Forex is the largest global financial market. Forex is a 24-hour marketplace with an estimated turnover US$6.5 trillion. Banks, businesses and hedge funds use it to purchase and sell national currencies. There are many factors that can affect the currency market. These factors include the country's economic strength as well as social and politically relevant factors.

Trades are best made when the market is active. Traders need to be aware of the implications of leverage. It can be difficult to keep track and monitor losses and gains when using leverage. Traders should follow a systematic approach. Traders should follow the path that is least likely to make a profit and avoid dramatic price changes.

Traders should also be aware of the effects of different markets on forex markets. Trading can be volatile when more than one market is open at the same moment. This can lead to large fluctuations in a currency pair's value. Trader should also be alert for major news releases that may have an immediate affect on the currency. Traders need to be careful not overtrade their accounts.

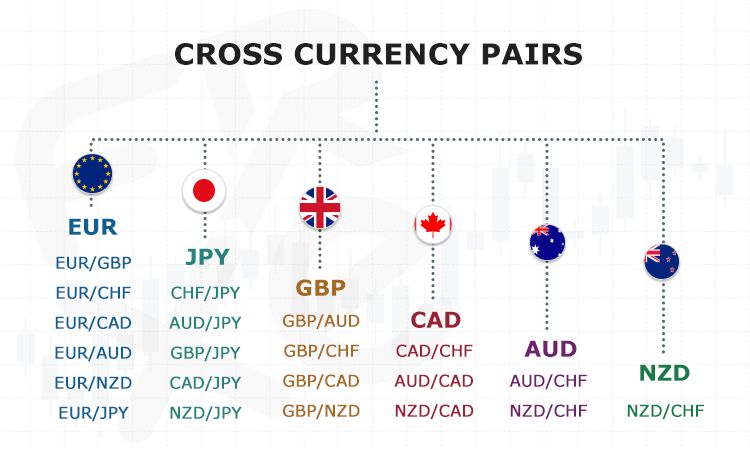

Knowing which pairs are most popular will help you determine when the best time is to trade. You can choose from EUR/USD or GBP/USD as well as USD/JPY, USD/CHF, USD/JPY, and USD/JPY. These four major currencies account for more than 80% of daily forex trade volume. There are many exotic currency pairs that are not as traded. These are typically more costly than major currencies and often have larger spreads.

You should also consider the timing and significance of key events when trading on the daily forex market. These events can have a direct impact on the dollar. In other words, if a transaction is completed, the value of the dollar could drop or increase. Investor demand can be sparked by strong U.S. growth.

It is important that you study the economy calendar before considering a career on the forex market. The calendar gives you a guideline to major events that could affect the currency markets. Important news releases may cause a 70 pip drop.

Remember to consider the overlap between U.S./London sessions. This happens from 8:00 am to 5:00 pm EST. Because there is the greatest overlap between these markets, trading from this window can be very profitable.

The NASDAQ and New York Stock Exchange, in addition to being the most influential trading centres in the foreign market, are also important. Even though they only overlap for a short time, this overlap can have an impact on the currency markets. USD/JPY has been the most popular currency pair on the NASDAQ.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Most Frequently Asked Questions

What are the 4 types?

Investing can help you grow your wealth and make money long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

Which trading platform is best?

Many traders may find it challenging to choose the best trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection starts with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Remember that scammers will do anything to obtain your personal information. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It's also important to use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.