Wash trading in crypto space is a growing concern. This can cause false price statistics and may deceive NFT market users. Wash trades could even be punished on some platforms. The legality of these activities is still up for debate.

NFT wash trade can be identified in many ways. One way is to look at the transaction history. Another way is to use the tools available to members. One tool allows you to see if an account has traded with at least three wallets. These tools can help you make better trading choices.

An investor should be aware of the risks associated with wash trading and how they can impact your investments. As with all financial activity, there are risks to be taken. Do your research before you invest. A lot of research can often be enough to determine if an NFT would be a good investment.

There are many tools to choose from, but there is a certain set of tools that have more potential. Footprint Analytics is a tool that can help you identify which addresses have traded with what wallets in the past. This tool is helpful in identifying the worst offenders.

Another way to find wash trading is to look at the NFT volume numbers. NFT marketplaces often reward users based upon their volume. Some NFT marketplaces measure volume in percentage of total trades. Generally, this is a very small % of overall volume. However, this can indicate that a collection might be very popular and susceptible to wash trading.

Another sign that wash trading may be occurring is multiple transactions between different wallets. These types of transactions can be hard to trace. These exchanges provide a way for malicious actors to get by the rules. A single whale could also contribute to a significant portion of global wash trading volumes.

The most important thing to learn about wash trade is that it does not limit to NFTs. This is due in part to the decentralized structure of cryptocurrency. This can make it hard to trace and prosecute the culprits. Additionally, cryptospace has little regulation oversight, which can encourage tax-loss harvesting.

Make sure you do your homework before you purchase or sell NFTs. This is especially important if you've never invested in tokens before. Knowing the basics of wash trading will allow you to make better investment choices and avoid costly mistakes.

Washed trading is unprofessional. It does, however, provide mainstream financial services with an important tool. The NFT market should evolve to be more proactive in combating this practice.

FAQ

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

You need to be aware that there are many investment options. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases, it's important to do your research before making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

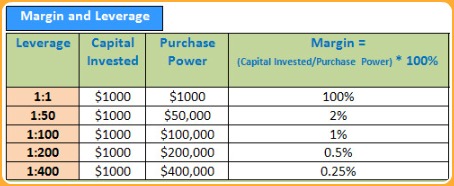

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

What are the pros and cons of investing online?

The main advantage of online investing is convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Can one get rich trading Cryptocurrencies or forex?

Yes, you can get rich trading crypto and forex if you use a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protection begins with you. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Unsolicited email or phone calls should not be answered. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Remember that scammers will do anything to obtain your personal information. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.