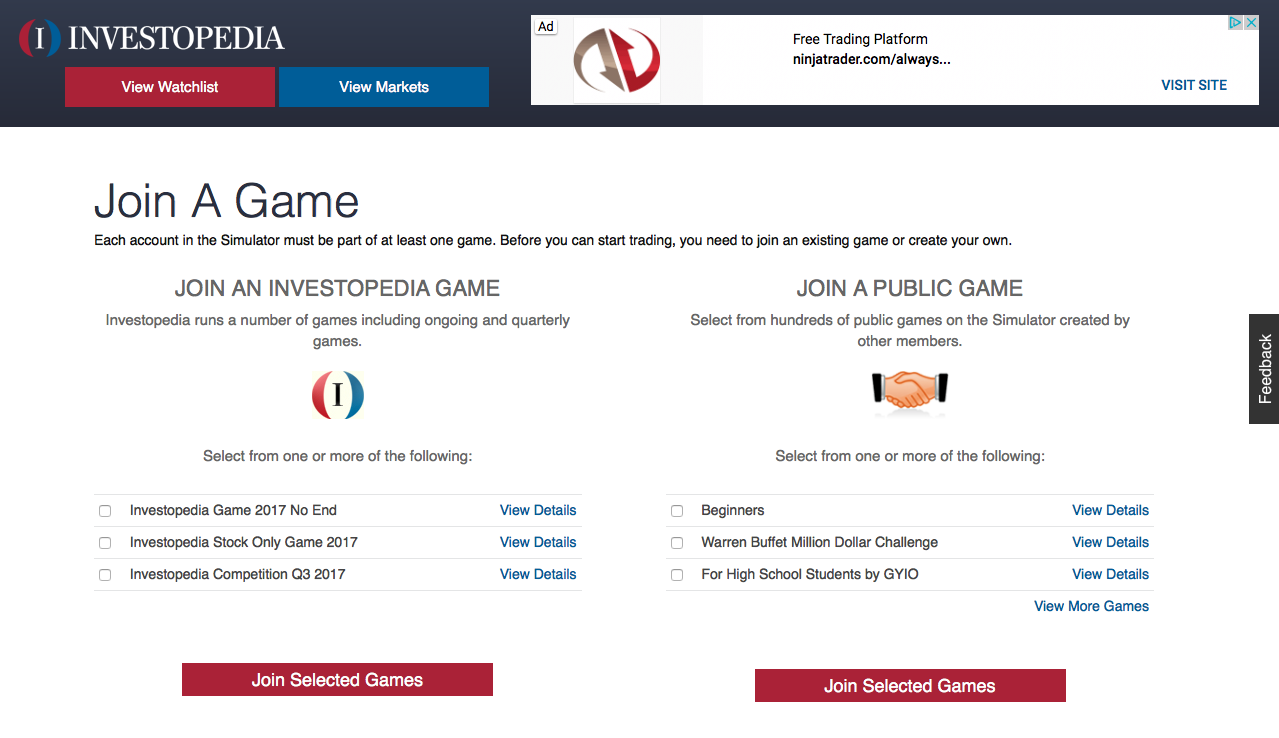

Which trading website is best for beginners

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Where can I invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Forex traders can make money

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts require security. It's vital that you protect your data, assets and information from unwelcome intrusion.

You must first ensure that the platform you're using has security. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Check your account activities regularly to be alert of any unusual activity.

Third, you need to know the terms of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. You can read user reviews and ratings about the platform to see how it works and what users have said about it. You should also be aware of the tax implications when investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.