Stock options are a form of compensation that allows employees to buy shares in their company at a fixed price. The amount of compensation is usually set by the board of directors of the company. Options can be immediately exercised, which means that they can be used before they vest. They are not transferable. However, warrants can also be part of an investment.

Stock options are common but not always used to their full potential. Stock options are often restricted to executives and early hires. This can make stock awards a tax burden to most people. There are ways to reduce the tax owed.

A section 83(b), election is one example. Section 83(b), which allows you to pay taxes before your stock vests, is an example. You do not get the money back if you make a section83(b) election, but it can help you save substantial money over the long-term. You have 30 days from the date you receive the option to make the election. If you leave the company prior to exercising the option, you don't have to pay any taxes back to the IRS.

Stock options also allow employees to repurchase stock. The company may purchase shares from an employee who leaves at the fair market value of the stock or at the cost. The stock option used depends on the stock and its terms.

Stock options and stocks have a major difference in the time they can be vested. A stock option typically expires after a certain number of years. Some companies may allow employees to keep the option window open until they leave. Pinterest, Quora, or Amplitude are some examples. Phantom equity plans are other examples.

The option may also be accompanied by other features. The option may let the employee purchase additional shares based upon the company's future growth. Or, the company may impose certain restrictions on the stock, such as the right to sell the stock to an accredited investor. The option may allow for the payment or withholding of taxes. A stock option might have the ability to increase in stock value depending on which stock it is.

An option can also come with a cliff. This allows for the option to only be exercised in stages. One example is that an option can give the option holder a right to buy the same amount of shares every 3 months. This is usually the best and most efficient use possible of company's money. But it can also be costly.

You can also do other things, but the most important thing is to understand the nuances of the stock option and your plan.

FAQ

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Frequently Asked Fragen

What are the 4 types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

How can I invest Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

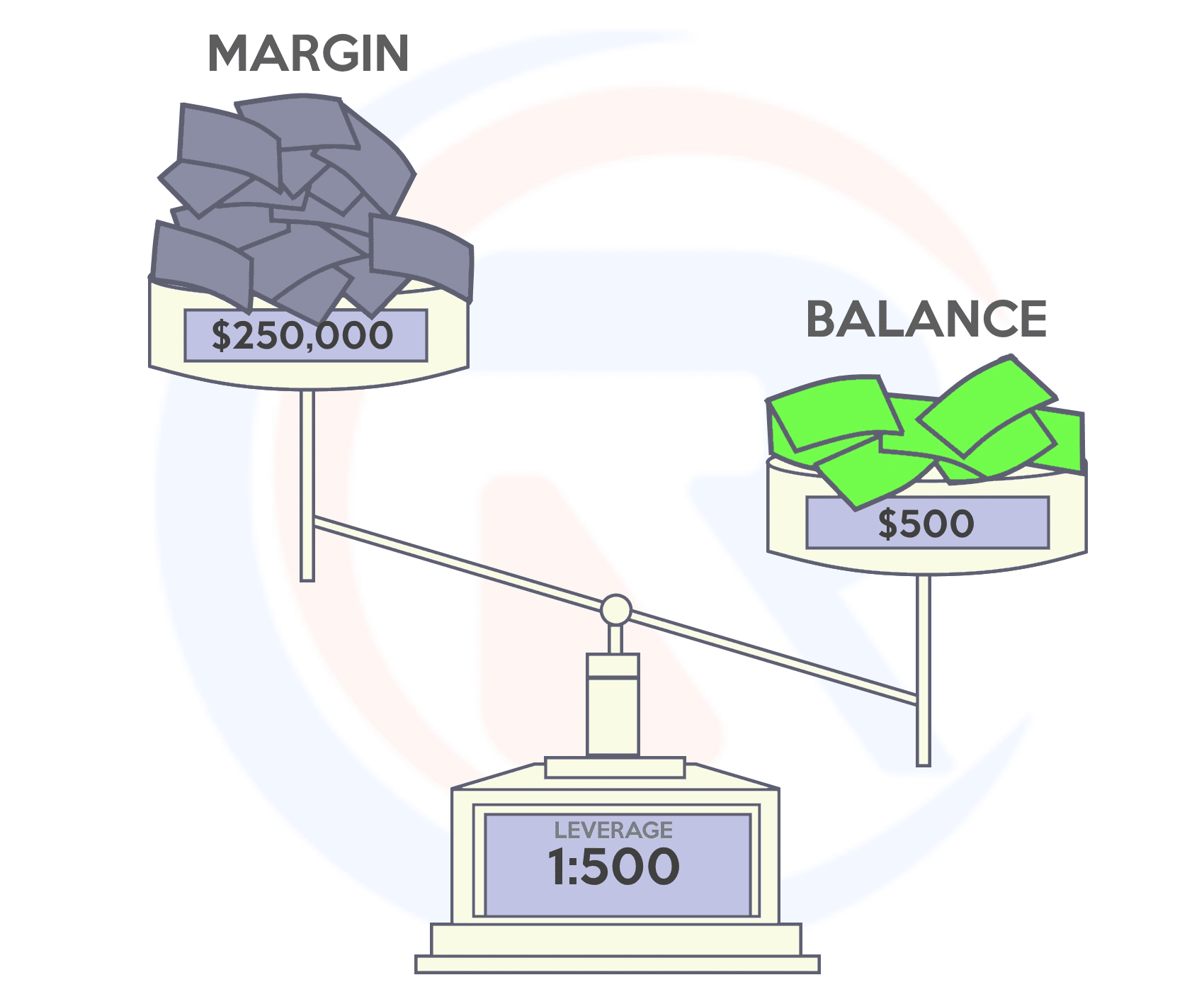

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are many options.

Real estate is another option. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection starts with yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Unsolicited email or phone calls should not be answered. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, investigate all investment options thoroughly and independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Never forget that scammers will try any means to steal your personal data. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.